- African tech startup funding received $3 billion in 2022, highlighting the growing significance of the industry among potential financiers.

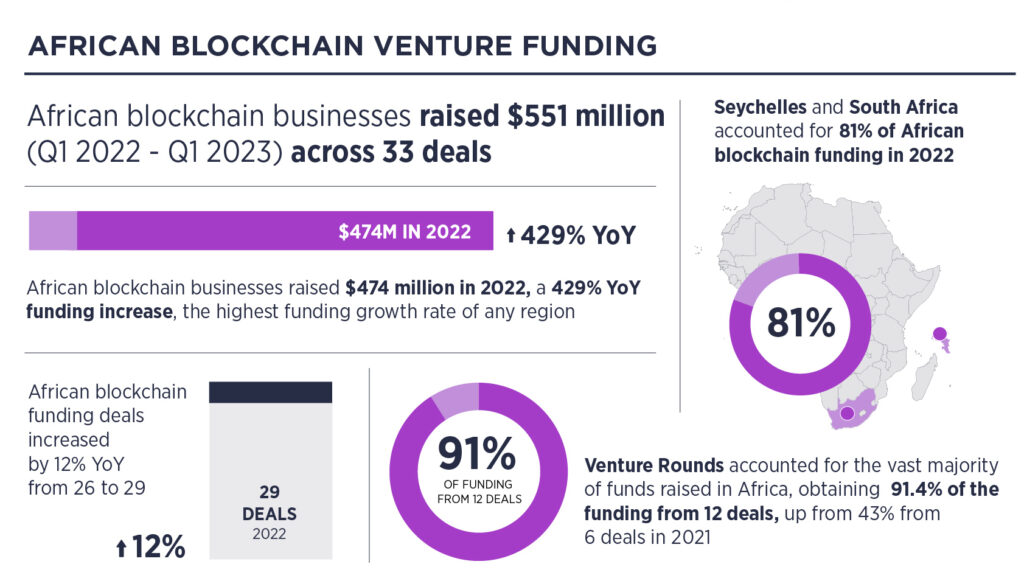

- Africa’s share of global blockchain funding, however, remains modest, increasing from 0.3 percent to 1.8 percent between 2021 and 2022.

- Seychelles’ gained $208 million for six deals while and South Africa earned $176.6 million from the same number of blockchain deals.

Blockchain startups in Seychelles and South Africa received nearly all the fresh funding raised in the segment in 2022. A new report shows blockchain startups from the two countries shared 81 percent of the $474 million fresh funding realized last year.

According to the African Blockchain Report 2022 by venture capital firm VC VC, startups in this segment are well within the fourth Industrial Revolution and are projected to play a huge role in Africa’s tech industry.

In 2022, Africa’s tech industry grew significantly as more investors poured millions of dollars to get a pie of the business segment. African tech startup funding got $3 billion in 2022, underscoring the growing significance of the industry. According to the report, African venture funding grew by 35 percent to $3.14 billion, while global funding fell by 35 percent to $415 billion.

Read: Kenya hosts Polygon’s first Web 3.0 Bootcamp in Africa.

However, the rate of blockchain deals grew exponentially, with a $26.8 billion rise globally. African blockchain startups raised 4 percent of this figure. The overall number of blockchain deals within the continent grew by 12 percent. These encompassed several areas, including infrastructure, personal identification, record-keeping and access to financial independence.

This means that existing African blockchain setups are heavily profiting from the continent’s ecosystems. Since the emergence of African blockchain “unicorn” startups, more blockchain developers have sought the glory that the 4IR technology promises.

According to the documentation, Africa’s share of global blockchain funding remains modest, increasing from 0.3 percent to 1.8 percent between 2021 and 2022.

This figure is distributed through several geographic locations. Seychelles and South Africa accounted for 81 percent of African blockchain funding, 43.9 percent and 37.3 percent, respectively. Nigeria was the leading country in the number of deals, 13, but their valuation amounted to $24.7 million.

This was a shy number compared to Seychelles’ $208 million for six deals and South Africa’s $176.6 million for six deals. Kenya attained $25.78 million across four deals, setting the competition high for Nigeria, Africa’s web3 hub.

Development of Web3

The concept of Web3, the third version of the Internet, has led to various milestones in different industries. The overall concept represents the full integration of blockchain technology in every aspect of the Internet or Web2.

Read African Startup League: Competition for funding over 10,000 startups annually.

Blockchain technology is responsible for one of Africa’s youngest and fastest-growing economic activities; the Fintech Industry.

African blockchain startups revolves around implementing a decentralized system. Companies such as Yellow Card, Flutterwave and other fintech investments derive their sophisticated system from this revolutionary idea. Blockchain technology is among the few revolutionary concepts ushering in the fourth Industrial Revolution.

This 4IR technology has wholly inverted the view of several industries. Initial application in the financial systems has led to the development of P2P payment services, which offer decentralized systems that can increase financial inclusion in Africa.

It has led to the development of identity verification in financial systems, allowing more African to access such services. In addition, it is also a significant factor in the continent’s digital economy. Organizations such as Jumia have hinted at their interest in incorporating blockchain technology within their systems.

In doing so, it would alleviate various flaws within their design and automate most of their processes. Its traceability will completely secure most e-commerce businesses, increasing user trust and preventing any theft of goods. This generally creates a conducive atmosphere where the customer and the business owner can rely entirely on the system.

Further, due to the high interoperability of blockchain technology, other industries are also benefiting from it. Developers use blockchain technology within agri-tech business, and its decentralized network has led to the growth of insurance coverage among farmers.

In addition, the transmission of information is faster than most systems. In medical sectors, blockchain secures most databases while creating a single decentralized network among hospitals. This ensures that each user has aces to their medical records regardless of the hospital.

Read: Kenyan exports remain strong, but the trade deficit persists.

Six of the seven unicorn startups in Africa’s tech industry are from its fintech industry. The success tries of organizations such as Bitsika and Luno have inspired various blockchain developers to use web3 technology to gain fame and fortune. As a result, governments have also noticed its lucrative potential. Thus many governments have urged their citizens to dive into the world of web3, a 4IR technology.