- The silent struggle: Women entrepreneurs in Africa and the financial divide

- Questions and answers on confirmation of war crime charges against Joseph Kony at the ICC

- The critical need for energy access in Africa: A roadmap to prosperity

- Killings, abductions, cruel laws worsen East Africa’s human rights record

- Will the Kampala Declaration deliver for African farmers amid climate change?

- Investments in ports, ICT and agriculture key in landmark Kenya-UAE trade pact

- The Just Energy Transition in Africa: Lessons from South Africa and Senegal

- Mukuru Wallet poised to bolster financial inclusion in Zimbabwe

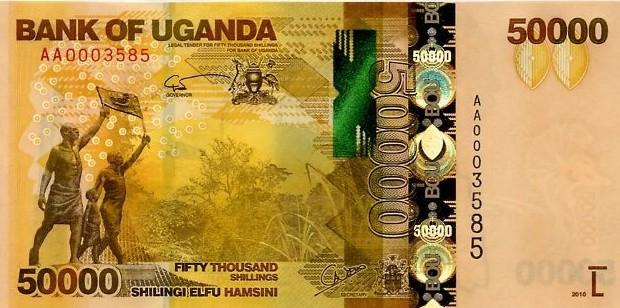

Browsing: Bank of Uganda (BoU)

Uganda’s Central Bank noted that easing of lockdown put in place as a measure to prevent the spread of covid-19 has led to economic growth recovery.

The Bank of Uganda in its latest monetary policy statements said that economic growth recovery has been supported by the easing of lockdown, a feeble improvement in both foreign and domestic demand as well as the stability of the exchange rate.

The government of Uganda started easing restrictions on some parts of the economy which had been affected by the pandemic in may.

Uganda’s Central Bank forecasts that the 2020/2021 financial year will see some growth of between 2.0-3.0 per cent which could increase to up to 6.0 per cent in 2021/22. The growth estimated before the pandemic which was of more than 6 per cent is forecast to be attained after 2022.

The 9 pm to 6 am curfew still remains in place …

East Africans should brace themselves for an increase in the cost of living as households and businesses pay more for goods and services.

Regional currencies are facing increased pressure against the dollar as increasing debt levels and increased servicing obligations threaten to wear down foreign exchange reserves, market data shows.

The projected drop of regional currencies is mainly attributed to the growing debt servicing obligations for foreign currency-denominated debts. To pay off external creditors, it requires a drawdown of the country’s foreign reserves.

According to analysts at AIB Capital, as a pick-up in consumer demand increases imports, the Kenya shilling is expected to further depreciate against the dollar. The country’s exports are likely to remain relatively uncompetitive therefore, this will lead to an increase in the current account deficit.

“We expect the shilling to gradually depreciate against the dollar but remain relatively unchanged against the euro and pound,” said AIB.…

Stanchart released the outlook for the EAC three big economies – Uganda, Kenya and Tanzania.

According to the outlook report, the bank lowered Uganda growth forecasts to 6.0 per cent in 2020 and 6.2 per cent in 2021.

According to the report, although it is difficult to assess the full impact of the regional locust invasion, food prices have already been pressured due to flooding especially in eastern Uganda in December last year.

“We now expect the Bank of Uganda to keep its policy rate on hold at 9.0% throughout 2020 having previously seen scope for more easing,” said part of the report.

The report adds that they project the Bank Of Uganda (BoU) will adopt a tighter policy stand to control inflation given the 2021 elections and the rising caution over the extent of the government’s public financing requirement.

Stanchart’s chief economist for Africa and the Middle East, Razia …

Uganda’s exports for the period ending September experienced an 8 per cent decline, according to the Central Bank of Uganda.

According to a report released by the Bank of Uganda last week, it indicates that earnings from exports for the period ending September stood at $296m compared to $326m in August.

Despite the decline, gold, which has become a key export commodity for Uganda among others such as coffee, fish, tobacco and maize, stood out as some of the commodities that hit impressive earnings during the period.

The report shows that in the period ending September, a total of 1,530 kilogrammes of gold were exported noting that the exports were less than the 1,755 kilogrammes that were exported in August.

Uganda’s Export Promotion Board trade and information executive, Mr John Lwere said they were still analyzing the trends in performance. He also noted that gold is gradually becoming part of …

The Bank of Uganda reduced its interest rates for the first time since February 2018 in a bid to support economic growth.

The monetary policy committee agreed to reduce the central bank rate by 1% to 9%. The rediscount rate and the bank rate were also adjusted by a similar amount to 13% and 14%, respectively.

This rate cut is expected to be of relief to businesses facing cash difficulties in funding operations or expansion. Businesses that are struggling with low sales and reduced household spending, can also get a boost from the rate that is cut through consumer lending.

“This policy move is expected to boost already high liquidity levels in the banking sector and this will eventually accelerate credit growth and real economic activity,” said Adam Mugume, Executive Director for Research at Bank of Uganda (BoU).

Also Read: Bank of Uganda warns of rising cost of debt repayment

…The Bank of Uganda has warned government against the accumulation of foreign debt, saying the central bank is under a lot of pressure to obtain foreign exchange to repay loans.

Speaking during the IMF and AfDB-organised conference in Kampala during the weekend, Bank of Uganda Governor Emmanuel Tumusiime Mutebile, said that the rising cost of servicing the debts is putting pressure on the Central Bank to accumulate foreign exchange reserved for future imports.

“The biggest challenge for Bank of Uganda (BoU) is how to accumulate foreign exchange reserves to service external debt. The forex reserves have to be purchased from the domestic market, without causing sharp exchange rate depreciation pressures that would eventually pass through to domestic inflation, thereby warranting tightening of monetary policy and later on impacting on economic growth,” said Mr Mutebile

Mr Mutebile revealed that for instance, in the 2019/20 financial year, the central bank has to …

Increased gold export in recent months has strengthened the Ugandan shilling, helping ease inflationary pressure from imported goods.

The Uganda Bureau of Statistics reported that the annual headline inflation had slowed to 1.9 per cent in the month of September compared to 2.1 per cent registered in August, which is largely attributable to a stronger shilling.

Data from the Bank of Uganda shows that the shilling which was trading at 3,765.6 against the dollar in May, has remained stable at just over the 3,600 units for the months of August and September.

Since May, Uganda’s earnings from gold exports have been increasing from $78.7 million to $97.3 in July.

Dr Fred Muhumuza, a development economist, says the shilling which had been destined to reach the 4,000 units to the dollar mark, is now gaining strength thanks to Uganda’s gold exports.