- Zambia is attempting to negotiate a deal to restructure its unsustainable debt load and gain access to funds from the IMF

- According to figures provided by the government, at the end of 2021, it had an external debt of $17.27 billion. 18 Chinese financial institutions, both official and private, controlled around $6.6 billion of that total

- The first sovereign default of the epidemic period occurred in Zambia in the year 2020

On Thursday last week, officials from Zambia had their first meeting with an official committee comprised of the country’s international creditors.

This comes as Lusaka is attempting to negotiate a deal to restructure Zambia’s debt load and gain access to funds from the IMF.

China is a member of the official creditor committee, which is comprised of members of the Paris Club, an informal club of creditor nations that meets each month in Paris, France, to seek solutions when debtor nations have payment problems, and China. The Zambian representatives joined the Paris summit via video link.

The first sovereign default of the epidemic period occurred in Zambia in the year 2020. According to figures provided by the government, at the end of 2021, it had an external debt of $17.27 billion. 18 Chinese financial institutions, both official and private, controlled around $6.6 billion of that total.

In December, Zambia came to an agreement with the staff of the International Monetary Fund (IMF) for a $1.4 billion, three-year extended lending facility. However, Zambia requires reassurance from its creditors that its debt can be adjusted in order for the rescue plan to move forward.

After meeting with President Hakainde Hichilema and Finance Minister Situmbeko Musokotwane on Wednesday in Lusaka, the Deputy Managing Director of the International Monetary Fund, Antoinette Sayeh, emphasised the need to reach a deal on Zambia’s debt crisis and called on all creditors to quickly find an arrangement. Sayeh’s comments came after she met with President Hakainde Hichilema in Lusaka.

“We urge creditors to offer financial assurances as soon as feasible, as they are essential before staff can put forth Zambia’s programme for deliberation by the IMF Executive Board. We ask that they do so as soon as possible.” This would let Zambia access resources from the Fund, and it will also unlock access to essential finance from other partners, which will help support Zambia’s economic recovery, according to Sayeh.

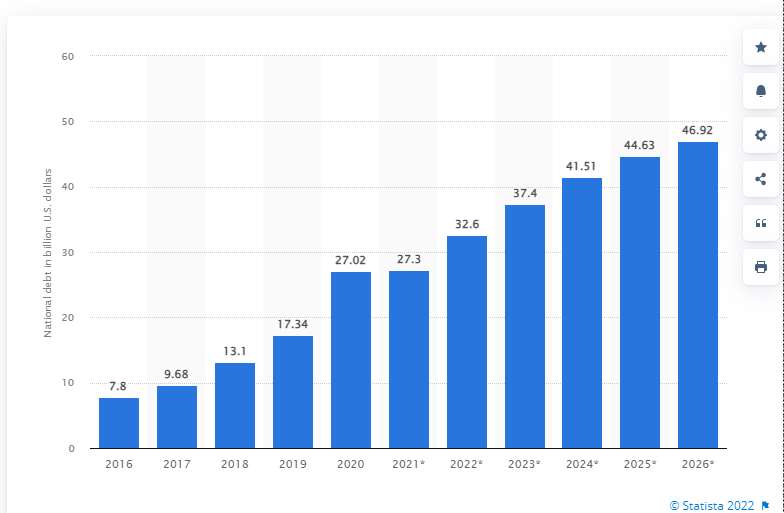

Zambia: National debt from 2016 to 2026(in billion U.S. dollars)

A deal to end Zambia’s debt problem is ‘probable.’

Expectations of a deal

Claims that China was holding up Zambia’s debt relief because of a lack of experience with complex debt restructurings and delayed coordination amongst its public creditors have made Chinese creditors eager not to be perceived as the roadblock to a prospective debt agreement. This is because the claims are false.

“There appears to be a growing consensus that some sort of agreement will be reached. According to Eric Olander, editor in charge of the website The China-Global South Project, “the Chinese are rather apprehensive about the optics of what happens in Zambia.”

Olander contends that China and other bilateral creditors do not want to be perceived as being in the way of the International Monetary Fund (IMF) rescue.

At this initial meeting, Zambia will make its case for debt relief; nevertheless, it is unlikely that discussions will be concluded by the target deadline of the end of June that Zambia has set for itself.

Olander claims that the aforementioned conversations will not be simple to have. “The Chinese alliance alone is made up of at least a dozen different creditors; therefore, it is not going to be easy to convince them to agree with one another, much less with the multilateral, bondholders, and other bilateral lenders.”

The arduous journey toward debt relief for Zambia

After the tumultuous relationship that existed between the IMF and Edgar Lungu’s administration, President Hichilema has made significant strides toward mending ties with the IMF.

After Zambia’s sovereign default, the G20 expressed concern that a “debt tsunami” could engulf the continent’s most heavily indebted nations. In response, the G20 and the Paris Club established a “common framework” with the intention of assisting more than 70 countries in dealing with the aftermath of the pandemic by providing debt relief and restructuring.

Given the substantial share of Zambia’s debt that is owned by Chinese lenders, the Paris Club needed the participation of China, which is not a member of the Paris Club. At the beginning of May, it was announced that China would co-chair the official creditor committee with France.

At the Paris negotiations, it will be determined whether Chinese and international lenders can work side by side to establish a clear debt overhaul plan. This might also pave the way for debt-restructuring talks between Chinese institutions and other countries that are in debt.

Will China’s presence be advantageous to Zambia in any way?

Hannah Ryder, the CEO of China-based African consultancy Development Reimagined told African Business that different creditors would be seeking different things at the meeting. “Different creditors will be looking for different things in the meeting.”

“Lenders from the Paris Club will be interested in Zambia’s presentation of the IMF’s debt sustainability assessment and, as a result, Zambia’s plans for cutting spending, such as decreasing subsidies or expanding privatisation, both of which are usual policy prescriptions from the IMF.

“On the other hand, Chinese lenders will be looking to Zambia to outline its plans for growth” because many of the projects that China has lent to require a buoyant, growing economy in order to deliver a return or even provide tax revenue that can be recycled into debt repayments, “Chinese lenders will be looking to Zambia to outline its plans for growth,” she said.

Ryder argues that having China in the room when Zambia presents its case could assist the country in resisting calls to reduce its spending.

She suggests that Zambia’s best answer to its debt issues may be to increase spending rather than reduce it, thereby allowing the economy to grow. This would be similar to the approach taken by high-income countries in response to Covid-19, but it is unlikely to earn the IMF’s approval.

It is uncertain whether the Zambian administration holds this type of economic outlook, but this will be the most important question for experts to consider after this conference, she explains.

“Unless Zambia has a clear plan for rebuilding its economy, taking into consideration the risks of rising interest rates and a risky and uncertain global economy, it is extremely dubious whether a bailout today will actually be of assistance in the medium run. It’s all about the quality of Zambia’s spending right now, and if those expenditures are not growth-enabling, I am sceptical of major progress.”

It is difficult to unlock Zambia’s own endogenous development because, like many other African countries, Zambia has a difficult history of colonialism and dependency, which makes it difficult to do so. Furthermore, she concludes that there are many forces both inside and outside of Zambia that will make it difficult to pursue this kind of reform.

Read: Understanding Zambia’s National Debt Crisis