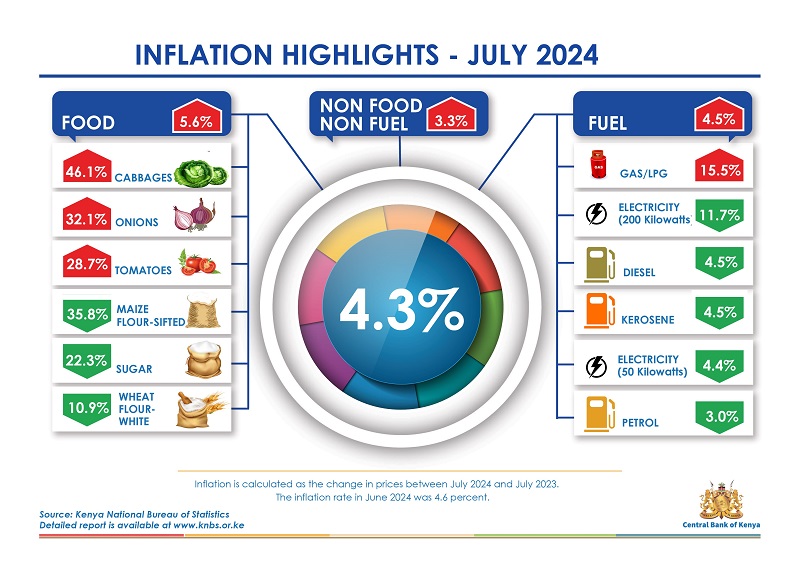

- Inflation in Tanzania has gone down to 3%, lower than Kenya’s 4.3% and Uganda’s 4% posted in July.

- While economic experts commend the country’s monetary policy for managing inflation, economic woes facing the poor persist.

- Policymakers in Tanzania project to control inflation within the National Vision 2020-2025 target of 3.3 to 4.4%.

Inflation in Tanzania has inched slightly lower to 3.0 percent, compared to 3.1 which was recorded in June, the National Bureau of Statistics (NBS) has reported. The NBS attributes this reduction to the country’s Monetary Policy Committee (MPC) in controlling inflation.

“What lower inflation means is that the cost of living has reduced…the price of goods and services have gone. The current efforts have ensured inflation remains within acceptable limits,” Central Bank’s Directorate of Research and Policy, Mr. Marwa Patrick commended the MPC as strategic and successful.

“This achievement reflects meticulous fiscal and monetary policies and strategies employed by authorities to stabilize prices and maintain economic stability.”

In comparison, Uganda’s inflation climbed to 4 per cent year-on-year in July, while Kenya’s CPI-based inflation slowed to 4.3 per cent, according to official data released on July 31, 2024.

At the moment, Tanzania’s government is prioritizing inflation control and projects to keep it within the National Vision 2020-2025 target of 3.3 to 4.4 per cent. This ‘Vision’ he said, outlines key interventions designed by the government to manage and mitigate inflation. “These interventions aim to ensure economic stability, promote sustainable growth, and improve the overall wellbeing of Tanzanian citizens,” he told the press.

Tanzania’s fiscal policy management

According to the Central Bank Directorate of Research and Policy, the key government interventions include a stringent monetary policy framework, control of money supply, fiscal policy management, promotion of agricultural productivity and industrialisation and diversification of the economy.

“Other key areas are foreign exchange, monitoring global economic conditions and improvement of infrastructure,” he added.

Overall, the Third Five-Year Development Plan (FYDP III) has managed to keep the annual rate of inflation in the desired single digit range. It shows that, inflation in Tanzania averaged 4.4 per cent between 2016 to 2020. This rate is slightly below the FYDP II projection of 5 per cent per annum and notably before that, the headline inflation declined from annual average of 5.2 per cent in 2016 to 3.3 per cent in 2020.

The expert said this commendable trajectory has been thanks to the improved food supply in the domestic market and neighbouring countries as well. He also attributed it to stability of global oil prices, but overall, he insisted that it is the country’s ‘prudent fiscal and monetary policies’ that have kept inflation in check.

It should be noted that the reported performance is much better than the IMF projections which had foreseen the CPI to average 3.3 per cent in 2020, rising to 4.0 per cent in 2021, 4.6 per cent in 2022. The IMF further projected that inflation would then drop to 3.1 per cent in 2023, and 3.8 per cent in 2024 and thereafter it would stabilize around 4.0 per cent through to 2027.

Sharing similar sentiments to the Central Bank Directorate of Research and Policy, Mr. Fortius Rutabingwa, the Executive Director, Research, Innovation and Projects at Orbit Securities said inflation in Tanzania has remained under control thanks to the effectiveness of the country’s monetary policy.

“Since January, we’ve observed a consistent trend of using interest rates as a tool to regulate liquidity. The actions of the MPC have played a significant role in this continued tightening of liquidity,” Mr. Rutabingwa underlined.

“However, what is crucial for inflation is stability, consistency without frequent changes, which is what we are observing right now,” he noted, adding, “The MPC decision is supported by successful implementation of a sound monetary policy over the previous two quarters which help to anchor the inflation forecast below the target of 5.0per cent.”

According to official statistics, inflation in Tanzania has gone down by 0.2 per cent over the last two months which is attributed to a price decrease for some food and non-food items as well. Some food items that contributed to a decrease of the index include wheat grains which went down by 0.9 per cent and rice that reduced by 4.3 per cent.

Others are finger millet grains by 1.7 per cent, maize grains by 2.9 per cent, wheat flour by 0.3 per cent, maize flour by 0.5 per cent, vegetables by 2.4 per cent and fresh cassava by 0.7 per cent. The non-food items that contributed to the decrease of the index include clothing materials by 0.3 per cent, footwear for men by 0.1 per cent, and materials for maintenance that went down by 0.1 per cent.

Others are charcoal by 1.3 per cent, parts for personal transport equipment by 1.4 per cent, petrol by 1.6 per cent and mobile telephone handsets by 0.1 per cent.

Inflation in Tanzania: Has cost of living actually reduced?

Inflation is measured by indices such as the CPI that take into account price changes for a basket of goods and services over a given period of time. However, a “reduction in price inflation does not mean prices are falling. Some prices fall, yes, but overall, what it really means is that the cost of that basket of goods and services is not rising as fast,” explains the Central Bank officer.

So, on the ground, the common man is not necessarily enjoying a lower cost of living. Prices of goods and services remain comparatively high demanding the consumer to dig deeper in their pockets to purchase their daily bread.

Read also: Inside the innovations pioneering health product access in Africa