- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

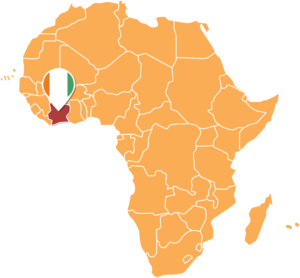

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- Standard Chartered Bank has found that health and fitness, retirement planning and leaving a family legacy have been on the minds of future-focused, affluent individuals worldwide, including Africa, for some time

- The top three goals the report uncovered were improving personal health at 44 per cent of those who set goals and setting aside more money for their children’s futures at 39 per cent

- The pandemic has also caused many affluent consumers to lose confidence in their financial management, making them increasingly averse to risk

A new survey by Standard Chartered Bank has found that health and fitness, retirement planning and leaving a family legacy have been on the minds of future-focused, affluent individuals worldwide, including Africa, for some time.

According to the bank’s Wealth Expectancy Report, these priorities have evolved into new goals, prompting changes to how they manage their finances amid the ongoing global pandemic.

The 20-minute online …

The entertainment and media industry has evolved to become one of the most profitable sectors in modern economy. Across continents, entertainment and media (E&M) has levitated talents and shared cultures like no other format since the dawn of time.

At the same time, media has connected cultures beyond language and physical barriers. Who doesn’t know Diamond Platnumz, Ali Kiba or Zuchu (except for non-Afro pop fans) in East, South and Central Africa, to mention a few?

From e-papers to virtual reality, modern ways of communication have made information- sharing seamless, and the world has become a village, literally.

When it comes to entertainment in Africa, Tanzania’s music industry has evolved over the past decade to become one of the most profitable creative performing arts landscapes.

International accolades won by Rayvanny, Diamond Platnumz, Ali Kiba, and many more prove how the genre has spilt over multiple locations worldwide, especially high-performing landscapes …

- Kenya’s continued recovery trajectory in 2022 would be supported by several factors, among them, improved business recovery

- According to Cytonn, there will be a recovery of businesses from the adverse effects of the pandemic, owing partly to the continued reopening of external trading partners

- The gradual increase in access to affordable credit will also support the economy’s continued recovery

The Kenyan economy may continue its recovery trajectory with the projected GDP growth expected at a range of 4.3 per cent – 4.7 per cent.

A report by Cytonn Investments indicates that the growth will be on the back of gains made in 2021. Using data from the Kenya National Bureau of Statistics, the investment firm says the average GDP growth rate for the three quarters in 2021 is 6.9 per cent, an increase from the 0.8 per cent contraction recorded during a similar review period in 2020. The average GDP …

- The banking sector in Kenya was stable and resilient in the third quarter of 2021

- The Quarterly Economic Review for the period ending 30th September 2021 indicates that the sector’s total assets increased by 2.4% to KSh 5.8 trillion in September 2021, from KSh 5.7 trillion in June 2021

- Loans and advances accounted for 54.8% of total assets in the third quarter of 2021, a 0.1% point increase from 54.7% of total assets in the second quarter

Kenya’s banking sector remained stable in the third quarter of 2021, said freshly released data by the Central Bank of Kenya (CBK).

In its Quarterly Economic Review for the period ending 30th September 2021, CBK indicates that the sector’s total assets increased by 2.4% to KSh 5.8 trillion (US$ 51 billion) in September 2021, from KSh 5.7 trillion (US$ 50 billion) in June 2021.

CBK said the increase was mainly because of a …

He gets his comedian background from his father who was also an impersonator. It is doing small impersonator gigs in Toronto that got him off the streets, to the US and to stardom.

At a young age, even before his career took off, Jim Carrey wrote to himself a cheque for $10 million.

According to legend, he one day drove up to the Hollywood Hills overlooking the city of Los Angeles and that is where he wrote himself the US$10 million cheque “for acting services rendered”.…

- EABL’s Group net sales grew 23% to KSh 54.9 billion, realised through strong organic growth across East Africa

- Profit after tax improved by 131% to KSh 8.7 billion, driven by margin expansion, prudent cost

management, and volume recovery mainly in Kenya - Cash and cash equivalents up 185% to KSh 7.2 billion, driven by increased net sales and robust working capital management

East African Breweries PLC (EABL) has reported KSh 54.9 billion in net sales for the half-year ended 31 December 2021, representing a 23% growth compared to the same period last year.

During the period, volumes grew strongly at 23%, driven by investment behind brands and innovation in the route to market in response to consumer behaviour shifts.

The continued investment in the capacity of KSh 6.2 billion enabled EABL to rapidly respond to the increased consumer demand.

The Group’s profit after tax grew 131% to KSh 8.7 billion, primarily …