- History beckons as push for Kenya’s Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

- Empowering the Future: Humanity Protocol’s Dream Play Initiative

- TikTok Community Guidelines update aims to curb hate speech and misinformation

- Rwanda sees 39% surge in bank borrowers as Sacco and MFI loan uptake declines

- Kenya Ports Authority wins dispute case over cargo release

Browsing: premium

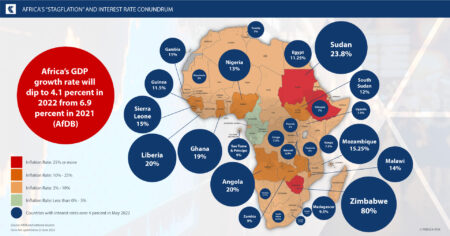

Over the past decade, African countries have accumulated external debt at a faster pace. The countries have capitalized on abundant, low-cost international credit for fiscal and balance-of-payments funding to help drive development plans.

Africa’s total external debt, accrued by both the private and public sectors, owed to foreign lenders, has surpassed $1 trillion. The related annual debt servicing costs broke through the $100 billion threshold for the first time in 2021.…

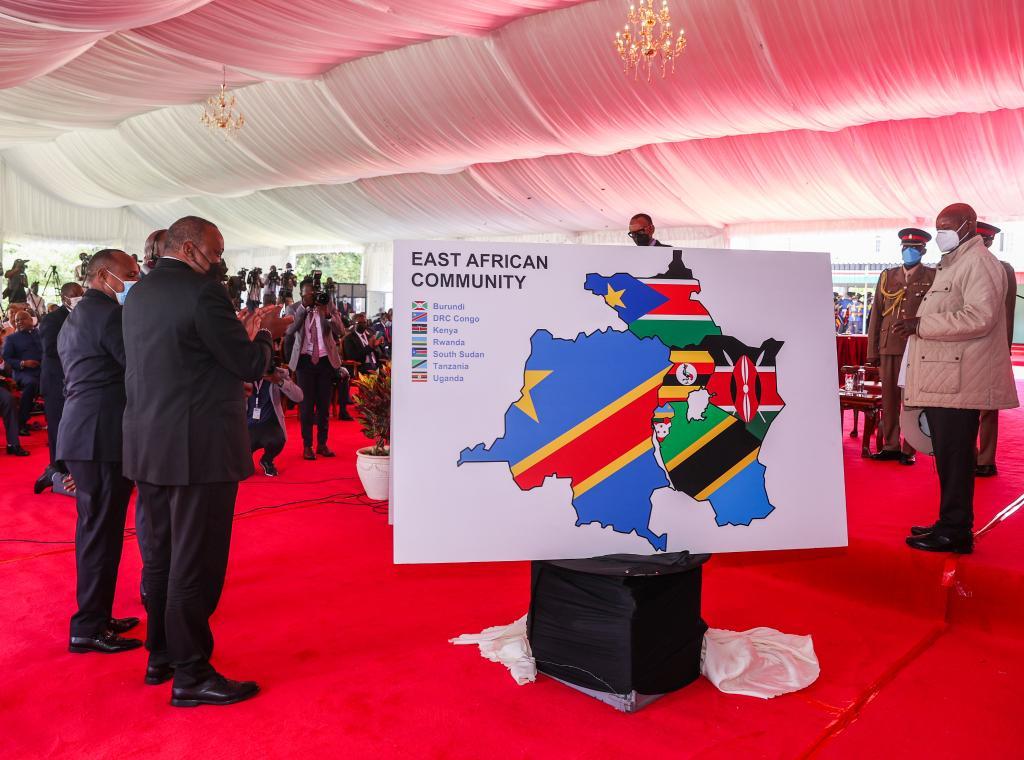

Most of the countries have no choice but borrow to bridge budget deficits. According to the IMF, the major EAC nations, namely Kenya, Uganda, Tanzania, Burundi and Rwanda, together, had borrowed more than $100 billion in both external and domestic borrowing.

With the global economy in teeters post Covid-19 and the impact of the Ukraine-Russia conflict, economies worldwide are contracting, leaving East African nations in a perilous situation.

According to the IMF, about

- Shares of Tesla the pioneer of electric vehicles fell spectacularly in 2022. This trend was the same for auto shares which list substantial amounts of value during the year.

- Tesla despite its anemic showing in terms of share price performance managed to deliver a record number of EVs.

- The EV company increased production of its products by as much as 40%.

- This impressive development by Tesla failed to excite the market which hammered the share price resulting in the EV company shedding 64% of its value in 2022.

- Notwithstanding the skepticism from the market Tesla has been making positive strides with its Gigafactory initiatives.

- Africa has been the focus of the Gigafactory initiatives by Tesla. A Gigafactory is a massive manufacturing facility that aims to speed up and scale up the manufacture of electric vehicles.

- The Gigafactory concept will contribute substantially to the economic wellbeing of African countries where Tesla

In recent years, the value of the African market for beauty products has skyrocketed. According to a report by Research And Markets, the African beauty and cosmetics industry is projected to increase from its current level to $22.8 billion by 2025, a compound annual growth rate of 5.5%.

One important reason for this growth is the rising demand for cosmetics made from natural, regional ingredients. Natural resources such as shea butter, coconut oil, and baobab oil have helped make several African countries well-known around the world. These natural ingredients not only help the skin, but they also promote the use of locally sourced resources, which is good for the economy and the job market.

The beauty industry in Africa is booming thanks in part to the rising demand for halal-certified products. Many Muslims choose to buy items that are labeled “Halal” because they are compliant with Islamic law. Considering Africa’s …

The continent as always, has great promise. This was the unanimous conclusion from the just-ended World Economic Forum, which is traditionally held at the Swiss resort town of Davos every year. However, significant obstacles stand in the way of the continent reclaiming its mantle of economic growth.

- The World Economic Forum held in Davos every has just ended. This year’s conference ran under the theme of Collaboration in a fragmented world.

- Africa was on the agenda of the World Economic Forum as is frequently the case.

- Discussions on Africa at the conference mainly centred on how the continent can regain its growth trajectory.

The World Economic Forum (WEF) identified four principal factors causing economic headwinds in Africa and will stall its economic growth as a continent unless dealt with. The so called “stallers” of Africa’s economic growth are and will remain as conflict, COVID, climate, and cost of living.

WEF …

The world has in recent months witnessed a dramatic turnabout on the future of nuclear energy, mainly in the developed countries.

This is on the back of the Russia-Ukraine war which has seen post-pandemic energy shortages turn into a full-blown energy crisis.

According to the International Monetary Fund (IMF), nuclear power plants slated for closure across Europe have been given “an 11th hour reprieve.

Japan has announced, after a decade of paralysis, that it plans to restart many of its reactors, which have sat idle since the nuclear accident at Fukushima Daiichi.

France, which had launched plans to reduce its dependence on nuclear energy during President Macron’s first term, reversed course and now, plans to build at least six new reactors and a dozen smaller modular reactors.

The UK on the other hand recently launched an ambitious plan to build eight new reactors and16 small modular reactors.

Even anti-nuclear Germany …

Africa has stumbled headlong into what has been called the ‘perfect storm’’. From the heavy burden of debt servicing, the instability created by election cycles, geopolitics and war as well as the lingering threat of food insecurity caused by conflict and adverse weather conditions. Seemingly, the proverbial pandora’s box of horrors has been let ajar and the evils through different manifestations are ravaging the continent from all corners. However, as the Greek myth holds, only one thing is said to have been left in the box after it was shut; hope. Amid all the daunting troubles Africa is facing, hope for a better and prosperous Africa is the fuel to help the continent weather these ominous challenges.

We explore some of these existential challenges and some plausible solutions thereof.

Political Instability in Africa

Africa is no stranger to political instability and civil unrest which has stagnated most economies and impeded …

Tanzanite is a precious stone said to be a thousand times rare than the rarest diamond. True to that claim, the tanzanite gemstone is mined in only one location in the world; a small area in Simanjiro District in Tanzania.

Given the scarcity of tanzanite you would expect that the single mining country, Tanzania would be stock rich, or at least earn the lion’s share of what the gem is valued.

This is not the case. In fact, the exact opposite is true. Tanzanite trade globally earns USD 500 million a year, but Tanzania’s export revenues are a paltry USD 20.75 million, or equivalent to 4.15 percent of the global export value!

Also Read: Tanzania: Small scale miners double in a year

The overwhelming question is why and more importantly how can the situation be resolved? how can Tanzania increase its earnings from its monopoly mining of tanzanite?

The …