- Kenyan Farmers Receive $2M Boost from Africa Fertiliser Financing Mechanism

- Brace for High Interest Rates for a Longer Period World Bank Warns Kenya

- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

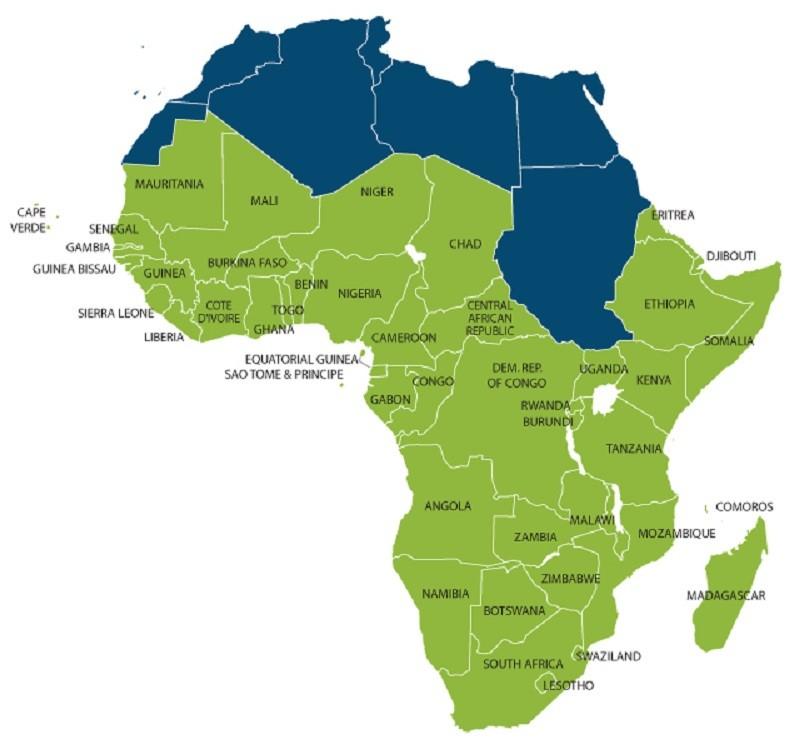

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

Browsing: Nigeria

The “Digital Lagos: Broadband for All” campaign initiative is to enable the digital transformation of the state which hosts Nigeria’s most populous city, Lagos.…

Sub-Saharan hospitality investment platform Kasada Capital Management has reached a first close on its maiden fund Kasada Hospitality Fund LP with equity commitments of over USD 500 million.

This is in line with a first announcement disclosed in July 2018 by Katara Hospitality and Accor who are respectively contributing USD 350 million and USD 150 million. In a region which offers robust growth opportunities, the fund will target both greenfield and brownfield projects.

The hospitality market is currently one of the most promising and yet underserviced sectors in Sub-Saharan Africa where growing economies and emerging middle class are creating high-growth markets that are left largely untapped.

The first platform of its kind in Sub-Saharan Africa, Kasada Capital Management intends to bridge the gap between the local hospitality market players and international investors.

The team is co-led by Olivier Granet (CEO and Managing Partner) a former CEO of AccorHotels Middle East …

Private capital remains an important driver of investment activity in much of Africa

Office yields remained largely stable in most African markets over the past two years, anchored by patient domestic capital as local investors assume a longer-term perspective, a new analysis by Knight Frank shows.

The analysis, published in a new Knight Frank report dubbed Africa Horizons, shows that of the 35 office markets covered, yield remained stable in 16 locations in the two years to 2018 and rose in six, while 13 markets recorded declines.

Africa Horizons provides a unique guide to real estate investment opportunities on the continent, examining developments in agriculture, hospitality, healthcare, occupier services (office), capital markets, residential and logistics property sectors.

“By taking a longer-term perspective, and in some cases a lower return profile, local investors have remained more active than headline figures suggest. This explains how yields in most major markets have remained …

Sub-Saharan Africa’s economic growth slowed to 2.3 per cent in 2018 from 2.5 per cent in 2017, remaining below population growth for the fourth consecutive year, the World Bank has said.

In the April 2019 issue of Africa’s Pulse, its bi-annual analysis of the state of African economies published on Monday, the bank said regional growth was expected to recover to 2.8 per cent in 2019, staying below three per cent as it has been since 2015.

The slow growth reflects ongoing global uncertainty but increasingly comes from domestic macroeconomic instability including poorly managed debt, inflation, and deficits; political and regulatory uncertainty; and fragility that is having visible negative impacts on some African economies.

It also belies stronger performance in several smaller economies that continue to grow steadily, the bank said.

It noted that Nigeria’s growth rose to 1.9 per cent in 2018 from 0.8 per cent in 2017, reflecting …

Three years past the crisis period, economies are still performing poorly

The growth story in Sub-Saharan Africa in the past few years has been one of faltering recovery from the worst economic crisis of the past two decades.

This remains the case according to the World Bank’s April 2019, 19th edition of Africa’s Pulse, which estimates GDP growth in 2018 at a lower-than-expected 2.3 per cent, with a forecast to 2.8 per cent in 2019.

“Three years past the crisis period, we should be seeing a more widespread pickup in growth; instead we have downgraded our estimates again for 2018,” said Gerard Kambou, World Bank Senior Economist for Africa, “Leaders in Sub-Saharan Africa have the opportunity to build stronger domestic policies to withstand global volatility – and now is the time to act.”

The report notes that the three largest African economies—Nigeria, Angola and South Africa—play a big role …