- Kenyan Farmers Receive $2M Boost from Africa Fertiliser Financing Mechanism

- Brace for High Interest Rates for a Longer Period World Bank Warns Kenya

- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

Author: Kanyali Muthui

Kanyali Cynthia is a Kenyan-based financial journalist with key specialisation in data and tech reporting and over eight years of experience.

- M-KOPA enables underbanked customers in select African markets to access a broad range of products and services without collateral or a guarantor.

- M-KOPA has raised $190 million over the past decade

- M-KOPA is known majorly for its pay-as-you-go (PAYG) financing model that allows customers to build ownership of appliances over time by paying an initial deposit followed by flexible micro-payments

- M-KOPA is looking to expand its flexible daily and weekly payments model by scaling financial services products such as health insurance, cash loans and BNPL merchant partnerships

M-KOPA began commercial sales in Kenya in October 2012 following 2 years of piloting and development.

The young startup expanded to Uganda a year later and commenced operations in Tanzania in late 2014.

The company, led by co-founder and CEO Jesse Moore started with solar-power home systems targeted at lower-income and rural customers without electricity in Kenya, Tanzania and Uganda.

Known majorly for …

Cashlet has been developed by Sycamore Capital Ltd, and it works in partnership with regulated fund managers in Kenya, to allow users to invest in unit trust products in simple, fully digital, and modern way.

The initial partner fund managers include ICEA Lion Asset Management, Old Mutual, and Genghis Capital.

The app seeks to pioneer saving and investing flexibility, life goals creation and tracking, market interest rates, financial visibility, and expert support.…

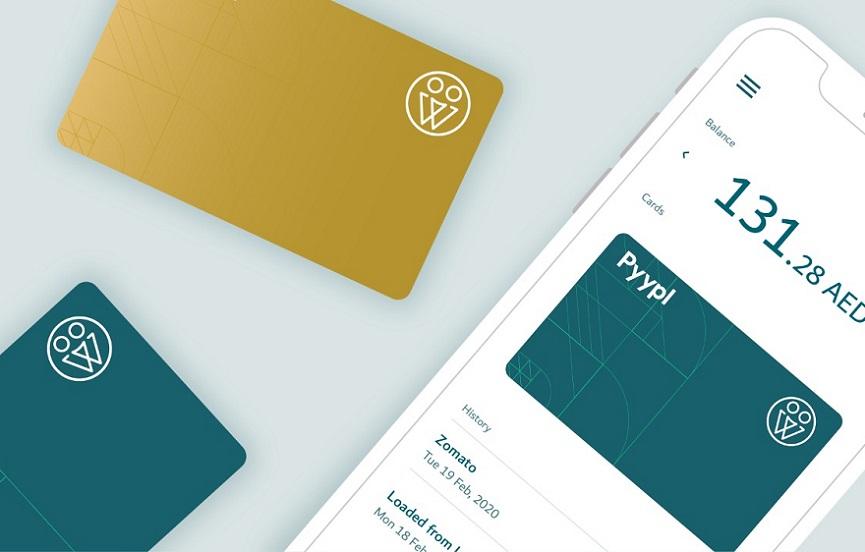

Pyypl uses advanced Artificial Intelligence (AI) and Machine Learning (ML) for regulatory compliance, Anti Money Laundering (AML), and Counter-Terrorism Financing (CTF).

The platform also conducts real-time Politically Exposed Persons (PEP) and sanctions (both country and individual) screening against the latest and historical UNSC, USDT, FATF, OFAC, and EUCFSF records, as well as all local databases.

Fintech startups in Africa have continued to gain a lot of attention from investors who have been pouring billions of dollars to support the industry. …

The funds which are an extension of an undisclosed six-figure raise MoneyHash announced last June from investors including Ventures Platform, Kepple Africa Ventures, LoftyInc Capital and lead COTU Ventures is aimed at fast-tracking the firm’s growth in the Middle East and Africa.

MoneyHash started in Egypt early last year, allowing 17 companies to use its sandbox environment to connect with its API and access payments gateways such as Fawry, Paymob and PayTabs.

As more companies opt to digitize their operations across the board, most firms initially work with one or two payment processing providers. …

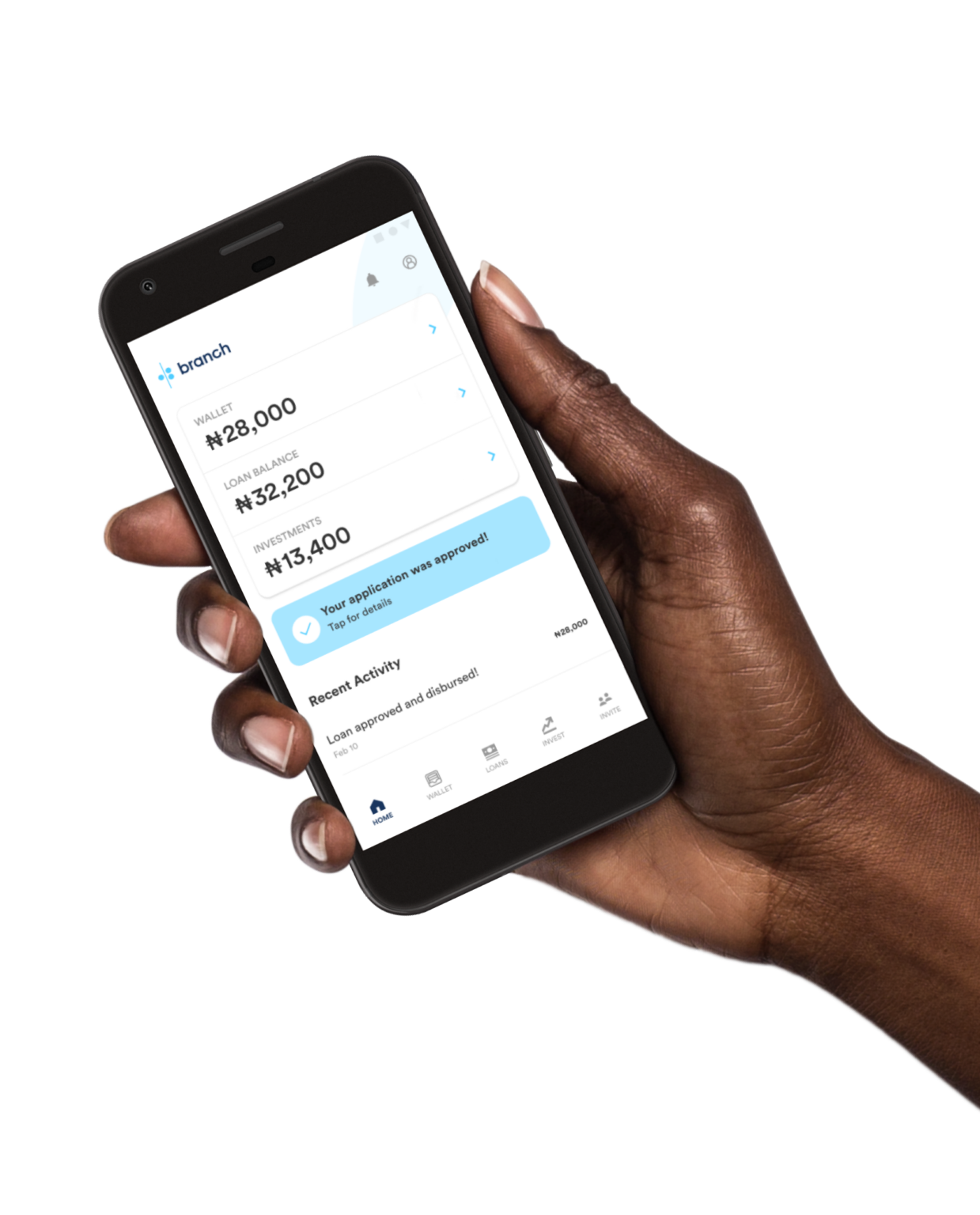

This comes after the National Treasury exempted the digital lender from a law limiting individual shareholding in microfinance to 25 per cent.

In a gazette notice signed by the Cabinet Secretary National Treasury, Ukur Yatani, the San-Francisco based fintech has been exempted from Section 19 of the Microfinance Act (for 4 years through 2025).

Currently, individuals or single entities are barred from holding more than a 25 per cent stake in a microfinance institution.…

However, economic growth and the rapid expansion of digital and mobile services are set to change this.

With the African middle class growing across many African nations, the target market for insurance products is growing.

The report highlighted that there has been a significant rise in demand for digital solutions, as smartphone and affordable internet penetration deepens across the continent, providing opportunities for InsureTechs to step in and offer innovative products.…

This as 19 per cent of people in sub-Saharan Africa lived in areas not covered by mobile networks while an additional 53 per cent did not use mobile internet despite having coverage.

The need for accessible internet solutions comes after Meta (formerly Facebook) announced plans to shut down its low-cost Express Wi-Fi internet.

The programme was launched back in 2016 to drive internet connectivity in regions where other forms of connectivity, like ADSL and fibre-optic networks, aren’t readily available or established.…

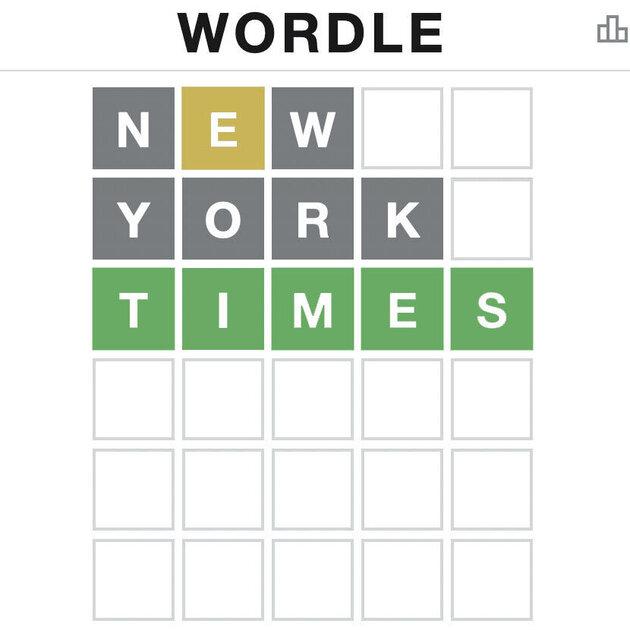

- The game has been acquired for an undisclosed price in the “low seven figures.”

- This adds to the publications growing portfolio of word games including The Crossword, The Mini, and Spelling Bee

- As of December 2021, The NYT had over one million games subscriptions

It has now become common for one to come across a post on different social media platforms with the title Wordle accompanied by a specific figure and what appears to be a strange-looking yellow, green and black graph.

This growing phenomenon is courtesy of a puzzle known as Wordle created by Brooklyn-based software engineer Josh Wardle in October 2021.

The game initially created for Wardle and his partner Ms. Palak Shah has now been purchased by the New York Times (NYT) Company. According to the NYT, the game has been acquired for an undisclosed price in the “low seven figures.”

Read: Piecing the Puzzle of African …

Findings show that increasing costs in every market due to a year of supply disruption did not deter data centre demand in most markets including Nairobi and Johanessburg.

The two African capitals were among 44 other locations that were surveyed.

According to the study, despite the negative impact of the coronavirus pandemic, demand remained relatively steady when compared to other industries owing to governments’ decisions to make working and schooling from home mandatory. …

- Data by the World Bank reveals that at least a quarter of the African population has internet access, a nearly fifty-fold increase in internet usage since 2000.

- The rapid spread of the internet across the African continent has been lauded as a key driver of prosperity and a sign of the continent’s technological coming of age.

Over the past few years, the wealth management industry has seen a significant amount of diversification, from traditionally having products geared towards institutional investors and high net worth individuals to offering more accessible products to low and middle-income earners.

While WealthTech is not a new concept in Africa, there is room for market players to leverage consumer demand for wealth management products that are more digitally accessible and easy to use.

WealthTech or wealth management technology is the combining of technology such as AI, big data, SaaS, with financial assets, such as savings, investments, …