- Uganda’s Public Debt sources from China and commercial banks have been increasing.

- Finance indicates that the share of multilateral credit stood at 61.7 per cent, representing an 8.9 percent reduction from June 2016 when it was 70.6 per cent

- Ministry of Finance data indicates that the share of commercial bank loans has been growing rapidly, with an increase of US$1.33b, or 10.39 per cent, by June 2022

According to the Status of Uganda’s Debt report, multilateral lenders remain the largest source of credit for Uganda. However, the report shows that the share of debt sourced from multilateral lenders has been decreasing, while other sources such as China and commercial banks have been increasing their share.

As of June 2022, data from the Ministry of Finance indicates that the share of multilateral credit stood at 61.7 per cent, representing an 8.9 per cent reduction from June 2016 when it was 70.6 per cent.

The report identifies the World Bank and bilateral lenders as other significant sources of Uganda’s external credit, contributing 34.5 per cent and 27.9 per cent, respectively.

In addition, China and commercial banks are listed as major sources of credit, with their share increasing over the past seven years. China’s share of credit has grown from 17.8 per cent to 20.7 per cent, while that of commercial banks has grown from zero to 10.4 per cent.

Expensive Credit

However, analysts have expressed concern about Uganda’s increasing reliance on expensive credit sources like commercial banks, particularly given that the government has had to use sovereign assets as collateral for some loans.

The data indicates that the share of commercial bank loans has been growing rapidly, with an increase of US$1.33b, or 10.39 per cent, by June 2022. The Ministry of Finance has acknowledged that there has been an increase in expensive external commercial and domestic debt but is taking steps to address it.

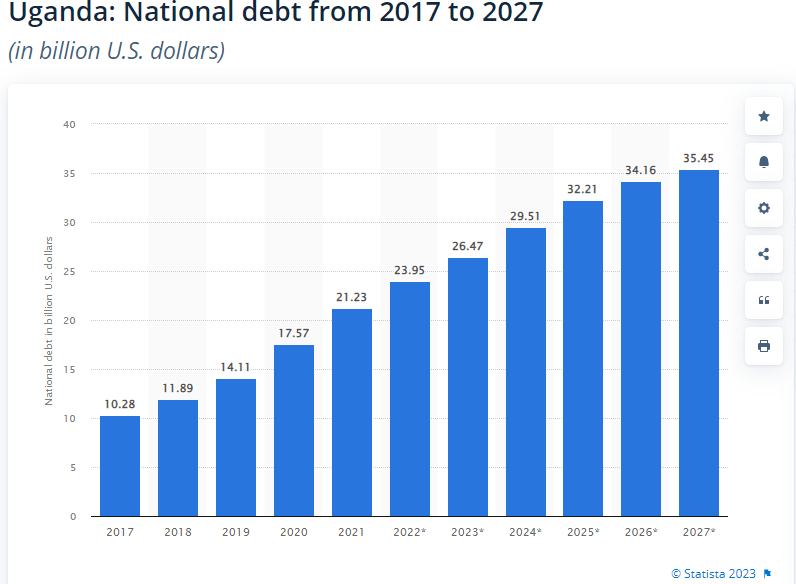

The Ministry of Planning’s quarterly debt statistical bulletin and public debt portfolio analysis note that as of September 2022, the stock of public debt had slightly reduced to US$20.33b, with external debt constituting 60.6 per cent and domestic debt constituting 39.4 per cent.

Multilateral creditors include the International Development Association, International Monetary Fund, and African Development Fund, while bilateral creditors are classified under the Paris Club and Non-Paris Club.

The report reveals that Uganda’s multilateral debt is dominated by the International Development Association and African Development Fund, while bilateral debt is dominated by the Exim Bank of China and the UK.

Uganda Expects Lower Debt and 7% Growth with Oil in 2025

The Ugandan government announced that it foresees a positive trend in its public debt, attributed to the country’s strong economic growth. The ministry of finance, along with the central bank and other stakeholders, has expressed concerns regarding the increasing debt burden and rising debt servicing costs.

To alleviate these issues, the ministry has decided against external borrowing in the upcoming fiscal year beginning in July.

Ramathan Ggoobi, the top Treasury official of Uganda’s finance ministry, issued a statement via the government’s communications department, expressing his confidence in the country’s future economic growth.

Ggoobi projected that the oil and gas sector would be the primary driver of economic growth, with real GDP expected to rise to over 7% upon the commencement of commercial oil production in 2025.

Uganda aims to commence oil extraction in 2025 from oil fields in the western region of the country, adjacent to the border with the Democratic Republic of Congo.

In January, China’s CNOOC 0883.HK launched the drilling programme for the first production well in partnership with France’s TotalEnergies TTEF.PA and Uganda’s national oil company.

Read: East African economies struggle with rising debt amid weak currencies