- PAPSS will enable instant, cross-border payments in local currencies between African markets

- PAPSS is set to boost intra-African trade significantly by simplifying cross-border transactions and reducing dependency on hard currencies

- PAPSS is a collaboration between some of the continent’s leading institutions

In September, the African Export-Import Bank (Afreximbank) and AfCFTA Secretariat announced the operational roll-out of the Pan-African Payment and Settlement System (PAPSS).

The revolutionary Financial Market Infrastructure is meant to enable instant, cross-border payments in local currencies between African markets.

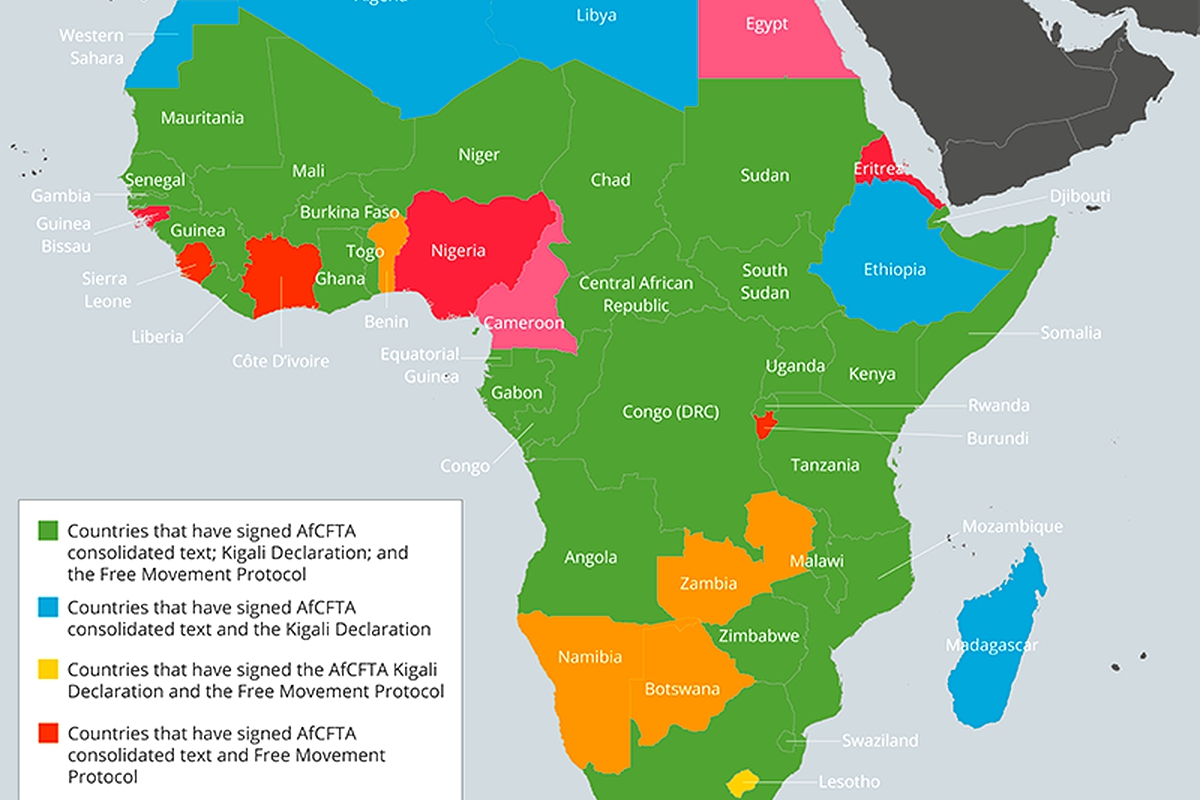

PAPSS is set to boost intra-African trade significantly by simplifying cross-border transactions and reducing dependency on hard currencies for these transactions. The system also underpins the implementation of the African Continental Free Trade Area (AfCFTA).

Read: Good week for Kenyan SMEs with American deals signing

The full implementation of PAPSS will serve as a continent-wide platform for processing, clearing and settling intra-African trade and commerce payments. This will leverage a multilateral net settlement system. Africa will save more than US$5 billion in payment transaction costs each year once the PAPSS is fully rolled out.

The Pan-African Payment and Settlement System is a multi-decade dream that seemed unachievable just a few years ago.

Oramah adds that PAPSS will not replace existing regional and national payment systems but will collaborate and work with them to better integrate African economies for the benefit of all.

PAPSS is a collaboration between some of the continent’s leading institutions. Afreximbank is the main Settlement Agent in partnership with participating African Central banks. The development of the pan-African payments infrastructure is taking place in collaboration with the AfCFTA Secretariat and endorsed by the African Union (AU).

The pan-African payments infrastructure was commissioned after a successful pilot phase in the West African Monetary Zone (WAMZ) countries where live transactions were done instantly.

Afreximbank worked with the West Africa Monetary Institute (WAMI) to launch the system in the WAMZ.

Following this successful milestone, PAPSS is now engaged in advanced discussions with other national and regional institutions for its rapid expansion across the continent.

The Afreximbank provides settlement guarantees and overdraft facilities to all settlement agents on the payment system.

Already, Afreximbank has approved US$500 million to support the clearing and settlement of transactions in the WAMZ countries. A further US$3 billion will be made available to support the implementation of the system continent-wide.

AfCFTA Secretary-General, H.E Wamkele Mene, said the establishment of a payment system to facilitate affordable and efficient cross border trade transactions will improve intra-Africa trade. The development of a Pan African Payment and Settlement System, Mene added, will usher in a new phase in the African economic trajectory.

PAPSS provides Africa with greater capacity to conduct cross-border transactions and expand the scale of both active and latent opportunities for enhanced intra-African trade, according to Mene.

Read: What lies in Africa investment space, economic partnerships

The new payments platform for African countries could in essence be a shift for independence from the dollar which is the common cross border trade currency.

Godwin Emefiele, the Governor Nigerian Central Bank said that with central banks working actively together alongside the Afreximbank, they are ushering in a new phase in Africa’s economic trajectory which is in keeping with the ideals of the AfCFTA.

He added that PAPSS provides central banks with greater transparency and control since the single window into all cross-border transactions emanating from various jurisdictions and across the continent can be easily monitored.

PAPSS CEO, Mike Ogbalu III, is of the opinion that the PAPSS will enable individuals, businesses and governments on the continent to trade with each other seamlessly since the system is designed to be a fundamental rail connecting African markets to each other.

PAPSS will provide fresh impetus for businesses to scale more easily across Africa, essentially eliminating the borders that have balkanized trades and robbed the continent of its economic prosperity for long.

With the successful accomplishment in the WAMZ countries, PAPSS is now set on integrating the rest of the continent into the infrastructure by assimilating National Payment Systems, Regional Payment Systems and other financial services providers.

Ogbalu III adds, “PAPSS has demonstrated credibility through its successful pilot and proof of concept in the WAMZ region, a region with the diversity and complexity anticipated in the larger African context (multi-lingual, multi-currency, multi-regulator, etc). ”

The PAPSS was launched on July 7, 2019, in Niamey, Niger, at the 12th Extraordinary Summit of the Assembly of the African Union (AU) who adopted it as a key instrument for the implementation of the AfCFTA.

Read: Pandemic is Africa’s golden digital opportunity