- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: real estate

- Maximizing rental income from investment properties in Kenya requires strategic planning and effective management.

- As a real estate investor in Kenya, it is important to focus on acquiring properties and have a well-thought-out exit strategy in mind.

- Real estate investment in Kenya can be rewarding if approached with knowledge and strategic planning.

Tips and strategies to maximise rental income in Kenya

Maximizing rental income from investment properties in Kenya requires strategic planning and effective management. By implementing the following tips and strategies, real estate investors can maximize their returns and ensure the financial success of their rental properties.

- Set Competitive Rental Rates

Determining the right rental rates for your properties is crucial. Conduct thorough market research to understand the rental prices in the specific location and consider factors such as property size, amenities, location, and market demand. Setting competitive and attractive rental rates will attract tenants and help maintain …

- Global NPL and distressed assets present a promising opportunity for investors looking to diversify their portfolios.

- A forum at the Annual Investment Meeting explored how rising interest rates are creating opportunities for distressed debt investors.

- Key speakers discussed the different asset classes, including real estate, corporate, and consumer debt.

Investors have been urged to capitalise on investing in distressed assets and non-performing loans to grow their portfolios. According to experts at the Annual Investment Meeting (AIM), non-performing loan (NPL) investing is becoming a popular strategy for investors seeking high returns.

The conference, which was held in two panels examined the current global economic environment and how rising interest rates are creating opportunities for distressed debt investors.

According to Harvard Business School, distressed debt investing is the process of investing capital in the existing debt of a financially distressed company, government, or public entity.

Why having partners is a must

The …

In the modern world, affordable housing is becoming a complex issue for many people, especially in Africa. Across the region, rapid urbanization, which has boomed over the past decade, has made affordable, decent housing challenging precipitating the emergence of informal settlements.

In the case of Tanzania, Dar es Salaam, the commercial pulse of Tanzania, is struggling to develop cities that bring inclusive growth and job opportunities for people, the Kigamboni City Project tried by failed..

A December 2015 publication by the World Bank argued that Africa could have as many as 1.2 billion urban dwellers by 2050 and 4.5 million new residents in informal settlements each year, most of whom cannot afford basic formal housing or access mortgage loans.

The informal settlements or slums is particularly pronounced in big African cities. In 2020, 24.2 percent of the global urban population lived in slums. In Sub-Saharan Africa, the slum …

New Zimbabwe went on to report that the court ruled that in the case of First Merchant Bank failing to reimburse Shah and his company, the Bank of Zambia was held liable and, in the alternative, the Attorney General was ordered to pay if the funds could not be found. The culmination of this dispute is that Shah and his company are in for a particularly large windfall of cash. The reclusive Indian business tycoon is said to have business interests in Zimbabwe, Zambia, and India.

Despite his wins in business Jayesh Shah has never successfully shaken off the controversy that comes from the notable success a person enjoys in any endeavour. Success always breeds as many admirers as it does critics. Tendai Biti, who was Zimbabwe’s finance minister at one time during the Government of National Unity, called Jayesh Shah a “loan shark of Indian descent”.

The opposition leader …

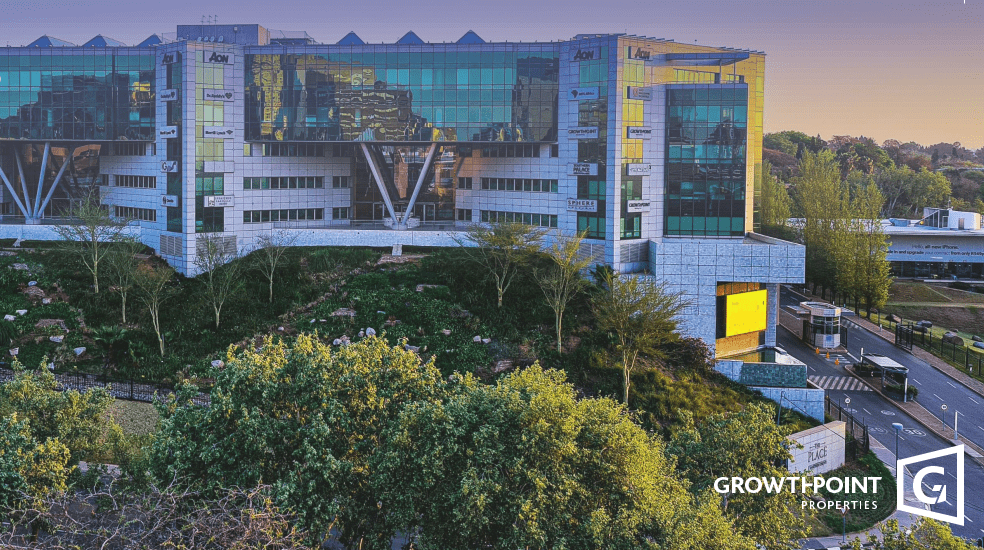

Growthpoint Properties Limited published its financial results for 2021 on the 15th of September 2022.

The real estate investment trust (REIT) is the largest such listed entity on the Johannesburg Stock Exchange and is reliable indicator for the sector as a whole. The real estate sector in South Africa as in the rest of the world was one of the biggest casualties of the COVID pandemic. REITs on the JSE were not spared.

The COVID pandemic created a perfect storm for property owners in South Africa. When COVID spread to the rest of the world after beginning in Wuhan in China in 2019 two things happened that adversely affected the REIT sector on the JSE including Growthpoint.

- Growthpoint Properties Limited which is the largest REIT listed on the JSE announced its results on the 15th of September 2022.

- Results for the REIT reflected an improved operating environment for

Africa has never been at a better time to capitalize on the real estate market. The sector is rigged with plenty of modern technology that offers myriad opportunities that shift away from traditional uses and increase transparency and efficiency.

Africa Business Insider pointed out ten pathways for investors to benefit from investing in the African real estate market in 2022.

Long-term residential rentals are argued to be one of the fastest ways for an investor to garner profits as the rising population in Africa calls for substantial development of decent shelter.

Real estate investment trusts (REITs) allow investors to acquire profits without holding physical property. According to Business Inside Africa, REITs provide diverse opportunities to investors, primarily in the market niches.…

One of the features that make the property unique as an investment is that it has a high unit value in comparison to other investments.

A nominal amount like ZWL$1,000.00 can buy an individual investor shares of a publicly listed company on the ZSE and the same amount in US dollars can purchase a decent number of shares through an offshore brokerage account.

This is not usually the case with real estate. There is very little an individual investor can do with ZWL$1,000.00 in terms of direct property investment, at least in the conventional sense.

Even with access to mortgage finance, an investor will also tend to be limited by their credit standing in terms of the funds that they can deploy into property investments.…

Shelter Afrique, Pan-African housing development financier signed a Memorandum of Understanding (MOU) with two Chinese construction firms to scale up the development of large-scale affordable housing projects in Kenya and its member States.

The two Chinese construction firms are Amberton International Holdings and Sichuan Huashi Enterprise Corporations E.A. LTD, with the MoU expected to boost Shelter Afrique’s mandate of providing decent and affordable housing in Africa.

The MoU was signed by Andrew Chimphondah, Shelter Afrique Chief Executive Officer, Nancy Yu, Amberton International Holdings Director and Sichuan Huashi Enterprise Corporations E.A. LTD Managing Director Cao Zheng.

“As a company, our overriding strategy is the provision of affordable housing across our member States through public-private partnerships. This strategic partnership with Amberton and Huashi will be key in expanding our projects across the continent as we draw from the experiences of the two companies. Shelter Afrique will work closely with Amberton International Holdings …

Tanzania is well on its way to achieving its long coveted middle income status, and the mushrooming skyscrapers in most all its major cities are evidence. Well that’s one way to look at it.

You see, where investment is on the raise, it is safe to say the economy is stable and even growing. That is Tanzania for you, a stable growing economy where investment, especially in the real estate sector is growing, and growing exponentially.

Tanzania has been enjoying a steady economic growth over the last few years averaging an impressive 7% annually. However, for the sake of this article, lets leave the data in the papers for now and take to the streets, on the ground, what is actually happening?

In major cities like the capital Dodoma, development is hands on, on the ground right in front of you. Empty stretches of land are now housing complexes complete …

Kenya is the barometer for what is happening or likely to take root in East Africa since the country tends to set the pace on matters development.

When it comes to land prices in East Africa, Kenya tops the list of the most expensive land rivalling even properties in some affluent areas of Johannesburg, London and New York.

In the last quarter of 2019, land prices in Kenya continued on their upward trend with properties in the suburbs increasing by 1.69 per cent over the year while satellite towns saw prices increase by 6.93 over the same period.

African economies must diversify, value add for quick recovery

In a report by Hass Consult, Kitengela which is just an hour from Nairobi city centre saw the highest land price increase recording a 10.71 per cent hike while Ongata Rongai led on a quarterly basis at 4.56 per cent.

The plush Spring …