Loans from China closed 2018 at USD6.2 billion (Ksh 627.1 billion)

Kenya will be keen to secure additional funds from China for construction of Phase 2B of the Standard Gauge Railway (SGR), as the World meets for the second Belt and Road Forum for International Cooperation (BRF) in Beijing.

The forum which takes place this week is expected to attract a high number of Heads of States from Africa and across the globe, with thousands of delegates from over 100 countries.

President Uhuru Kenyatta’s administration is seeking a Ksh370 billion (USD 3.67 billion) loan to extend the rail project which is currently at its second phase of construction (Nairobi-Naivasha).

Phase one of the project, 472 kilometre Mombasa —Nairobi line, is currently operational having been completed and commissioned by President Kenyatta on May 31, 2017.

It was constructed by China Road and Bridge Corporation (CRBC) on a Ksh327 billion (USD3.2 billion) loan from the Exim Bank of China.

READ: Boost for East Africa trade as Kenya commences SGR cargo services

Phase 2A is being developed by a sister company-China Communications Construction Company (CCCC), funded by the Chinese at a cost of Ksh150 billion (USD1.48 billion).

The 120-kilometre line which runs between Nairobi-Mai Mahu and -Duka Moja, a small centre between Suswa and Narok town, is 90 per cent complete.

The funds being sought by the government are meant to fund Phase 2B (Duka Moja-Kisumu) and the final stretch (Phase 2C) connecting Kisumu to the Kenyan-Ugandan border of Malaba.

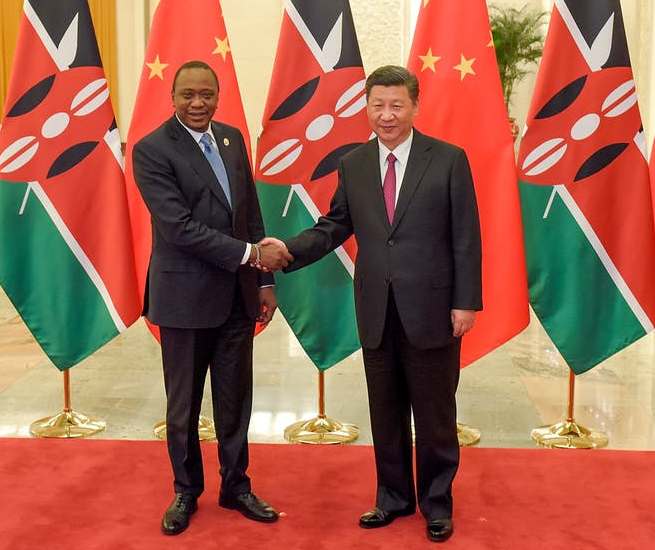

President Kenyatta and former Prime Minister Raila Odinga are expected to lead a delegation from Kenya to the Beijing meeting.

“I will be part of the delegation that will accompany the President to the Asian country next week,” Mr Odinga confirmed at a public forum over the weekend.

In a recent meeting at the Chinese Embassy in Nairobi, Kenya Railways acting Managing Director Philip Mainga said the government is keen to secure funds during the BRF meeting.

“We hope to sign phase 2B during the meeting,” Mainga said, “Kenya Railways is working with the Chinese government in achieving the commitment we have on the 974 kilometre Mombasa-Malaba SGR project.”

Heavily indebted to China

If secured, Kenya will push up its debt obligation to China to above USD9.8 billion (Ksh991.2 billion), after loans from Beijing closed 2018 (December) at USD6.2 billion (Ksh627.1 billion).

This is up from USD5.3 billion (Sh536 billion) a year earlier, where a lion share has gone towards the construction of the multi-billion SGR.

The move will add pressure to the country’s debt portfolio which stands at USD53.3 billion (about Ksh5.4 trillion), nearly double the country’s annual budget.

ALSO READ: Tough times: Kenya piles Kshs 2.5 billion debt in a day

China tops the list as the biggest lender to Kenya followed by Japan, France and Germany.

Other sources for Kenya’s funds include the International Development Association (IDA), International Fund for Agricultural Development (IFAD) and the African Development Bank (AfDB).

In the next financial year commencing July 1, the government plans to borrow Ksh306.5 billion (USD3.03 billion) externally and Ksh277.5 billion (USD2.24 billion) in the domestic market to bridge its budget deficit.

It plans to spend Ksh2.67 trillion (USD26.3 billion) in the fiscal year with the budget focusing on President Kenyatta’s Big Four Agenda of affordable housing, growth in the manufacturing sector, universal healthcare and food security.

Kenya Revenue Authority (KRA) is expected to collect Ksh1.88 trillion (USD18.5 billion) to support the budget up from the current revised Ksh1.65 trillion (USD16.3billion).

The proposed spend for the year 2019-2020, by Treasury Cabinet Secretary Henry Rotich, is up from the Ksh2.51 trillion (USD24.8 billion) he had proposed for the current fiscal year(2018-2019) which ends on June 30. The budget was however revised upwards to Ksh3.074 trillion(USD30.3 billion).

Kenya country’s ballooning debt has continued to spark debate over its sustainability with both the World Bank and the International Monetary Fund (IMF) cautioning the government to go slow on its borrowing.

In a recent report, the IMF noted that the country’s risk of defaulting on debt repayment had increased from low to moderate.

There has been a heated debate that Kenya could lose its key assets, among them the Port of Mombasa, to China if it defaults its debt. Kenya could lose Mombasa port to China over SGR debt

Financial experts have since questioned China’s motive in its increasingly lending spree to Kenya to finance mega infrastructure projects, warning that it could be a debt trap.

READ: Is China setting a debt trap on Kenya?

The Chinese government has however dismissed the claims, even as it defended its relationship with Kenya, which it has termed mutually beneficial.

“We are not putting Kenya into a debt trap. China-Africa Corporation cannot put Africa into a trap but booming economic growth,” the Chinese Embassy in Nairobi said.

The Belt and Road Initiative

A project of President Xi Jinping, China is using the Belt and Road Initiative (BRI) to enhance both China’s development and its cooperation with global partners.

According to the Chinese government, BRI represents a major breakthrough in “both theory and practice, and it carries far-reaching significance.”

Since its inception, the BRI has received a strong endorsement and warm support from the international community. So far, a total of 124 countries and 29 international organizations have signed BRI cooperation documents with China.

Most recently, during President Xi’s visit to Italy, the two countries signed an MOU on promoting BRI cooperation, giving a new impetus to this process.

Meanwhile, the BRI vision has been included in documents of major international institutions including the United Nations, the G20, the Asia-Pacific Economic Cooperation and the Shanghai Cooperation Organization.

China has been using the platform to strengthen global trade links across the world, in particular between Asia, Africa and Europe, with investment in an array of large-scale infrastructure projects along these two land and sea corridors.

The land route runs along the ancient Silk Road that for centuries connected China with Europe via Central Asia and Russia. Once completed, it will consist of a number of new road and rail routes, as well as energy pipelines and other key infrastructure.

The sea route is a maritime trade corridor built for the 21st century. It will stretch from Chinese coastal ports all the way to Europe via new and upgraded ports in the South China Sea, the Indian Ocean, the Middle East and the Mediterranean.

The potential size and scope, with related investments totalling as much as USD8 trillion by 2020, is projected to boost global trade by 12 per cent, impacting more than 65 countries and nearly two-thirds of the world’s population.

This year’s BRI has three things to look out for. First, the number of foreign heads of state and government officials in attendance (expected to be high) as they seek partnerships.

Secondly, the number of countries participating with thousands of delegates expected and third, there will be numerous side events including 12 thematic forums focusing on practical cooperation, and for the first time, a conference organized specifically for the business community.

A huge number of African leaders are expected to attend the forum where they will be keen to present the interests of their respective countries, especially on development.

Business communities from Africa are also expected to sign numerous MoUs for closer trade ties, a move that will tighten China’s grip on Africa.