- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

The Indicator

Last year, the African Continental Free Trade Area (AfCFTA) launched opening up the continent’s 1.3 billion people-strong market. The AfCFTA focuses on increasing intra-African trade which is very low on the continent.

Trade between African countries is limited and is worsened by language barriers and the lack of harmonised payment settlement systems. These challenges are some of the hurdles that the AfCFTA is meant to address.

In addition, the treaty proposes more value addition of resources produced in Africa before exporting them outside the continent. The extractives industry in Africa has suffered immensely from the sale of raw products which denies the continent the opportunity to create jobs that could help address the incessant poverty.

Africa is emerging from the pandemic-induced recession. …

Industries and households in Kenya could soon be out of frequent power interruptions and outages as Kenya Power kicks off live maintenance of power lines.

The programme launched on Monday this week is meant to reduce planned electricity shutdowns, enhance stability of power supply and improve revenue generation.

READ ALSO:How Kenya Power plans to manage electricity tariffs

The launch follows the completion of the pilot phase where more than 70 staff were trained to carry out maintenance of live power lines.

During the pilot phase, eight insulated trucks and three digger derricks were also acquired.

Following the success of the pilot phase, the World Bank has funded the programme to a tune of $20 million (about Ksh2 billion) for procurement of additional insulated trucks, tools and accessories, training of staff in live line maintenance techniques and establishment of a laboratory for testing live line equipment.

READ ALSO:World bank

…Kenya’s Capital Markets Authority (CMA) has for the fifth year been feted as the ‘Most Innovative Capital Markets Regulator in Africa 2019’ by the International Finance Magazine.

This is in recognition of its ongoing efforts to facilitate innovations in the capital market in Kenya, East Africa’s economic powerhouse.

READ ALSO:Another feather on Kenya’s Capital Markets Authority as London applauds

“The Authority is pleased to receive this recognition for the fifth consecutive year from this respected publication, which is a testament to the authority’s commitment to supporting innovation as a catalyst for transformative growth of the capital markets,’ said CMA Chief Executive Paul Muthaura.

At the core of its strategic objectives, CMA aims to leverage technology to drive efficiency in the capital Markets value chain.

“We target to effectively balance robust regulatory and compliance requirements with the objectives of market deepening and growth. This involves consistent evaluation of regulatory approaches …

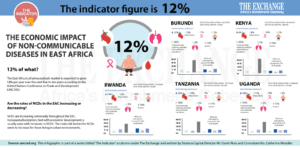

Today’s indicator figure is 12%.

12% of what?

The East African pharmaceuticals market is expected to grow 12% per year over the next five to ten years according to the United Nations Conference on Trade and Development (UNCTAD). The majority of this growth will be due to non-communicable diseases (NCDs) such as heart disease, stroke, chronic kidney disease, dementia, osteoporosis, cataracts, diabetes, cancer, and other similar ailments.

How do the rates of NCDs in the EAC compare to other regions of the world?

The rates of NCDs in the EAC are approaching the rates found in developed economies such as North America and Europe. They have not matched them yet but the growth seen in recent years indicates that they will soon.

Are the rates of NCDs in the EAC increasing or decreasing?

NCDs are increasing universally throughout the EAC. Increased urbanization, tied with economic development, is usually seen with …

Kenya’s insurance sector has been rocked with controversies among them failure to meet contract obligations, exposing policy holders to risks rather than being cushioned as expected of indemnity.

In the latest twist of events, it has emerged that over ten insurance companies in Kenya are not paying claims, despite collecting billions in monthly premiums from their clients.

This has left hundreds of thousands exposed to risk while affected persons suffer despite having insurance covers.

There are 37 general insurance companies and 25 long term insurance companies, placing the total number of underwriters at 62.

The country’s insurance market has also been infiltrated by banks, which are offering insurance services under the ‘Bancassurance’ umbrella.

READ:What’s next for the insurance industry in Kenya?

Billions in premiums

According to official data by the industry regulator-Insurance Regulatory Authority (IRA), insurance industry gross premium written stood at Ksh216.37 billion (US$2.12billion) as at end of …

Today marks 17 years since the International Labour Organisation (ILO) declared a fight against child labour.

June 12th is World Day Against Child Labour, the day is meant to raise awareness and activism to prevent child labour.

Child labour are all forms of work by children under the age laid down in ILO standards. Worst forms of child labour include slavery, debt bondage, prostitution, pornography, forced recruitment of children for use in armed conflict, use of children in drug trafficking and other illicit activities, and all other work likely to be harmful or hazardous to the health, safety or morals of girls and boys under 18 years of age.

The ILO has recently estimated that some 246 million children aged 5-17 years are engaged in child labour around the world. Of these, some 179 million are caught in the worst forms of child labour.

Africa has the greatest …

In yet another review of the country’s macroeconomics, Kenya’s Central Bank has held the benchmark lending rate at 9 per cent, meaning banks in the country will continue giving loans with a maximum interest rate of 13 per cent.

This is under the Banking Act which caps lending rates at four percentage points above the CBK rate.

The decision was reached on Monday by CBK’s decision making organ-Monetary Policy Committee (MPC), which meets every two months to review the outcome of its previous policy decisions and recent economic developments.

The meeting was held against a backdrop of domestic macroeconomic stability, sustained optimism on the economic growth prospects, improving weather conditions in most parts of the country and increased uncertainties in the global financial markets.

This is the sixth time the MPC is retaining the benchmark rate at nine per cent after bringing it down from 9.5 per cent in July …

Global oil prices which have been on an upward trend since January are putting pressure on Kenya’s economy, as the country’s population continues to dig deeper into their pockets to meet the cost of living.

This is in the wake of a rising inflation in Kenya which rose to 6.58 per cent in April from 4.35 per cent in March, the highest increase in the cost of living in 19 months, mainly driven by high food prices.

Crude oil prices have been on the rise since January after edging up from USD59.50 per barrel in December. In January, a barrel traded at USD60.95.This went up to USD66.35 in February, USD 68.60(March) and USD73.05 in April.

Brent, which is a benchmark crude, is currently trading at USD71.90, with overall oil prices projected to surge.

Kenya which prices its oil products on the previous month’s market prices (due to the import period), …

The Kenya shilling is arguably the strongest currency among the East Africa Community (EAC) member states, giving the region’s economic power house a competitive edge over her peers in international trade.

READ:Here are Kenya’s biggest trading partners

However, the country has been operating a managed shilling than a free float currency, running a risk of making its exports more expensive in the short run as compared to competitors, eventually causing a reduction in export earnings and the economy’s growth, a report by Amana Capital has established.

Amana’s “Kenya’s Economic Puzzle – Putting the pieces together” report highlighted that 10 years ago, the Consumer Price Index (CPI) stood at 97 but has since shot up to 192 to date, meaning what the value Ksh100 (USD0.99) could buy in January 2009 can only buy 50 per cent of that now.

This translates into a 50 per cent devaluation of the purchasing …