- Youth Unemployment in Kenya: The Role of Vocational Training

- New $900,000 initiative aims to boost sustainable trade in Tanzania

- Organization of the Petroleum Exporting Countries’ (OPEC) pride in its African roots

- AIM Global Foundation pushes for stronger Gulf-Africa trade partnerships

- Investment opportunities in South Sudan’s emerging gold industry

- Family planning drive in Kenya gets 450,000 self-injectable contraceptive doses from UK

- AfDB commits $2 billion to revolutionise clean cooking in Africa, save forests

- The harsh realities of family laws for African women revealed

Africa’s Development

- Leaders are meeting in Nairobi for the Eastern Africa ‘Waste is Wealth’ conference.

- The inaugural Waste is Wealth Series is organised by Taka Ni Mali, East African Business Council, and Alliance for Science.

- The three-day conference is themed: Promoting Effective Waste Management Practices for Environmental Conservation and Climate Change Mitigation.

The concept of a circular economy is fast gaining momentum in East Africa with both the private sector and government’s stuck on the drawing board shaping policies and regulations to help realise the shift.

World business leaders, policy makers, academics and NGOs have argued that a move towards a more circular economy is necessary to help solve global environmental and economic challenges.

Moving towards a more circular economy could increase competitiveness, and stimulate innovation. It will also boost economic growth and create jobs across economies.

Waste is Wealth

It is against this background that leaders are meeting in Nairobi for …

- Project Management Institute’s recent Talent Gap report shows 2.3 million people will be needed each year to fill all project management-oriented (PMO) positions that are expected to open by 2030.

- To remain competitive, companies will need to hire problem solvers and relationship builders who can help drive change and deliver strategic value.

- During this decade, sub-Saharan Africa will witness a 40 percent growth in PMO employment opportunities.

African economies could be headed to a severe shortage of skilled project managers to implement critical infrastructure investments across the continent.

According to Project Management Institute’s most recent Talent Gap report, 2.3 million people will be needed each year to fill all project management-oriented (PMO) positions expected to open by 2030.

To remain competitive, companies will need to hire problem solvers and relationship builders who can help drive change and deliver strategic value.

During this decade, sub-Saharan Africa will witness a 40 percent …

- Vodafone Group developed a business tailor-made to deal with Africa’s rising digital economy

- Etisalat, Vodafone’s largest shareholder, is currently exploring options for investment in Vodacom Africa.

- A decision to divest assets in a specific market or sell a stake in Vodacom Africa to fund new projects is also on the table

Vodafone Group is mulling strategies of extracting more value from its 65% stake in Vodacom Africa. According to Bloomberg, the telco is working with several advisers to evaluate the various strategic options available including mergers and acquisitions. A decision to divest assets in a specific market or sell a stake in Vodacom Africa to fund new projects is also on the table With the recent decline in Vodacom Africa and its market value in Safaricom, the organization is considering other alternatives.

This new take is crucial given that Vodafone has acquired new interested investors. Liberty Global, Xavier Niel,…

Africa’s leading Mobile Network Operators (MNOs), MTN, Vodacom and Safaricom, have recently made bold plans to venture into the increasingly dynamic world of fintech. On 23rd June 2021, Safaricom launched its super app, which creates an ecosystem of mini-apps from the network operator as well as third-party apps that feed off the super app[1]. A month prior to this development, Safaricom, the leading MNO in Kenya announced plans to release an Application Protocol Interface (API) for the super app to enable third-party app developers to build more products and services on top of the super app[2]. This means the super app is going to be an app store that consolidates the reach of Safaricom.

In May, MTN also announced plans to become a tech platform to rival the likes of Apple and WeChat as part of their Ambition 2025 which is currently being implemented[3]…

Noteworthy is that the depreciation of local currency causes an upward revaluation of a country’s debt and also makes debt service in the foreign currency more expensive.

“This currency-mismatch exposure explains a significant portion of the deteriorating debt dynamics shown by the decomposition analysis. Covid–19 has caused recent sharp swings in currency valuations for many countries, especially oil-exporting economies. The outlook for the debt ratios in these countries is expected to worsen simply because of the depreciation of their currencies. This issue would be less severe for countries that rely more on the domestic capital market for borrowing and on concessional debt with low-interest rates,” notes the report. …

Harrowing tales of men, women and children drowning in the Mediterranean, after taking treacherous journeys by foot, car and boat; crossing borders in search of safer pastures has hitherto proven to be a truth stranger than fiction. However, the deadly voyages are just a tip of the iceberg of the plight suffered by refugees and migrants, who flee their native countries seeking safer havens in foreign lands. Instead, to the few who make it to the other side, they face an uncertain future. For most, this hope is extinguished upon setting foot on foreign soil, where they are met with unspeakable violence, endure untold horrors and experience extreme human rights violations such as assault, detainment and even sexual defilement.

Consequently, psychological trauma plagues this lot, which in most cases leads to dysfunctional behaviors that impair their ability to cope with social or family life. Heretofore, more than 20,000 migrants and …

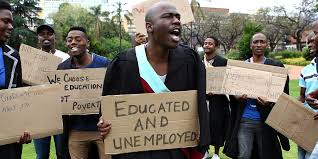

The young and the restless are befitting words to vividly depict the status quo of the countless educated but unemployed African youth; a ticking time bomb threatening the future of the continent.

Is it the lack of proper skill sets or the intermittent nature of opportunities that has resulted in the shrinking job market? This remains a puzzle yet to be unraveled. Upon graduation from tertiary institutions, the almost assured optimism by young people of landing top jobs on the basis of their qualifications is swiftly replaced with the icy glare of disillusionment. As desperation creeps in hope for a bright future slowly seeps out for many young people; moving from office to office wielding briefcases filled with job applications, whilst others frequent internet cafés to fill out a dozen more steadfast in their quest for jobs. Pushed to the brink, it is not a rarity to find young people …

Some 11 sub-Saharan African (SSA) countries are currently at high risk of debt distress according to the latest debt sustainability analyses by the International Monetary Fund (IMF).

Already, six countries are in debt distress and the debt burden is worsening in the region where the public debt ratio to gross domestic product has surged to 65.6 per cent from 56.4 per cent pre-Covid-19 period.

A study conducted by the China-Africa Research Initiative (CARI) at Johns Hopkins University shows that there is a trend where African governments are mortgaging their natural resources to secure loans from China. This has often ignited debt distress when commodity prices collapse.

Read: Why do lenders want “COLLATERAL”?

This mortgaging of resource is referred to as collateralized sovereign debt. This is where a sovereign loan is secured by existing assets or future receipts owned by the borrowing government. The collateral could be commodities, future export revenues, …

The AfDB notes that high commodity prices have played a role in seeing the African economy’s take off but not only so, macroeconomic policies and sustained reform have also helped improved the growth. Other key factors that have contributed to this growth include stronger governance and better conditions for private sector development.

A damper to the rallying growth of the African economy is conflict which remains a concern though incidences have declined which has reduced the contagion for neighbouring countries and boosting investor confidence in many regions. …