- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

Browsing: Africa

President William Ruto’s election in August 2022 introduced an element of uncertainty in Kenya’s foreign policy landscape. While it is challenging to predict the exact trajectory, his past statements suggest a more pragmatic and balanced approach to international relations. While emphasizing the importance of regional integration and South-South cooperation, President Ruto has also acknowledged the significance of Kenya’s longstanding relationship with the United States. This nuanced stance implies that the government might not abandon the Look East Policy entirely but rather recalibrate to strike a more balanced approach between the East and the West.…

Financial knowledge remains paramount in an era in which increasingly complex financial products have become readily available to many. Governments in different countries have put more effort into expanding access to financial services. Consequently, the number of individuals with bank accounts and access to credit products is increasing.

Financial literacy remains crucial to personal and economic empowerment, enabling people to make sound financial choices and manage their finances effectively. Africa suffers from a significant shortage of financial literacy, which hinders its economic growth and development.…

Until the Biden Administration, US-Africa trade relations had remained remarkably consistent. Africa Growth and Opportunities Act (AGOA), in place since October 2000 through five separate US administrations, has been the ‘centrepiece’ of this consistency.…

In recent years, Africa has emerged as a promising destination for global investment, with its vast natural resources, expanding consumer markets, and growing middle class. As the continent’s economies continue to strengthen and diversify, global players increasingly recognise the potential for mutually beneficial partnerships. The United States has significantly contributed to Africa’s economic transformation among these partners.…

However, integrating cryptocurrencies with conventional financial systems becomes increasingly essential as they become more commonplace. This presents several obstacles to overcome before cryptocurrencies can realise their full potential. For instance, traditional institutions may be hesitant to work with cryptocurrencies due to concerns about money laundering and other illicit activities. Moreover, the technical difficulty of integrating cryptocurrencies with existing banking systems can prove intimidating.…

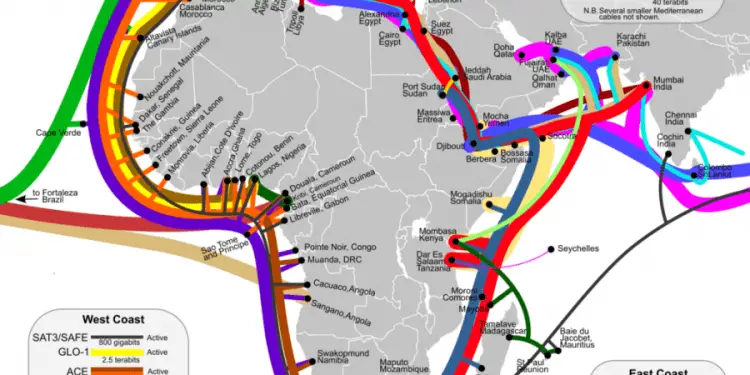

- The funding will see SEACOM grow its broadband cable network and cloud-based product offering in sub-Saharan Africa.

- Under the new deal, IFC will provide a $207 million long-term loan to SEACOM.

- The funding will support SEACOM to become the next-generation cloud-based IT service business.

SEACOM has partnered with the International Finance Corporation (IFC) to increase the access to broadband IT services for small and medium-sized businesses across Africa. The partnership will see SEACOM, a digital infrastructure and IT services company, grow its broadband network and cloud-based offerings in sub-Saharan Africa.

IFC will offer SEACOM a $207 million loan, which includes $70 million from IFC’s own financing. A total of $42.24 million co-financing will come from institutional investors through IFC’s Managed Co-Lending Portfolio Program. Another $94.76 million will be mobilized from Nedbank Limited and Mauritius Commercial Bank.

SEACOM expanding cloud-based services

“Access to affordable, good-quality internet is central to economic …

Population growth and economic development have necessitated speeding up and scaling up infrastructure development in Africa. Over 28 African nations have seen population growth of more than double in the last 30 years. The population of 26 other African countries will quadruple over the next 30 years. Consequently, funding for the continent’s infrastructure has become essential.…

- USAID is committing $3 million in funding for water and sanitation investment projects in Africa.

- The financing through African Water Facility (AWF) will be in grants and technical assistance to African countries.

- AWF assists African nations in achieving the goals and targets outlined by the African Water Vision 2025.

The African Water Facility (AWF) has received a $3 million commitment from the United States Agency for International Development (USAID). The financing will facilitate the planning of water and sanitation investment projects in Africa. Financing will be through grants and technical help to African nations and regional economic groups.

Housed by the African Development Bank, the African Water Facility was launched by the African Ministers Council on Water. It is the first institution in Africa fully dedicated to addressing water and sanitation challenges.

AWF assists African nations in achieving the goals and targets outlined by the African …

France will host, in Paris, on June 22 and 23, 2023, the Summit for a new global financing pact. The Summit seeks to rethink the contract between the countries in the Global North and the Global South. The organisers aim to formulate a new pact to address the global economic crisis and climate change.…

The United Nations (UN) has called for major reforms for two institutions considered key players in the new world order. Antonio Guterres, the UN secretary-general, is pushing for major changes in the IMF and the World Bank.

According to Guterres, the International Monetary Fund has profited the rich nations at the expense of the developing ones. The UN secretary-general describes the response by IMF and the World Bank towards the COVID-19 pandemic as a “glaring failure” that left most developing nations significantly indebted.…