- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

Fintech

- The pioneering accelerator programme aims to grow insurance coverage among low-income consumers by investing in innovative solutions in nine African countries.

- The expanded pan-African program is designed to support entrepreneurs in developing innovative solutions for the insurance sector.

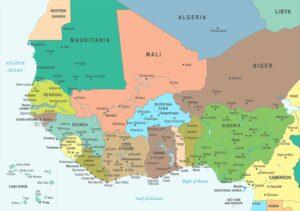

- It targets Insurtech (insurance technology) innovations from Egypt, Ethiopia, Kenya, Ghana, Morocco, Nigeria, Rwanda, Uganda, and Zimbabwe.

- The expansion of BimaLab is supported by $500,000 financing from the Swiss Re Foundation.

FSD Africa has partnered with the Swiss Re Foundation and the National Bank of Rwanda to launch BimaLab Africa Acceleration Programme to raise insurance uptake among low-income consumers in nine countries across the continent.

The expanded pan-African program is designed to support entrepreneurs in developing innovative solutions for Insurtech (insurance technology) innovations from Egypt, Ethiopia, Kenya, Ghana, Morocco, Nigeria, Rwanda, Uganda, and Zimbabwe.

The expansion of BimaLab is supported by $500,000 financing from the Swiss Re Foundation, which is among the …

An efficient crypto mining industry can generate more job opportunities in Africa as the demand for miners, blockchain specialists, and technology specialists increases, . This encourages nations to enhance their energy and technological capacities to support crypto operations. These enhancements can considerably benefit other industries and the economy as a whole.

African nations must embrace the chance to become a crypto mining hub. This can aid in the digital economy’s growth, citizens’ financial standing, and the infrastructure for energy production. Consequently, African governments can invest in cryptocurrencies to acquire alternative funding sources for developing renewable and alternative energy sources.…

Africa is a strong contender for developing technologies such as blockchain and cryptocurrency owing to the continent’s growing mobile tech adoption rates. Considering the turbulent global financial markets, expensive remittance costs, and restricted banking access, blockchain in Africa offers alternatives to tackle their day-to-day issues.…

The Crypto market in the world is looking ugly.

The bitcoin price fell to a three-month low on January 10, accelerating the slide that started when the Federal Reserve ignited a broad sell-off worth US$300 billion. The bank cautioned that it might move more quickly than previously expected to reverse policy meant to reinforce the economy during the Coronavirus pandemic.

Experts predict that the latest crypto fall will persist for weeks in the Federal Reserve measures continue to be more aggressive.…

The question is, what if one day you went to pay for expenses with your card or mobile app and it returned an error message? Or was your service provider that issues your money declared bankrupt? Scary, right?

Recently, customers have been converting their regular traditional money into e-money. Service providers have enabled the transfer of electronic money to banks, from person to person, and for making payments.

For regulators and supervisors that control the protection of consumers’ e-money and digital currencies, coming up with legal bindings and restrictions in the fast-changing sector has become very challenging. These regulators and supervisors must devise ways to protect customers from a possible system failure and ultimately prevent them from losing their funds.…

Whether Nigeria and Ghana will abandon their digital currencies and jump on the Eco train is an unclear narrative, but it appears unlikely because of the significant investments put into them and the optimism by the governments to embrace digital transformations.

Nigeria had banned cryptocurrency transactions in February last year which increased the popularity of the eNaira as an alternative for cross-border trade and remittance inflows.

eNaira critics say that the solutions being offered by the digital currency are already existing in online banking and bank card transactions. …

- Mastercard is collaborating with Meta to support the digitization and growth of SMEs across the MEA region

- The firm says it will be is organizing a training webinar that will provide SMEs insights from industry experts

- Access to credit, data, training and digital tools are among the key challenges for SMEs, further compounded by infrastructure limitations and power supply interruptions in some MEA markets

Global technology company Mastercard has announced that it is collaborating with Meta to support the digitization and growth of SMEs across the MEA region.

In a statement, the firm says it will be is organizing a training webinar that will provide SMEs insights from industry experts, and a masterclass on how to manage uncertainty from renowned author and academic Nathan Furr, Associate Professor of Strategy at INSEAD.

The event takes place on Wednesday, 8 December at 13.00 East Africa Time.

The collaboration comes at a …

Liquid Intelligent Technologies has opened an Internet Point of Presence in Miami, connecting to the Liquid network via a South Atlantic subsea cable.

In a statement, the technologies company says the new POP is connected to their 100,000km of fibre across 11 countries on the continent and another 14 countries via the Operators Alliance Programme and Liquid Satellite Services.

This is part of Liquid’s East-West route between the US and Asia via Africa.

The company says the move will result in customers being able to leverage a better connection to the US, giving them access to Cloud services, OTT resources, Internet content and high-quality voice and video calls with family and business partners.

Speaking about the impact, David Eurin, Chief Executive Officer, Liquid Sea, said the new POP in Miami will enable US-based operators, businesses, OTT, Cloud service providers and CDN operators to access 40 data centres across Africa, including …

The government amended the Electronic and Postal Communication Act (CAP) last month by imposing a levy of between US$0.0043 (10Tsh) and US$4 on mobile money transactions, depending on the amount sent and withdrawn.

One of the key factors that led to the expansion of mobile money in Africa and Tanzania, in this case, was the increased interoperability, product expansion—which brought financial inclusion to enable nearly everyone with decent income-earning schedules to own a mobile wallet account.…