- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Central Bank of Kenya

The first National Payments Strategy implemented in 2004 through to 2008, was aimed at addressing challenges across risks due to the absence of a real-time settlement system, limited trust in payment instruments such as high-value cheques and an under-developed policy, legal and regulatory framework.

The NPS is motivated by a desire to meet the diverse needs of the Kenyan people and its economy and support our nation’s ambition for a digital, inclusive and 24/7 economy. The Strategy will also be the basis for consolidating and extending Kenya’s global leadership in digital payments and innovation. Finally, the Strategy will provide the overarching policy framework that will guide the work to strengthen the NPS legal and regulatory framework.…

- Land prices in Nairobi’s suburbs and towns maintained a mild upward growth in the fourth quarter of 2021

- Prices in the suburbs increased by 0.34 per cent over the quarter, while in the satellite towns, growth stood at 1.4 per cent

- The appreciation was on the back of several factors including the implementation and conclusion of vast infrastructure projects promoting accessibility and opening up areas for Real Estate investments

- Gross loans advanced to the Real Estate sector increased by 3.2 per cent to KSh 463.0 billion in the third quarter of 2021, from KSh 448.0 billion in the first half of 2021

Land prices in Nairobi’s suburbs and towns maintained a mild upward growth in the fourth quarter of 2021.

Data collected by property experts HassConsult indicated that prices in the suburbs increased by 0.34 per cent over the quarter, while in the satellite towns, growth stood at 1.4 per …

The Central Bank of Kenya added that all countries in the region needed to participate in flattening the multi-layered correspondent banking structure and shortening the payment chains for a digital currency to work.

The development of CBDCs has been on the rise. According to a 2021 survey of central banks by the Bank for International Settlements (BIS), 86 per cent of central banks are in the process of researching the potential for CBDCs, 60 per cent are experimenting on them, and 14 per cent were deploying pilot projects.

The CBK has maintained the cryptocurrency ban and has not issued a digital currency due to concerns about the risks of a CBDC.…

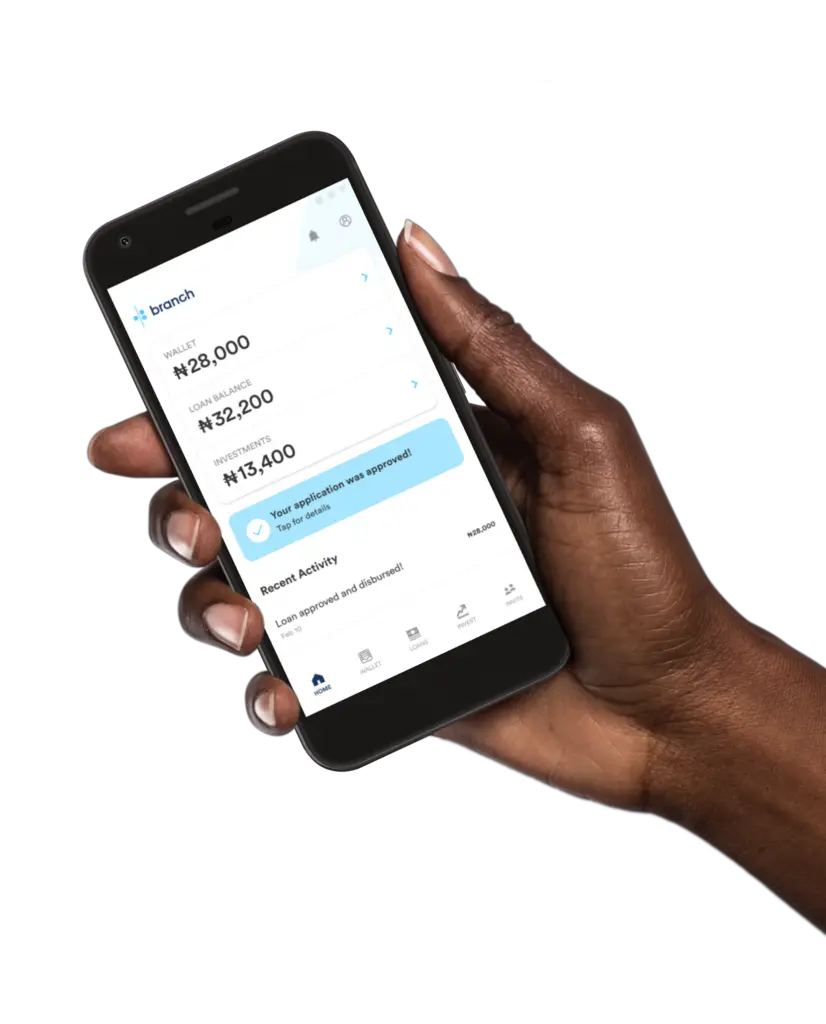

This comes after the National Treasury exempted the digital lender from a law limiting individual shareholding in microfinance to 25 per cent.

In a gazette notice signed by the Cabinet Secretary National Treasury, Ukur Yatani, the San-Francisco based fintech has been exempted from Section 19 of the Microfinance Act (for 4 years through 2025).

Currently, individuals or single entities are barred from holding more than a 25 per cent stake in a microfinance institution.…

The CBK has also issued circulars to local commercial banks warning them against dealing with cryptocurrencies transactions or face penalties for non-compliance.

The last circular was issued in 2018 and has remained in action up until now.

While delivering the monetary policy announcement where the monetary policy committee retained the base lending rate at seven per cent for the 12th time, Dr Patrick said that their position had not changed on any of the crypto products in the market.…

The National Treasury is projecting real GDP growth of 6.0 per cent and 5.8 per cent for 2021 and 2022 respectively and has used the same as the basis for its revenue projections. But this adds to the overall optimism being projected.

In September 2021, the Central Bank of Kenya Governor projected a 6.1 per cent growth rate for 2021 and 5.6 per cent in 2022.

The International Monetary Fund’s most recent forecast puts 2022 growth expectations at 6.0 per cent. The World Bank, on the other hand, projects growth to print at 4.5 per cent and 4.7 per cent in 2021 and 2022 respectively.

We really believe this optimism being projected around is largely irrational and the story of Kenya’s economic growth still remains a puzzle to us. …

Microfinance institutions are trying to cope with the changing times as the market is moving to fast delivering digital systems of money transfer.

Chinese investors in lending apps

A couple of lending apps in Kenya cannot be mentioned without referring to Yahui Zhou, the chief executive of Kunlun Tech. Company Limited.

Zhou is famous for two things; his gaming company and his very expensive divorce settlement; he gave his ex-wife shares of Kunlun Tech worth US$1.1 billion.…

- Central Bank of Kenya has liquidated Imperial Bank of Kenya which was placed under receivership in October 2015

- The bank’s regulator said liquidation was the only feasible option, adding that it was acting in the interest of the general public

- Imperial Bank was placed under receivership, after CBK discovered massive fraud committed by its leadership through illegal deals, milking the bank at least KSh 34 billion

Kenya’s Central Bank has approved the complete shutting down of a bank that was placed under receivership five years ago.

On Thursday, December 6, Central Bank distributed a press release informing the general public that it was closing down Imperial Bank of Kenya Limited in Receivership (IBLIR) bank, seeing that it was the only feasible option.

The liquidation of Imperial Bank now sets the stage for the sale of its remaining assets.

After the bank went under, Central Bank placed it under the receivership …

SMBs share a similar technology adoption trend to SACCOs exposing them to Cybersecurity threats that are detrimental to their growing business.

Speaking during the launch of a cyber security sensitisation campaign, Dimension Data East and West Head of Managed Security Services Dr. Bright Mawudor said there’s a looming misconception that threat actors are only focusing on large enterprises yet small businesses equally possess sensitive data that is lucrative to attackers.…

Yet for SME and corporate lending, credit decisions remain an extended process as information is gathered manually and appraised over, sometimes, weeks, to establish the creditworthiness of the borrower.

The need to abandon such cumbersome processes has recently seen leading banks adopt technology, such as our CreditQuest, to automate credit origination, and manage credit workflow, appraisals, documents, customer ratings and credit decisions.

This kind of technology draws all current and historical credit data onto a unified platform, giving the bank’s analysts a true single customer view of credits and collaterals.…