- Gold exports slowed down due to decline in production

- Food prices increased in the year ending January 2022

- The price of petroleum prices soared

Tanzania’s economy progresses well through exports and doubling down on revenue collection. Despite the latter, the efforts are pulled down by high debt issues.

The sixth government led by President Samia Suluhu Hassan is reshuffling and prolonging sound economic strategies.

President Samia’s administration focuses on critical issues such as slashing unfriendly taxation, complex work permit policies, strengthening international relations and zero tolerance on corruption.

According to the central bank of Tanzania’s (BoT) monthly economic review for February 2022, the economic performance of Tanzania is healthy, composed of the trend of exports.

Inflation

The report pointed out that, in January 202, inflation remained within the East African Community (EAC) and Southern Africa Development Community (SADC) criteria. On headline inflation, the central bank report noted that the decrease of non-food consumer goods and services brought it to 4 per cent from 4.2 per cent.

“Twelve-month core inflation was 3.3 per cent in January 2022 compared with 4.6 per cent in the preceding month. Energy, fuel, and utilities inflation was 7.3 per cent, higher than 4.4 per cent recorded in the preceding month,” BoT report said.

The report highlighted the rise of oil prices- diesel and petrol and major food crops in January 2022.

Money and Credit

Thanks to the credit extended by BoT, the private sector credit maintained a strong recovery pace, recording an annual growth of 10 per cent, the same as in the preceding month, and significantly higher than the 2.6 per cent recorded in January 2021.

The central bank report noted that accommodative monetary policy had catapulted good performance of the sector. Money supply growth was strong in January 2022 and consistent with the target of 10 per cent for 2021/2022.

“Extended broad money supply (M3) grew at an annual rate of 14.9 per cent compared with 15.5 per cent in the preceding month.”

The review unequivocally pointed out that the growth rate was more than twofold of the outturn in the corresponding period in 2021.

Tanzania’s central bank has been working tirelessly to shield and promote the performance of the private sector, which contributes to the growth of the economy.

The report noted that domestic credit extended to the private sector and central government by the banking system grew by 19.6 per cent in January 2022 compared with 6.2 per cent in January 2021.

Revenue

Tanzania has become accustomed to outperforming its revenue collection targets. For nearly half a decade, the fifth government under the late President John Magufuli, internal revenue collection has become a crucial part of the economy.

The entire revenue gathering process has revolutionised the way taxpayers interact with the tax agency. In December 2020, the government of Tanzania wrote a new history in revenue collection – marking more than $900 million.

In the context of the report, in January 2022, revenue collection surpassed targets and proved how serious Tanzania has become in advancing its economy.

The revenue collected amounted to more than $941 million, surpassing the target of $922 million and collection in the corresponding month in 2021 by 40 per cent.

“Central government revenue collection amounted to $913 million, the balance being collected from local government own sources. Tax revenue amounted to $711, which is 98.7 per cent of the target and 30.8 per cent higher than the collection in the corresponding month in 2021,” the report noted.

Debt

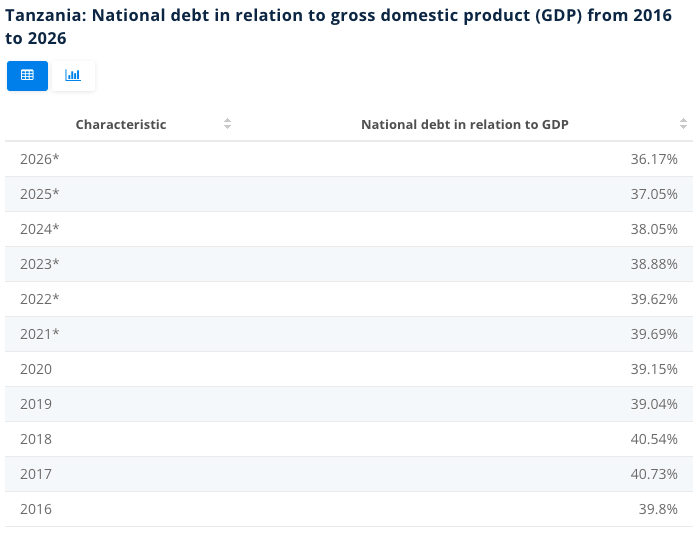

Numbers depict how Tanzania’s debt keeps surging. According to data from Statista, the national debt concerning GDP from 2016 to 2021 show debt sucking the life out of the economy.

The central bank report expanded on the latter with detailed numbers. The review noted that the national debt stock, compromising the public and private sector, amounted to $37.5 billion at the end of January 2022.

The increase was $133.2 million from the previous month and $6 billion from the debt score registered in the same month in 2021.

On the other side of the fence, external debt (public and private) accounted for 75.4 per cent of the national debt stock.

Across the funnel of time, Tanzania has been one of Africa’s high borrowers from various regional and international lenders, the International Monetary Fund (IMF) and World Bank, to mention a few.

The review argued that, in January 2021, the stock of external debt rose by $75.7 million to $28.3 billion from the previous month “owing to disbursement of contracted loans, which outweighed principal repayment”.

Tanzania is now pushing its luck towards investment. Work permits are now accessible within seven days, promoting better working and business operations for investors.

Essential investment pools, notably, Economic Processing Zone Authority (EPZA) and Tanzania Investment Centre (TIC), have registered projects worth $3.5 billion within one year, adding 43,700 jobs in the market. (www.utahcnacenters.com)

Read: Report Insight: How Sub-Saharan Africa is recovering