- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

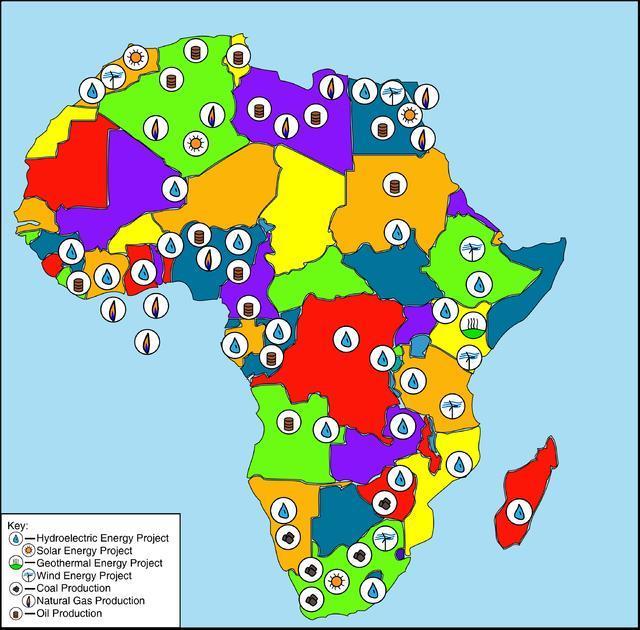

Extractive and Energy

- South Africa has adopted a number of measures aimed at boosting the country’s critical mineral industry.

- In January 2023, mining production experienced its twelfth consecutive month-to-month decline, recording a decrease of 1.9 per cent.

- According to the Minister of Mineral Resources and Energy Gwede Mantashe, the industry needs to advance a commitment to working together as stakeholders on the reconstruction and recovery of the mining industry.

South Africa’s vast reserves of critical minerals present a huge opportunity for the country to accelerate economic growth and boost employment creation, while ensuring the energy transition is just and inclusive.

Statistics South Africa recently released its key findings for the fourth quarter of 2022, wherein the real Gross Domestic Product (GDP) decreased by 1.3 per cent. According to the report, the mining and quarrying industry decreased by 3.2 per cent and thus contributed -0.1 per cent to the GDP growth.

Key to

The rapid snowballing of Africa’s rare earths metal production is set to become the world’s alternative source in 2023 and beyond, as global demand surges and world powers seek to wean off their dependence on China amid a new geopolitical multipolar world order. Africa’s vast reserves of rare earth metals have come under the radar of world powers fueled by the devastation emanating from the climate change crisis and calls for a drastic reduction in the growth and operations of extractive industries.

Furthermore, the race to net-zero emissions compounded by increased climate-induced natural disasters has intensified the green energy transition, instigating another scramble for Africa’s resources rare earth metals are at the heart of the race to green energy as well as providing opportunities for massive economic growth by injecting much-needed revenues to finance core socio-economic objectives in the continent.

Rare earth elements (REEs) refers to a group of 17 …

Africa has been hailed as the next frontier in the provision of global oil and natural gas resources, especially now in the wake of the ongoing Russia-Ukraine war.

This crisis has not only altered the global energy landscape, but also instigated an inflation in gas prices, given the former’s position in the hierarchy of major global producers. As sanctions continue to soar, Europe has embarked on a quest to find contingency energy supplies, as it seeks to minimize its dependency on Russia; which has already cut off gas supplies to countries like Finland, Poland and Bulgaria, over energy payment disputes.

Consequently, Africa’s gas resources have gained a newly found prominence, pertinently by the European Union (EU); owing to the continent’s rich endowment of oil and deep gas reserves. The mounting global demand for gas, has been pushing international energy companies to reconsider African projects. The numerous ongoing and upcoming oil …

- African nations are harnessing it’s push toward the oil and gas industry despite global push to reduce greenhouse gasses

- Oil-rich nations are keen to explore and pump out various fossil fuels as the rest of the world moves toward being Carbon Neutral

- COP 26 focused on resolutions for the world, but that was mainly the developed world, what about Africa?

Part 1: The fuel of modern-day civilization

The backdrop of modern-day development as embodied in Europe, America, Asia and the Arab Peninsula all lies in fossil fuel, crude oil, black gold. It is the burning of fossil fuels that runs our engines and powers our economies. Indeed, we owe our modern civilization and advances to fossil fuel.

Great! What is not so great is the cost that comes with burning fossil fuels. The primary cause of current climate change, altering the Earth’s ecosystems and causing human and environmental health problems …

The company has managed to make a strong comeback from when it faced an existential threat when prices of commodities slowed down in 2014. Prior to that period, mining company shares were hot because of China’s urbanization. It drove prices of commodities through the roof taking the shares of resource companies with them.

When China’s economic growth slowed down the miners also felt the pinch. The pinch was felt especially at Gold Fields which had to restructure its business and retrench at least 1,300 workers mainly from Ghana to ensure the long term sustainability of the company. The restructuring produced desirable results characterized by net cash inflow of US$ 235 million. In that same year, its Australian operations produced 1 million ounces of gold.

The company’s operations are massive and span 3 continents.…

Once again, Heijin was at the centre of another dispute. This time around, it was displacing more villagers in Murehwa. Murehwa is a village in Mashonaland East province.

This time around, it affected up to 100 families. As with the example above, the company received a special mining grant to mine black granite in the area. The mining claim sits on a densely populated place covering between 200 & 300 hectares.

Due to the presence of granite in the area, Chinese companies are laying siege on the province. All this to get their hands on the rare and lucrative stone. Heijin’s newest intrusion follows another bloody battle between Mutoko and Shanghai Haoying Mining Investments villagers.

They have claims to mine black granite, which was. At the same time, Shanghai Haoying has compensated households who would lose their home due to mining activities. The Chinecompany’sy’s plans to establish operations in the …

TotalEnergies CEO Patrick Pouyanne said that the memorandum of understanding will see the French firm produce Liquefied Petroleum Gas (LPG) and also deploy large-scale renewable energy technologies to identify areas of commercial investment.

Uganda’s Minister of Energy and Mineral Development, Ruth Nankabirwa said in a speech ahead of the signing that the agreement would put the country on the path to first oil in 2025. She added that EACOP would create approximately 160,000 jobs during the project’s development.

The agreement dictates TotalEnergies will develop solar, wind, geothermal, and other renewable technology power projects in Uganda to add a combined installed electricity output capacity of 1 Gigawatt by 2030 to the current 1.2-Gigawatt production.…

According to the Business Wire report of 2021, South Africa generates up to 108 million tonnes of annual waste, about 90 per cent of this which ends up in landfills. The problem is that landfills are projected to be full in a few years to come.

The national waste management strategy gazette by the government in 2020 gives a clear direction on how to acquire raw products for metal products and how to even trade the final products.

The producer’s responsibility scheme hold the manufacturers responsible for their products and packaging to the end of their life cycle.…

This comes as the IMF has downgraded economic prospects for countries in this cluster. The downgrades have, however, been offset relatively by projections for some commodity producers and exporters that were upgraded on the back of rising commodity prices.

The economic prospects between wealthy nations and low-income countries are expected to be divergent and this divergence will remain of great concern to multilateral lenders and world leaders. In wealthy nations, for example, aggregate output for the cluster economies is expected to regain its pre-pandemic trend path in 2022 and exceed it by 0.9% in 2024 whereas the cluster of nations comprise emerging markets and developing economies (excluding China) will remain 5.5% below their pre-pandemic forecasts in 2024.

This event should it occur as forecast will set back improvements in living standards.…