- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

- Empowering the Future: Humanity Protocol’s Dream Play Initiative

- TikTok Community Guidelines update aims to curb hate speech and misinformation

- Rwanda sees 39% surge in bank borrowers as Sacco and MFI loan uptake declines

- Kenya Ports Authority wins dispute case over cargo release

- Why Africa can reap billions from digital economy

Month: June 2019

The Kenya Shilling showed the first sign of loosing ground against major currencies since the Central Bank of Kenya introduced new notes and decided to recall the Ksh 1, 000 note in order to curb illicit flow.

Commercial banks have quoted the Shilling trading against the US dollar at Ksh 101.95/102.15 per dollar, compared with 101.80/102.00 at last week’s close. This weakening despite being marginal is the highest rate the currency has traded this year.

At the beginning of June, Central Bank of Kenya announced measures to introduce new currencies meeting a long overdue constitutional requirement to introduce new faces of the currency. In doing so, the CBK governor also announced that the Ksh 1,000 note in circulation was to be recalled and removed from the list of legal tender in Kenya due to illicit use in the country and the region.

Holders of the old 1000 note are …

Kenyan listed banks had an improved performance on aggregate in the first quarter of 2019 as they recorded improved profitability in a relatively tough operating environment, a survey by Cytonn Investment has revealed.

During the quarter, return on equity rose to 19.2 per cent from 18.4 per cent in Q1 2018, with equity group having the highest at 22.8 per cent, Cytonn’s Q1’2019 Banking Sector Review indicates.

The report, themed ‘Consolidation and Diversification to drive Growth’, analyzed the Q1’2019 results of the listed banks.

“We note that the increased emphasis on operating efficiency by banks seems to be bearing fruit, with the listed banking sector’s operating efficiency improving year-on-year, which was further supported by a recovery in interest revenue, largely supported by the asset re-allocation to government securities, and increased lending to specific segments”, said Caleb Mugendi, investment Associate at Cytonn Investments.

“The continued focus on alternative banking …

EFG Hermes, the leading financial services corporation in frontier emerging markets (FEM), has for the second year running been ranked the number one frontier market brokerage firm in the Extel Survey 2019.

The firm also remains the second highest ranked brokerage firm in the Middle East and North Africa(MENA).

Prior to this accolade, EFG Hermes was also named, for the second time in as many years, the leading Africa (Ex-South Africa) Equities House by the Financial Mail, attesting to the success of its expansion into African markets.

EFG Hermes launched its operations in Kenya in 2017 and has been using its Nairobi office as the hub for its East African research coverage and trading execution.

“As the most dynamic and leading economy in the region, we strongly believe that Kenya is the most appropriate hub for the region,” said Kato Mukuru, EFG Hermes’ Head of Frontier Research.

“Holding our ground …

Tala, the leading consumer lending app in emerging markets, has disbursed loans to over 2.5 million customers globally, in the wake of continued global expansion of financial technology.

READ:Kenyan fintech companies brace for sectors’ revolution

This was revealed on Monday during the celebrations to mark the company’s five year anniversary in Kenya.

When Tala, formerly Mkopo Rahisi, was launched in Kenya in 2014 becoming the first in the world to offer unsecured mobile loans direct to consumers.

Since then, Tala has expanded credit access across Kenya by using alternative data to instantly underwrite and disburse credit to people who have been excluded from traditional finance due to lack of credit history or formal records.

READ:Tala raises $30 million to expand into new markets

Speaking during the launch of ‘Tala at 5’ celebrations, the head of Tala’s Kenya business, Ivan Mbowa, noted that Tala has changed the way people …

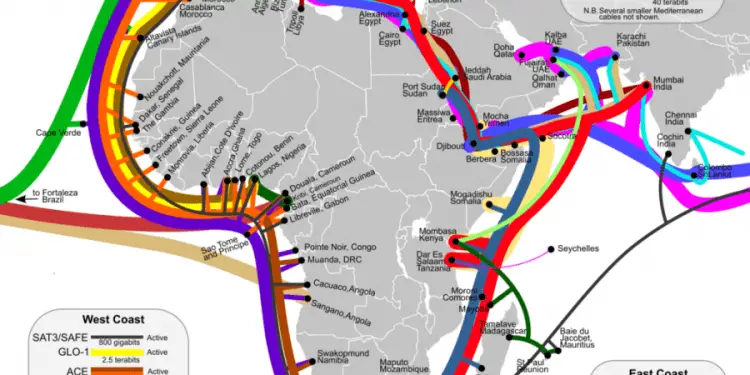

Pan-African telecoms enabler SEACOM has further extend its corporate market offering into the East African region, under its Seacom Business brand, by providing its industry-leading Internet connectivity and cloud services directly to corporate customers in Uganda.

SEACOM has been a leading data connectivity provider in Uganda enabling access though the service provider segment.

READ ALSO:SEACOM and Microsoft to boost connectivity in Kenya

It is now bolstering its presence in Kampala by expanding its enterprise reach and will now be able to provide corporate organisations in Uganda with reliable data connectivity and cloud services.

SEACOM will provide a corporate-grade consistent service quality by leveraging its existing high-speed fiber-based network infrastructure that extends from Kampala onto its diverse subsea international backbone.

Speaking during the launch, SEACOM’s Managing Director for the Eastern North and East Africa region, Tonny Tugee, said the new development is part of the telecoms provider’s plan to strengthen …

The Ethiopian banking sector is comprised of the National Bank of Ethiopia (NBE), two government-owned banks and sixteen private banks.…

ATZ Law Chambers, the Africa Legal Network (ALN) member firm in Tanzania has rebranded to A&K Tanzania, in its quest to expand its services in the country and the region.

Anjarwalla & Khanna (A&K) Tanzania has taken over the practice of ATZ Law Chambers in the new move. The firm’s core leadership team will now include Partner, Geofrey Dimoso and Director, Shemane Amin who joined in April and February respectively.

“Driven by the firm’s vision to complement its robust local practice with the capability to service clients regionally and in recognition of the value that our clients have gained as a result of our cross-border collaboration with A&K Kenya, these developments will enable us to strengthen our regional offering by providing greater access to a broader pool of specialist teams and resources,” the entities said in a statement.

“Our office address, client engagement terms and operations in our Dar es …

Bolt, the leading European on-demand transportation platform has launched ‘Bolt for Business’, a plan that allows companies to manage and pay for all corporate trips from one central location.

On the new Bolt for Business portal, account managers can set up company-wide rules and control when and who can use business trips, making it simple to budget for and get a clear overview of the company’s transportation expenses.

The platform also enables the corporate to set and customise the spending allowances and the number of trips employees can take. It is also possible to require employees to report the purpose of the trip before the ride. The new system can be used on both desktop and mobile.

Olaoluwa Akinussi, Country Manager, Bolt Kenya said: “A growing number of Bolt trips are taken for business purposes, whether it’s commuting to work, rushing to client meetings or getting to the airport. Most …

Trading at the Nairobi Securities Exchange (NSE) more than doubled this week compared to the previous week, as the market recorded increased investor activities.

Week on week turnover rose Ksh3.7 billion (US$36.3 million) on 102 million shares traded against 51.8 million shares valued at Ksh1.3 billion (US$12.8 million) transacted the previous week.

During the week’s trading which closed on Friday, the NSE 20 share index was up 6.32 points to stand at 2706.78. All Share Index (NASI) shed 0.35 points to settle at 150.12 while the NSE 25 Share index lost 11.08 points to settle at 3637.98.

Banking Sector

The banking sector was busy with shares worth Ksh1.3 billion transacted which accounted for 35.78 per cent of the week’s traded value. Equity Group Holdings actively moved 15 million shares valued at Ksh601 million at between Ksh39.75 and Ksh40.05.

KCB Group moved 11 million shares worth Ksh446 million and closed the …

The Kenya Bureau of Standards (KEBS) has initiated Kenya Quality Award (KQA), a scheme aimed at promoting and entrenching a quality culture amongst Micro, Small and Medium Enterprises (MSMEs) in Kenya.

This comes in the wake of increased efforts to improve the quality of local products to meet international standards, which will help Kenyans manufacturers and producers increase Kenyan exports to foreign markets.

The move is also as a strategy to prepare local businesses to tap into the Africa Continental Free Trade Area which is slowly taking shape.

READ:What Africa stand to gain from ACFTA

Designed to recognize MSMEs striving to produce quality product and which already have a valid Standardization Mark of Quality (SMark), the KQA programme will additionally assist MSMEs to initiate, develop and implement quality management systems to a status of certification.

Speaking during the KQA launch ceremony, Kebs acting managing director Lt. Col. (Rtd). Bernard …