- History beckons as push for Kenya’s Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

- Empowering the Future: Humanity Protocol’s Dream Play Initiative

- TikTok Community Guidelines update aims to curb hate speech and misinformation

- Rwanda sees 39% surge in bank borrowers as Sacco and MFI loan uptake declines

- Kenya Ports Authority wins dispute case over cargo release

Month: December 2019

The Chinese government offered Ghana a grant of $42.62 million for economic and technical projects implementation.

The economic and technical cooperation agreement was signed on Thursday by Chinese Ambassador to Ghana Wang Shiting and Kenneth Ofori-Atta Ghana’s Finance Minister.

This follows Madam Sun Chunlan China’s First Premier visit to Ghana where she had promised to give the grant to finance some economic and technical projects.

The Minister of Finance, Ken Ofori-Atta commended the Chinese government for its continuous support to Ghana during the signing ceremony in Accra

Also Read: Ghana hosts key African Continental Free Trade Area meetings

“We would like to acknowledge the immense support the government of the People’s Republic of China has provided Ghana over the decades especially in the areas of infrastructure, information communication technology, trade and investment, tourism and education including technical vocation education training,” he said.

Mr Ofori-Atta said the grant would be used …

South Sudan traders and businesses are hoping for intermission in the foreign exchange market after the Bank of South Sudan said it would introduce dollars into the market to protect the local currency.

Since after the payment of several months of salaries in arrears in September, South Sudan pound has been weakening against the dollar.

“The pound has lost value in the past two months due to the impact of the recent payment of salaries,” said Central Bank Governor Dier Tong.

About $115.2 million which is about 31 per cent of the currency in circulation was put into the economy for the payments.

Also Read: AfDB funds South Sudan’s capital city power distribution system

In October, South Sudan’s government secured $400 million financings from the Africa Export-Import Bank to pay the salaries and finance infrastructure projects.

Elijah Wamalwa the managing director and CEO of Co-operative Bank of South Sudan said …

Uganda’s Umeme has secured a $70 million syndicated loan from the International Finance Corporation (IFC), Dutch Development Bank (FMO), Standard Chartered Bank and Stanbic bank.

From the loan $28 million was from IFC, $10 million from FMO, $16 million from Standard Chartered Bank and $16 million from Stanbic bank.

Umeme chairman, Mr Patrick Bitature said the loan would partly be used to undertake capital investments to get electricity from Uganda’s newest dams.

“The planned investments are aimed at expanding the network to uptake the new generation, improve reliability and create access,” he said.

Also Read: IFC $22M partnership with Investment Funds for Health in Africa

Mr Bitature said the loan would also be utilised to prioritise Umeme’s investments in five other areas such as upgrading its network, extending power to industrial parks, building the backbone for more electricity connections to be supplied, reducing energy losses and accelerate prepayment metering.…

South African Aerospace, Maritime, and Defence Export Council (SAAMDEC) CEO Sandile Ndlovu urged the South Africa defence industry to cultivate a healthy interest in the Egyptian market.

Speaking at the outward trade and investment mission (OTIM) in Egypt, Mr Ndlovu said the export council’s mission was spearheaded on a two-pronged approach.

“The first was to formally introduce the South African defence industry to the market and acknowledging the efforts of individual companies that have been interacting with the Egyptian defence. The second was to identify areas where South Africa and Egypt could cooperate in the defence space8,” he said.

He said that their first interactions with the Egyptian private sector occurred during a defence exhibition held in Egypt last year. Adding that with the interactions they have had during the event, they have found that there is a lot of interest to cooperate with them specifically on promotion and marketing …

Bank of Tanzania (BoT) monthly (November 2019) economic report has analyzed the economic development of Zanzibar, a semi-autonomous region of Tanzania, (an archipelago in the Indian oceans composed of several islands), highlighting various keys issues and developments particularly in managing inflation.

READ: Sector review: a glance at Zanzibar’s agricultural sector

Inflation

The report indicated that the headline inflation remained below the medium target of 5 per cent, same as the previous month of October, while Annual headline inflation was 2.4 percent in October 2019 compared with 3.7 percent recorded in October 2018 largely due to easing in non-food inflation.

On the same mark, the report indicated that twelve-month non-food inflation eased to 2.7 percent in October 2019 from 4.5 percent in the corresponding month of 2018 mainly due to a decline in prices of kerosene, diesel and petrol, while in October the inflation was moderated by prices of fish, rice, …

The United Nations (UN) Climate Change Conference COP 25, has levitated the climate action landscape in Africa

This has led to the African Development Bank (AfDB) to join forces with 11 other international organizations to assist developing countries to build resilience against the impact of natural disasters caused by extreme weather.

The initiative comes at a rather perfect moment, especially when the region is faced with unprecedented catastrophic weather events affecting the continent’s economy.

According to AfDB, the institutions came together at the COP 25 climate change conference in Madrid on Tuesday to launch the Alliance for Hydromet Development.

Alliance for Hydromet Development

According to the World Meteorological Organization (WMO), the Alliance for Hydromet (hydrological and climate services) Development brings together major international development, humanitarian and climate finance institutions, collectively committed to scale up and unite efforts to close the hydromet capacity gap by 2030. It aims to increase …

Serena Hotels and Resort, a leading global hospitality brands with prominence in East Africa has partnered with a Forbes feted travel-tech company INTELITY to launch a mobile app to promote easy bookings.

The upscale hospitality brand, best known for its unique collection of luxury hotels, resorts, and safari lodges within East Africa, Mozambique, and Asia, will partner with INTELITY to build a custom, richly branded mobile experience for their guests.

Serena Hotels’ new brand app will enable guests to book and manage reservations, check-in (and out), and download a mobile room key directly to their smartphone. Additionally, the app will support service requests, mobile dining orders, messaging with staff, and local and property information, while easy access to amenities will simplify the booking process for spa, dining, and tours. From an operations perspective, INTELITY’s staff-facing dashboard collects and streamlines workflows, tracks all activity, and offers real-time operational insights with built-in …

The East African Community has for long earmarked the linking of partner countries through roads. One of this link is the link road that connects the coastal towns of Mombasa and Tanga, touching the lives of thousands of commuters and transporting goods and services worth millions.

Recently, the EAC announced that it has increased its funding for key projects from various donors among the Africa Development Bank (AfDB), which has now approved this project.

The Bank’s support for the Mombasa-Lunga Lunga/Horohoro and Tanga-Pangani-Bagamoyo roads Phase I, is in the form of African Development Bank and African Development Fund loans and represents 78.5% of the total €399.7 million project cost. The European Union contributed a grant of €30 million, 7.7% of the total project cost, to the government of Kenya.

The road is a key component of the East African transport corridors network, connecting Kenya and Tanzania. Producers, manufacturers and traders …

The European Investment Bank (EIB) recently partnered with the Eastern and Southern African Trade and Development Bank (TDB) to open a $120 million credit line to finance renewable energy projects for small and medium-sized enterprises (SMEs).

The agreement was signed between the European Investment Bank (EIB) and the Trade and Development Bank of Eastern and Southern Africa (TDB), a commercial bank owned by the Member States of COMESA, the World Bank (AfDB) and China on the sidelines of the 9th Summit of Heads of State and Government of African, Caribbean and Pacific (ACP) Countries

The partnership agreement was signed by EIB Vice-President, Ambroise Fayolle and Admassu Tadesse, President and CEO of TDB. The agreement provides a line of credit to support small and medium-sized enterprises (SMEs) investing in renewable energy and energy efficiency.

Also Read: French Development Agency provides $30 million for African SMEs

Companies have the means to bypass …

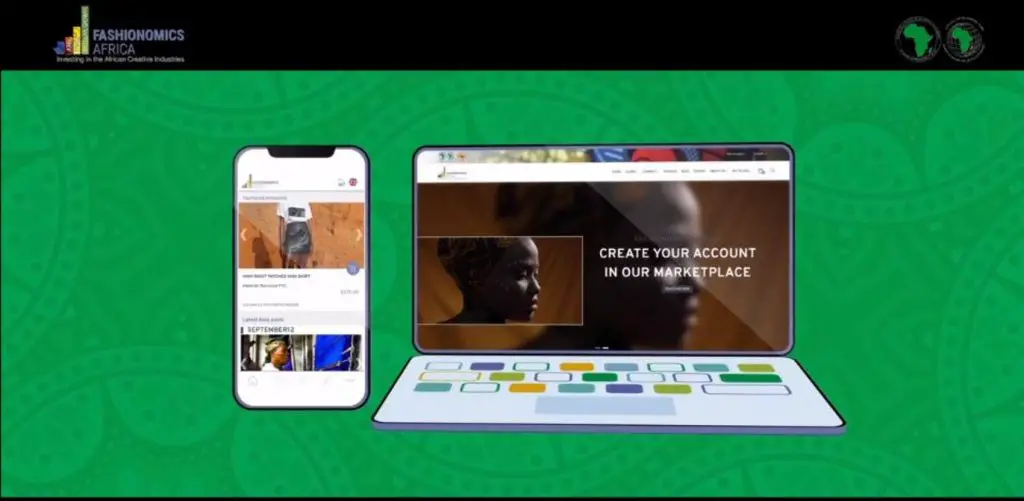

The African Development Bank’s flagship initiative, Fashionomics Africa launched the pilot phase of a digital marketplace to help Africa’s fashion designers, textile and accessories professionals connect with global markets.

The launch took place at the Global Gender Summit, attended by more than 1,500 representatives from multilateral development banks, financial institutions, governments and private sector leaders in Kigali, Rwanda.

The Fashionomics Africa digital marketplace website and mobile app is sponsored by the Fund for African Private Sector Assistance. It is the latest innovation from Fashionomics Africa, a platform which enables African entrepreneurs from the textile, apparel and accessories industries to create and grow their businesses, with a focus on opportunities for women and young people.

“It is the first-ever B2B (Business-to-Business) and B2C (Business-to-Consumer) platform that has ever been created for, micro, small and medium-sized enterprises that are working along this value chain,” said Dr. Jennifer Blanke, the Bank’s …