- Russia and Tanzania unite to double trade, boost Africa market access

- History as Janngo Capital seals Africa’s largest gender-equal $78M tech VC fund

- South Africa Budget Disappoints Investors as Deficit Widens

- Kenya drops to 6th place in Africa trade barometer

- Tanzania’s bold move to boost cashew nut exports by 2027

- Chinese cities dominate global list of places occupied by billionaires

- Sudan tops up as Africa aims for $25 billion development fund

- Opportunities for youth: Tech firms Gebeya and NVIDIA to train 50,000 developers in Africa

Author: Kang'ethe Njoroge

A communication expert with over 10 years’ in journalism and public relations. My ability to organize, coordinate and follow through assignments has enabled me to excel in media. I have a passion for business in Africa and of course business in Kenya!

- Analysts have termed Central Africa as a sleeping Giant, yet to awaken as the region recorded the least funding for startups in 2022.

- In 2022, Central Africa was by far the region where start-ups raised the least funding through deals worth $100,000 and over with a total of $51 million according to the latest report by The Big Deal.

- While the region represented only 1.1 percent of the funding raised on the continent, Year on Year growth was commendable, as start-ups raised more than double the amount that had been raised in 2021 ($24 million).

Analysts have termed Central Africa a sleeping giant, yet to awaken as the region recorded the least funding for startups in 2022.

Max Cuvellier from The Big Deal says there is a huge potential in the region despite the depressed numbers.

“This is not to say that there isn’t talent or potential in the DRC, …

- LG Electronics has appointed Dong Won Lee as its new Regional Managing Director for East Africa (EA) as the company seeks larger market share in the region.

- Lee replaces Sa Nyoung Kim who served as LG EA Managing Director for three years since January 2020.

- Lee brings over 20 years of hands-on experience and knowledge in leadership, performance improvement, sales, and marketing in the consumer electronics industry.

LG Electronics has appointed Dong Won Lee as its new Regional Managing Director for East Africa (EA) as the company seeks larger market share in the region.

Lee replaces Sa Nyoung Kim who served as LG EA Managing Director for three years since January 2020.

Before his appointment, Dong Won Lee was the Managing Director of LG Iraq, a position he has held since 2019. He is celebrated for turning around the business in Iraq by increasing sales growth by 50 percent hence …

- Kenya has begun preparations to support the transition from fossil fuel-powered vehicles as demand for electric vehicles intensifies.

- Kenya Power has established a liaison office which acts as a one-stop shop to champion the Company’s e- mobility business.

- The company is also in the process of hiring a consultant to guide the development of an E-mobility Network Infrastructure System (ENIS) to pilot the electric vehicle charging stations, both for company use and demonstration purposes.

Kenya has begun preparations to support the transition from fossil fuel-powered vehicles as demand for electric vehicles intensifies.

Speaking during the opening session of Kenya Power inaugural E-mobility Conference Kenya Power’s Ag. Managing Director Geoffrey Muli said the firm has established a liaison office which acts as a one-stop shop to champion the Company’s e- mobility business.

“Through this office, we are working with investors and stakeholders to support the development of the e-mobility ecosystem, which …

- Burkina Faso’s largest microfinance institution ACEP Burkina has received $2 million from the International Finance Corporation (IFC).

- The loan facility will allow ACEP to ramp up access to longer-term finance for agri-sector MSMEs, smallholder farmers, and businesses in rural food chains in Burkina Faso.

- The financing will also help improve ACEP Burkina’s liquidity and support the company’s expansion of its mobile banking and access to credit services for rural MSMEs.

Burkina Faso’s largest microfinance institution ACEP Burkina has received $ 2 million from the International Finance Corporation (IFC) aimed at improving access to finance for farmers and micro, small and medium sized enterprises.

The loan facility will allow ACEP to ramp up access to longer-term finance for agri-sector MSMEs, smallholder farmers, and businesses in rural food chains in Burkina Faso, including women-owned businesses, contributing to increased agricultural production.

The financing will also help improve ACEP Burkina’s liquidity and support the …

- About 22 districts across Zambia are underwater due to climate change-induced flooding caused by above-average rains according to CARE Zambia

- The humanitarian organisation reports that over 70 districts in Zambia are at a high risk of flooding even as the rains continue to fall, and rivers burst their banks.

- The climate crisis has directly affected at least 1.5 million people – including an estimated 821,000 children.

About 22 districts across Zambia are underwater due to climate change-induced flooding caused by above-average rains according to CARE International.

The firm reports that over 70 districts in Zambia are at a high risk of flooding even as the rains continue to fall, and rivers burst their banks.

In six districts where CARE works, there has been continuous rains that have led to flash floods. Hundreds of hectares of planted fields and grazing lands are underwater. Homes have been submerged as roads and bridges …

- Equity Bank (Kenya) Limited (EBKL), has completed the acquisition of certain assets and liabilities of teachers-owned Spire Bank Limited following regulatory approvals.

- With completion of the transaction, customers holding deposits in Spire Bank, other than the remaining deposits from Spire Bank’s controlling shareholder, and specified loan customers will now transition to become EBKL customers, having new Equity Bank accounts.

- The decision to acquire Spire Bank’s certain assets and liabilities was inspired largely by the banks’ history with teachers who have continued to support the Bank over the years.

Equity Bank Kenya Limited (EBKL) has completed the acquisition of certain assets and liabilities of Kenyan teachers’ owned Spire Bank Limited following receipt of regulatory approvals.

The bank had to get approvals from the Cabinet Secretary Treasury and Planning under Section 9 (1) of the Banking Act, the Central Bank of Kenya under Section 9, ( 5) of the Banking Act, the …

- Union Bank of Nigeria Plc has received a $30 million loan facility from the International Finance Corporation (IFC) to help the bank expand lending.

- The facility will allow Union Bank to increase trade financing and working capital lending to Nigerian businesses.

- The loan facility to Union Bank is being made through IFC’s COVID-19 Emergency Response Working Capital Solutions Envelope, which was launched in 2020.

Union Bank of Nigeria Plc has received a $30 million loan facility from the International Finance Corporation (IFC) to help the bank expand lending to hundreds of businesses operating in critical sectors in the country that include food, healthcare, manufacturing, and services.

The facility will allow Union Bank to increase trade financing and working capital lending to Nigerian businesses, including those whose cashflows have been strained by recent disruptions in global and local markets.

“As a bank, we are deeply committed to enabling success for …

- Majority of Kenyans buy from companies with distinctive branding a new study reveals.

- The study by Elite Mawu Agency reveals that more than 65 percent of Kenyans interact with companies that have attractive branding.

- According to the report, branding provides an emotional link by tying people to lifestyles.

Majority of Kenyans buy from companies with distinctive branding a new study reveals.

The study by Elite Mawu Agency reveals that more than 65 percent of Kenyans interact with companies that have attractive branding that include distinctive creative logos and branding collaterals.

The report dubbed Kenya Branding Report Card 2022, indicates that brands with originality and creativity attracts more interaction and buy-in.

“There are small businesses with similar products at every corner, so what makes your business different? Your brand! Stand out from the competition and develop your brand further than just a logo,” said Elite Mawu Agency Chief Executive and …

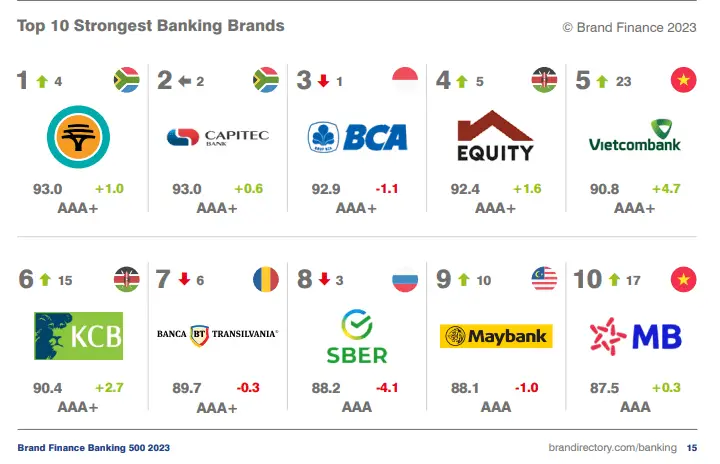

- South African Banks topped the list of the world’s top 500 most valuable banking brands in Africa according to Brand Finance Banking 2023 report.

- South Africa scooped the first top five spots in Africa headlined by First National Bank ranking at number 155 worldwide albeit a drop from 146 the previous year.

- Kenya’s Equity bank came in 6th position followed by National Bank of Egypt in 7th position while Nigeria’s Access Bank and Zenith Bank followed at 8th and 9th position respectively as Egypt’s Banque Misr closed the regional to ten list.

South African Banks topped the list of the world’s top 500 most valuable banking brands in Africa according to Brand Finance Banking 2023 report.

The report shows South Africa scooped the first top five spots in Africa headlined by First National Bank ranking at number 155 worldwide albeit a drop from 146 the previous year.

Other banks who …

- Female-led and female-founded ventures attracted even less funding in 2022 than they had in 2021.

- Female-led start-ups in Africa have raised $188m (4%) in 2022, while male-led ventures raised $4.6bn (96%).

- The number of $100k+ deals announced by female-led start-ups has also seen a YoY decrease, (128 in 2022 vs. 141 in 2021) and relatively (13% vs. 16%).

Female-led and female-founded ventures attracted even less funding in 2022 than they had in 2021, latest data from Africa’s The Big Deal shows.

According to the report, female-led start-ups in Africa have raised $188m (4%) in 2022, while male-led ventures raised $4.6bn (96%). In other words, 25x times less funding has been invested in female-led start-ups in 2022, compared to their male-led counterparts.

“Year-on-year, the amount of funding raised by female CEOs has decreased between 2021 and 2022, both in absolute ($188m in 2022 vs. $290m in 2021) and relative numbers (3.9 …