- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: East Africa

Tanzania suffers from an extreme shortage of electricity access standing at 32.8 per cent of its 57 million people.…

In her quest to pursue more renewable energy, Kenya has injected an additional 79 megawatts of geothermal power to the national grid.

This follows the completion of Unit 1 of Olkaria V Geothermal Power Plant by the Kenya Electricity Generating Company (KenGen) PLC.

The Unit was first synchronized to the grid on the June 28 and thereafter subjected to commissioning tests. It was then taken through a series of load tests until it attained its full design output of 82.7MW.

Commenting on the milestone, KenGen Managing Director & CEO, Mrs. Rebecca Miano, said the additional capacity would play a significant role in supporting Kenya’s power needs while enhancing the amount of green energy in the national grid.

“We are delighted to announce the completion of the first unit of Olkaria V Geothermal Power Plant and subsequently injecting 79 MW to the national grid. This brings to 612MW the total amount …

Java’s strategic approach is building robust value chains which are essential for ensuring that they are capturing the full value of East African coffee. …

Tullow Oil PLC (TLW.LN) recorded a strong performance in the first half of 2019 reporting a 91.5 per cent jump in profit, as it continued with its investments in Africa’s oil space.

Profit after tax for the period ended June 30, closed at US$103.2 million up from US$53.9 million in a corresponding period last year.

This is despite a drop in sales revenue which closed the period under review at US$872.3 million; compared with US$905.1 million it recorded a year-earlier.

Operating profit however went up to US$388 million compared to US$300 million in H1 of 2018 with the British oil firm reducing its net debt to US$2.9 billion from US$3.1 billion in June last year.

“Tullow has delivered a good set of financial results in the first half of 2019, with further reductions in net debt and gearing underpinned by strong cash flow generation from our assets despite the lower …

Kenya’s Insurance sector is set to face disruption following the launch of a new InsurTech ecosystem seeking to create new solutions to the ailing insurance sector.

READ:Why Kenya’s insurance sector is “rotten”

Over 60 InsurTech start-ups pitched to investors at the inaugural two day Africa 3.0 conference held in Nairobi, as they seek to partner in increasing insurance penetration in the region.

The Conference which was organised Market Minds in partnership with Evolution East Africa and the UK Department for International Trade also saw over 150 start-ups from Africa participate.

Market Minds Founder, Sebastian De Zulueta, says a number of deals are expected to be signed with over 30 venture capitalists keen to tap into the opportunities in the insurance market in Kenya and Africa at large.

READ ALSO:Sanlam Kenya reveals secret weapon for 2019

“East Africa’s mobile penetration gives great opportunities for disruptions in the insurance sector. …

Mining experts will be converging in Rwanda later this year to deliberate investment and growth opportunities in the continent’s mining sector, in the wake of increased focus on Africa by multinationals.

The Rwanda Mines, Petroleum and Gas Board (RMB) will be hosting the new East and Central Africa Mining Forum conference and exhibition that will be held in Kigali from October 28-29, an event the country intends to also use to open the country for investment.

“We are opening up our mining sector in a way that has not been done in the past” says Francis Gatare, CEO of the RMB, “providing as much geological information as possible and we have recently revised our regulatory framework from policy to mining code and regulation – to not only make it competitive for companies to operate in but to also provide a platform that will make it easy for companies to comply …

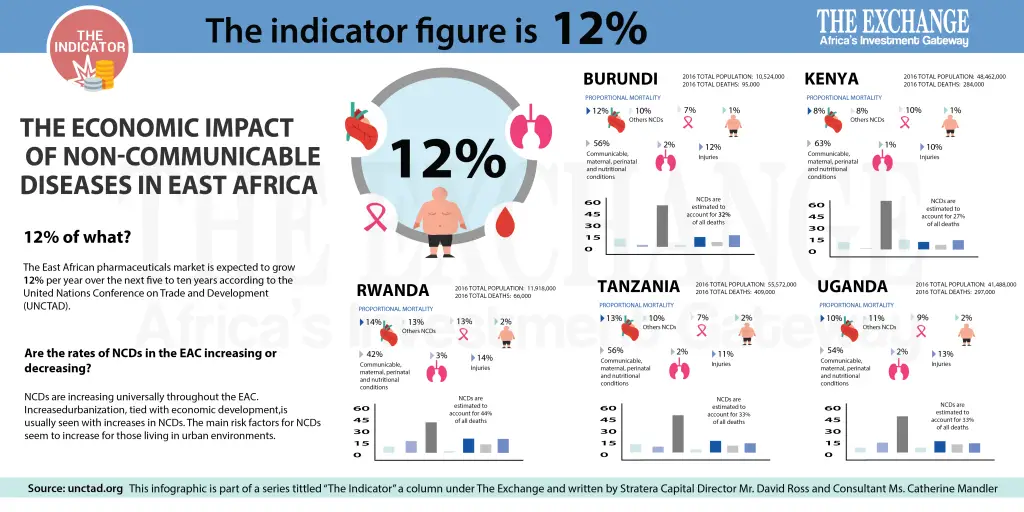

Today’s indicator figure is 12%.

12% of what?

The East African pharmaceuticals market is expected to grow 12% per year over the next five to ten years according to the United Nations Conference on Trade and Development (UNCTAD). The majority of this growth will be due to non-communicable diseases (NCDs) such as heart disease, stroke, chronic kidney disease, dementia, osteoporosis, cataracts, diabetes, cancer, and other similar ailments.

How do the rates of NCDs in the EAC compare to other regions of the world?

The rates of NCDs in the EAC are approaching the rates found in developed economies such as North America and Europe. They have not matched them yet but the growth seen in recent years indicates that they will soon.

Are the rates of NCDs in the EAC increasing or decreasing?

NCDs are increasing universally throughout the EAC. Increased urbanization, tied with economic development, is usually seen with …

Barely a month after intercepting a consignment of contrabands and illegal imports at the Port of Mombasa, Kenyan authorities have yet again seized another multi-million shipment by rogue importers in Kenya.

Kenya Revenue Authority (KRA) seized 144 drums of imported Ethanol at the Port of Mombasa, which had been mis-declared as 1,000 bags of cement.

Customs officers have also seized another high end motor-vehicle, a Range Rover Sports suspected to have been stolen from the United Kingdom which had been mis-declared as second hand window frames, doors, folding chairs, stools and wall pictures.

READ ALSO:KRA intercepts narcotics disguised as candy at JKIA

The Ethanol was imported in two by twenty feet containers while the vehicle was in a twenty-foot container. The two were intercepted following intelligence reports; they were scanned through KRA’s non-intrusive scanners and the images showed inconsistency with what had been manifested.

A multi-agency team lead by …

KCB Bank Kenya has launched a Ksh300 million (US$2.9 million) poultry farmer empowerment project in Makueni County, in its latest move to support agribusiness in Kenya.

This will see over 1,000 poultry farmers in Kibwezi benefit from credit facilities, capital, vaccinated insured chicks, chicken feed and vaccines.

The project will be offered under KCB MobiGrow, a mobile-based platform which provides financial and non-financial services to smallholder farmers in Kenya and Rwanda.

Under the project dubbed, ‘From Chick to Market’, poultry farmers will access various tailor-made MobiGrow services.

Upon maturity, the chicken will be bought at a pre-contracted price by KCB market partners, guaranteeing farmers of a ready market.

Proceeds from the sales will then be remitted to farmers through their KCB MobiGrow accounts to ensure the recovery of loan amounts.

“We are committed to growing agribusiness in the country. We continue to accelerate access to financial services which is in …

Tanzania is consistently hindering East Africa’s integration by its aggravated actions in dealing with its neighbours…