Mining is a critical industry in Africa.

The continent is endowed with just about every mineral imaginable. The mineral resources in the modern-day Democratic Republic of the Congo alone are mind-numbing both in terms of metals and other natural resources.

It has been said that if waters from the Congo River were harnessed to provide hydroelectricity, that energy could power the whole continent. This is a legend.

- The mining industry is central to the economic development of Africa

- Countries like South Africa, Nigeria, Zimbabwe, Angola, Zambia, and Botswana owe their existence to the sector

- Despite its great promise, the sector generally fails to reach its potential to provide economic transformation to countries that are host to large deposits of natural resources. This is a phenomenon known as the resource curse or the paradox of plenty

It has not yet been tested for its veracity; however, when one considers the vast mineral deposits in that country, it is not difficult to imagine it as a fact. The African continent is also host to several countries that owe their existence to their mining activities.

Where would South Africa be today without the diamond fields of Kimberly? And what would that country be today if not for the hive of mining activity that took place in that country without the rich gold deposits of the Witwatersrand?

The same can be said of Botswana, a country built on a deposit of diamonds that were first discovered in that country in the 1960s. Zimbabwe has been called a gold mine. The entire country has deposits of gold littered all over its geographic expanse.

Diamonds in the early 2000s were discovered in the country’s eastern highlands in an area in Marange called Chiadzwa. The deposit is a fabulously rich one. There is something unique about the Chiadzwa diamond field in Zimbabwe. It is one of the few in the world where diamonds are alluvial.

Alluvial deposit refers to an unconsolidated deposit of ores, minerals or mineral resources located at or near the surface formed where the concentration of ore minerals was caused by the physical or mechanical separation of heavier from lighter weight minerals during the surficial flow of running water in stream channels.

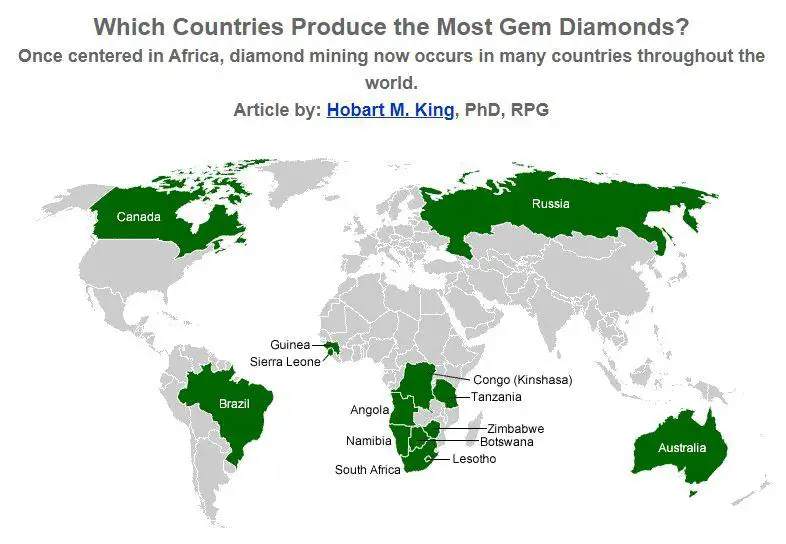

Simply put, this means that the diamond deposit in Zimbabwe consists of gems that occur very close to the surface to the extent that miners, residents, and fortune hunters could pick up diamonds right off the ground without digging a single hole in the ground. Alluvial diamond deposits around the world are also found on the Atlantic coast of South Africa and Namibia, as well as in some riverbeds in Angola, Sierra Leone, Democratic Republic of Congo, Central African Republic, Cote d’Ivoire, Guinea, Ghana, Liberia, Tanzania, Togo, Brazil, Venezuela, Guyana, and South Africa.

This is according to the geoscience news and information website geology.com.

Zimbabwe also has other resources like coal and methane gas. Recently Australian firm Invictus has been prospecting an area in the country in search of oil. This is a matter unfolding, and it remains to be seen if, from its exploration activities, the company will discover an oil field that is commercially viable to exploit. Nigeria is rich in oil and gas and is even a member of the Organization of Petroleum Exporting Countries (OPEC).

According to recent news reports, the country is set to begin exporting liquified natural gas to European countries. This is after many of them placed embargoes on coal and gas from Russia. Russia has also turned off the gas taps to the rest of Europe in retaliation to the economic sanctions and measures set against it by the world’s leading countries.

Despite the immense natural resources that African countries are endowed with, these countries, for the most part, have high levels of poverty. A cruel irony of sorts. This is attributed to a concept called the “resource curse”. The Natural Resource Governance Institute defines this concept which is also known as the paradox of plenty, as the failure of many resource-rich countries to benefit fully from their natural resource wealth and for governments in these countries to respond effectively to public welfare needs.

While one might expect to see better development outcomes after countries discover natural resources, resource-rich countries tend to have higher rates of conflict and authoritarianism and lower rates of economic stability and economic growth compared to their non-resource-rich neighbours.

The effects of the natural resource curse are easily identifiable in Africa. The DRC, Nigeria, Zimbabwe, Sierra Leone, and others have notably high levels of poverty despite their endowment of natural resources. Nigeria has historically been a contentious hotbed of political upheaval due to the country’s oil wealth. From its independence in the 1960s, the country has experienced numerous and successive coups up to 1999. In Sierra Leone, the diamond deposits in that country financed a protracted and brutal civil war.

In Zimbabwe, the diamond fields of Chiadzwa are militarized, with reports of human rights abuses rife. What is the cure? How do countries in Africa rid and cure themselves of the natural resource curse?

Read: The changing face of the global mining industry according to PWC

The answer is in the law and the governance models that these countries approach. The way in which the governments of those countries approach the mining industry is imperative.

In South Africa, the natural resource curse is more pronounced in the sense that while the mining sector has made a few individuals fabulously wealthy, inequality in that country has meant that while the richest of the rich get richer, the poor get poorer.

How can governments approach the mining sector to ensure its development leads to broad-based and shared prosperity for all? The answer is the same. The answer is in the respective governments and the legal frameworks for the mining industries of those countries. Recently The Exchange published an article on how and why Australia is a top mining investment destination. The article found several reasons why the country attracts the highest amount of exploration expenditure of any country in the world.

The country has made good use of strategic comparative advantages like its proximity to China to supply the Asian giant with a near ceaseless supply of commodities. The country has focused its mining industry on minerals and resources, which it is a leading exporter. Australia is a world leader in terms of exports of iron ore, coal, gold, and cobalt. These are some of the reasons why the country is home to one of the most robust mining sectors in the world. Most importantly, Australia does not suffer from the natural resource curse that characterizes many of the named African countries.

- The legal, regulatory, and governance framework a mining country adopts is the most sustainable cure there is for the natural resource curse. Australia offers an excellent case study to countries in Africa on how to mitigate the resource curse by applying the right kind or most conducive legal framework

- Nigeria, Zimbabwe, Sierra Leone, and South Africa are countries where the resource curse is very prevalent or pronounced. Nigeria suffered successive brutal military coups since its independence due to the discovery of oil in that country. Sierra Leone suffered a protracted and brutal civil war financed largely by the diamonds in that country. Zimbabwe’s discovery of diamonds in the eastern highlands of that country has done little to change the plight of the people in that country

- The mining industry will only reach its full potential to deliver economic transformation in Africa if it is supported by a robust legal, regulatory, and governance framework

At best, Australia suffers from what is called Dutch Disease. This is a concept that describes an economic phenomenon where the rapid development of one sector of the economy (particularly natural resources) precipitates a decline in other sectors. It is also often characterized by a substantial appreciation of the domestic currency. Dutch disease is a paradoxical situation where good news for one sector of the economy, such as the discovery of natural resources, negatively impacts the country’s overall economy.

One of the reasons best to explain the success of Australia’s mining sector is the legal framework and context in which it exists. Its governance system is another reason. Australia is a vibrant democracy that has respect for property rights, the rule of law, and human rights. Its legal framework, combined with its governance system, inspires confidence among investors when it comes to the safety and certainty of their investments. The Law Review of the United Kingdom states that Australia is a federal constitutional monarchy under a parliamentary democracy, formed in 1901 because of an agreement among six self-governing British colonies, which became the six states (and which later included three self-governing territories).

The head of state is Queen Elizabeth II, who the Governor-General represents. The Queen appoints the Governor-General on the advice of the Prime Minister of Australia but has no active role in the day-to-day operations of government. Australia’s Constitution establishes a centralized federal government (known as the Commonwealth government) and various state and territory governments. The Constitution also reserves exclusive responsibility for certain matters (i.e., trade, commerce and defence) to the Commonwealth government. It allocates law-making responsibilities among the Commonwealth and the states and territories.

According to Thomson Reuters, the regulatory and legal framework governing the mining industry and mineral extraction process is divided throughout the three levels of government. Federal government involvement in the mineral extraction process is not extensive. The federal government is indirectly involved through policy concerning tax, foreign investment law, competition policy, trade and customs, corporation law, and international trade agreements, among others.

Also read: Tharisa PLC Backed Karo enters the Great Dyke in Zimbabwe

The Federal government interacts in terms of foreign investment approval. Interestingly, the states and territories are responsible for conferring mineral exploration and mining titles. This is not the case with most countries in Africa. Mining rights are granted only by the central government. The justification for this is that African countries keep a much closer eye on who receives the rights to mine in their country for the benefit of all that country’s citizens. The demerit of this system of mineral resource governance is that it gives rise to corruption.

In Australia, however, the territories and states collect mining royalties on minerals produced and regulate mining operations.

What is similar in Australia to countries in Africa is the ownership rights to minerals. Under State/Territory legislation, the State/Territory owns the minerals. The mineral rights do not vest in the landowner. Only the State/Territory government can grant rights to parties to explore or mine. The rights to explore/mine are regulated by extensive and objectively administered State/Territory legislation. Holders of mining leases gain ownership of minerals extracted when the minerals are separated from the earth. This system is the same in South Africa and Zimbabwe. With the significant role the mining sector plays in the economic development of African countries, the legal, regulatory, and governance framework that Australia has created is something countries in Africa need to replicate without fail.

Government policy needs to be intentional about being geared towards encouraging the development of the mining sector.