Sustainability is no longer a buzzword, it has become a high-growth economic opportunity for innovative companies and the investors supporting them.

This is partially fueled by the emergence of new markets, such as the demand for residential solar energy systems as fossil fuel grids collapse and/or natural gas lines run out as a result of geopolitical events like the conflict between Russia and Ukraine.

Sygnia has moved quickly to capture this opportunity by listing the Sygnia Itrix Sustainable Economy Exchange Traded Fund (SYGSE) on the Johannesburg Stock Exchange (JSE). The ETF invests in 300 industrial and energy stocks that help fight climate change.

- Asset manager Sygnia, cofounded by Magda Wierzycka, has listed a new exchange traded fund (ETF) on the Johannesburg Stock Exchange that provides investors with access to clean energy and space exploration.

- The Sygnia Itrix Sustainable Economy Exchange Traded Fund (SYGSE) listing will bring the number of ETF instruments on the JSE to 94, with a total market capitalisation of over R114 billion.

- The ETF will track the S&P Kensho sustainable technologies index, which is designed to measure the performance of companies that provide products and services that mitigate climate change. That includes companies with exposure to sustainable agriculture, clean power, space exploration, smart transport and manufacturing, intelligent infrastructure and an array of technologies that enable remote working.

The new ETF is a passively managed index tracking fund, which aims to replicate the price and yield performance of the S&P Kensho Sustainable Technologies Index. The S&P Kensho Sustainable Technologies Index measures the performance of companies with exposure to smart transportation and manufacturing, sustainable agriculture, clean power, space exploration, intelligent infrastructure, and the technologies that enable remote working. The Fund’s investments are divided into four parts: sustainable infrastructure; sustainable agriculture; sustainable manufacturing; sustainable society.

“Finding themes that provide growth in a low-growth world is critical to successful investing, and innovation stocks focused on building a sustainable economy present key opportunities,” said Kyle Hulett, Head of Investments at Sygnia.

Valdene Reddy, Director of Capital Markets at the JSE, said she is pleased that issuers continue to flock to the JSE, giving South African investors an opportunity to diversify their portfolios while fulfilling their environmental and social needs and governance (ESG) investment objectives.

“The JSE is a magnet for ETF issuers who take seriously their responsibility to strike a balance between generating returns for investors and addressing ESG related concerns. Investors have the opportunity to invest in ETFs like SYGSEO and gain exposure to the underlying companies who contribute towards growing a sustainable economy,” added Reddy.

In June 2022, the JSE introduced its Sustainability and Climate Disclosure Guidance to promote transparency and good governance and guide listed companies on best practices in environmental, social, and governance (ESG) disclosure. The guide aims to support businesses expand the quality and accessibility of information on sustainability-related risks and prospects that affect their organizations’ financial performance and impact on communities, the environment, and the economy.

In addition, the Financial Sector Conduct Authority (FSCA) approved amendments to the JSE listings requirements, reducing red tape and creating an enabling environment for companies listed on the bourse.

Read: Johannesburg Stock Exchange lists ‘Socially Responsible’ ETF

According to the company website, the Johannesburg Stock Exchange offers secure and efficient primary and secondary capital markets across diverse securities, spanning equities, derivatives, and debt markets. It prides itself on being the market of choice for local and international investors looking to gain exposure to leading capital markets on the African continent.

It is currently ranked in the Top 20 largest stock exchanges in the world by market capitalisation, and is the largest stock exchange in Africa, having been in operation for 130 years.

The JSE has attracted several ETF listings this year, confirming its status as the leading exchange for global capital raising. The JSE currently has 93 ETF listings with a total market capitalisation exceeding R114 billion.

Read: Zimbabwe Stock Exchange to list Forth Exchange Traded Fund (ETF)

Investing in ETFs or exchange-traded funds is equivalent to directly investing in all constituents that are part of an index. According to Forbes, the yields or returns generated by ETFs replicate the benchmark index. It gives investors an opportunity to benefit from diversity, flexibility and scope for growth that comes from ETFs being traded on stock exchanges.

The listing of SYGSE happens at a time the JSE is preparing to usher in new amendments to its listings requirements, paving the way for issuers to list and trade Actively Managed ETFs (AMETFs) for the first time in the bourse’s history.

In September, the bourse announced that the Financial Sector Conduct Authority (FSCA) approved amendments to the JSE listings requirements, allowing issuers to list and trade AMETFs for the first time. “The changes [allow] locally registered Collective Investment Scheme (CIS) management companies to list ETFs which related to offshore assets on South African securities exchanges. It [allows] these funds unlimited investment in offshore assets, subject to the restrictions on their offshore portfolio allowances.”

The stock exchange indicated that given the global ETF market’s evolution and the local industry’s desire, the impending introduction of AMETFs in South Africa aligns with global best practices.

AMETFs are funds that are traded on the market in which the investment manager uses an active investment strategy to produce a return for the investor instead of passively tracking an index or other type of asset. Traditionally, ETFs listed on the JSE are passively managed.

Actively managed ETFs have seen strong growth globally, growing assets under management by 7.1 per cent year-to-date to US$474 billion in 2022 from US$442 billion at the end of 2021.

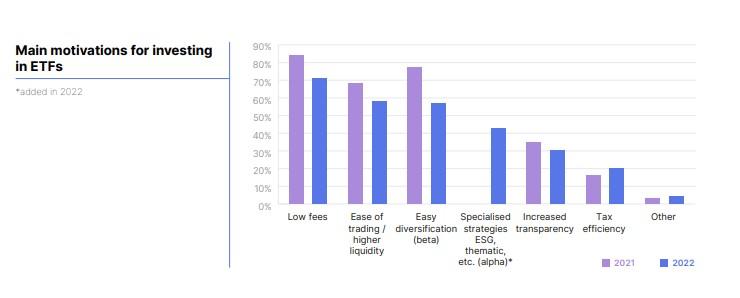

According to Trackinsight, the main motivations for buying actively managed ETFs are primarily lower fees (for those replacing active funds), excess return (for those replacing passive ETFs) and diversification (for those replacing direct investing).