- In the last 15 years, remittance inflows to Kenya have increased tenfold, reaching a record of US$3.72 billion in 2021

- The number of active mobile money accounts went up from 66.59 million in January to 66.88 million in October 2021

- Digital payments include mobile money transfers, card payments, contactless cards and bank transfers

Digital payments in Africa

With the increased penetration and mobile phones in Africa, adopting a digital cashless mode of payments is on the rise.

In a survey by Visa highlighting the impact of digital platforms, Kenyans preferred to use cashless payments to conduct business transactions more than South Africans and Nigerians. About 71 per cent of businesses in Kenya use cash as a means of payment, compared to 91 per cent in South Africa and 94 per cent in Nigeria.

Digital payments include mobile money transfers, card payments, contactless cards and bank transfers.

Read: The case for peer-to-peer insurance

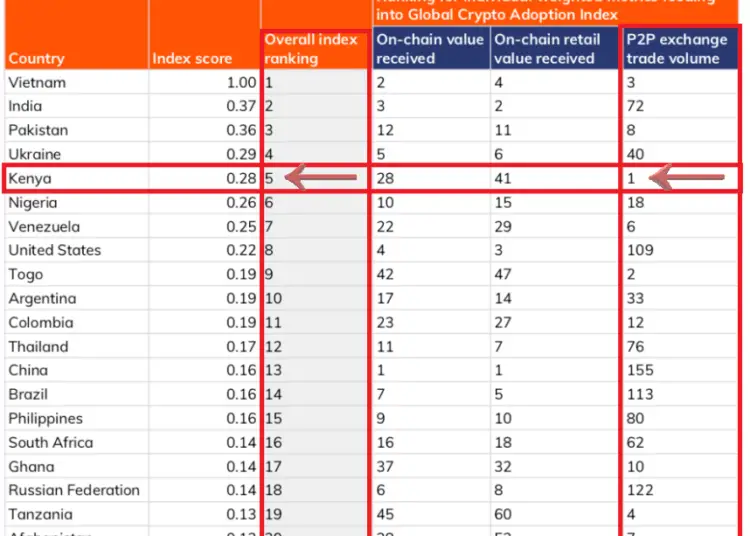

According to the 2021 Global Crypto Adoption Index, Kenya tops peer-to-peer cryptocurrency transaction volumes.

The study established that high usage of digital payments in Kenya thrived in industries like entertainment, food, accommodation and tours, agriculture, transport and delivery, and professional services sectors of the economy.

Sixty-nine per cent of Kenyan businesspeople said that digital payments have positively impacted their businesses as they can easily track expenses and income returns, which reduces errors and enables faster transactions.

The Central Bank of Kenya (CBK) has been pushing mobile money payments recently. Last year, following the outbreak of the Covid-19 pandemic, the Kenyan government released a directive through CBK, instructing commercial banks and payment service providers to halt charges on all transfers from mobile money wallets and bank accounts.

Despite the positive trajectory in digital payments adoption in Africa, Visa says there still is room for improvement.

The Visa survey concluded that 83 per cent of digital payments users reported an improvement in revenue, while 55 per cent of business owners plan to increase investment in business payment technologies.

Mobile money transactions in Kenya hit a 10-year growth record

Mobile money platforms have evolved from their primary person-to-person cash transfers but are now a significant business payment channel.

CBK data shows that mobile money service provider agents in Kenya -Safaricom’s M-Pesa, Telkom’s T-Kash and Airtel Money- handled Sh5.64 trillion (US$50 billion) in the first ten months of 2021, a 38 per cent increase from 2020, the fastest growth in ten years.

Read: Central Bank of Kenya firm on Cryptocurrencies ban

Mobile money transfers have gained popularity due to several reasons:

- Convenience. Mobile money reduces interactions with cash payments and reduces errors in revenue calculations.

- Last year, the ministry of health recommendations and incentives discouraged the use of hard cash branded as a potential avenue for spreading COVID-19.

- Digital payments have favourable transaction charges and exchange rates.

- Security and safety.

The number of active mobile money accounts increased from 66.59 million in January to 66.88 million in October 2021. The number of active mobile money agents also increased by 2.67 per cent, from 287,410 in January to 295,105 in October, underlining the growing demand for their services across the country.

Mobile money transfer in Kenya gains popularity in paying remittances

The CBK said remittances are sent to meet the basic needs of nuclear family members every month, including paying for food and household goods, education expenses, medical expenses, farming needs, rent and investment in real estate.

Remittances remained resilient during the Coronavirus pandemic period, with most of the respondents providing annual support averaging about Ksh.453,613 (US$3,992) in 2020 compared to US$6,000 in 2019.

In the last 15 years, remittance inflows to Kenya have increased tenfold, reaching a record of US$3.72 billion in 2021.

Read: The future of a cashless economy