- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

Browsing: East Africa

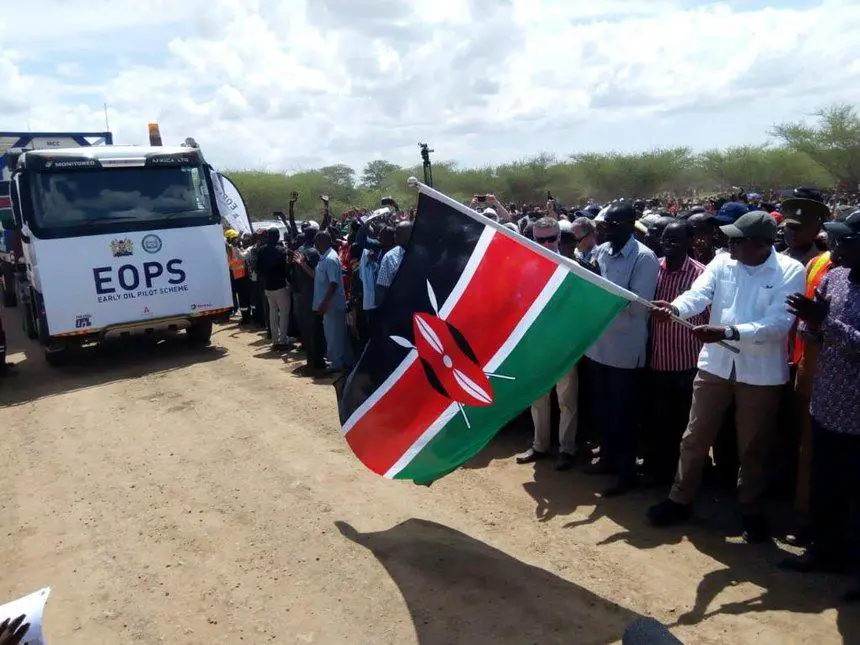

Kenya has made a major step in the commercialisation of its oil ahead of planned exports which will see the East African nation become a major net oil exporter in the region.

In the latest developments, the government and its Joint Venture Partners: Tullow Kenya, Total and Africa Oil Corp, have signed Heads of Terms for the development of the oil fields in the northern part of the country (South Lokichar Basin-Turkana), where exploration and production has been ongoing on small scale.

These Heads of Terms capture all of the key commercial principles related to the implementation of ‘Project Oil Kenya’ and provides both the framework and commercial certainty required to draft the fully termed upstream and midstream agreements, ahead of a Final Investment Decision(FDI).

This is a major and important milestone towards reaching a FDI.

Oil blocks and pipeline

Under the deal, all parties have agreed that the Amosing, …

Global risk and information solutions provider—TransUnion has urged the use of credit scores for better loan product pricing.

With a keen focus on Kenya where the capping of interest has led to a credit crunch to private sector and households, TransUnion Kenya is urging lenders to focus on individual credit scores to make smarter decisions and empower consumers to take control of their financial health.

“With new risk-based pricing systems for loans on the horizon in Kenya, it’s becoming increasingly important for both consumers and financial institutions to understand how credit scores can help enable the right conversations,” the firm says in its latest market review on the East African country.

According to the firm, there is need for a new pricing system for interest rates (ether risk-based or not) to become increasingly clear.

“Many banks currently take a blanket approach to pricing,” says TransUnion Kenya CEO Billy Owino, “This …

By Washington Ndegea

In the year of our Lord Two thousand and Eighteen, the Treasury Secretary Henry Rotich strode to parliament carrying the characteristic brief case just in time to read the twenty eighteen-twenty nineteen budget. That was in the month of June.

Expectations were high, that the prices of various basic commodities would reduce, and that we in the insurance industry would get the much needed relief and create an enabling environment to do business.

The issue of the prices of the basic commodities were met, but we in the insurance sector were left reeling by the recommendations that were being proposed in the Insurance Act in form of Insurance (Amendment) Bill 2018, that it would be criminal to handle insurance premiums from then on if the recommendations were to be made law.

We quickly instituted an emergency meeting to look at what could have prompted the Treasury department …

Bolt, the leading ride-hailing platform in Europe and Africa, has expanded its operations to three major urban centers in Kenya, setting the stage for a continued push to expand its market footprint within the country.

This comes as competition heats up for taxi hailing apps in Kenya, where both local and international companies are pushing to secure a substantial market.

Bolt’s launch in Kisumu, Kakamega and Thika will see the number of Kenyan towns and cities served by the platform rise from the current two, to five, making it the largest ride-hailing service provider in terms of geographical reach.

READ ALSO:Bolt targets corporates with new business strategy

According to Bolt Country Manager (Kenya) Ola Akinnusi, Bolt’s mission is to make urban transportation more convenient and affordable for more people, thus broadening the company’s reach, providing a platform for job creation through its social contribution.

“After Nairobi and Mombasa cities, …

The East African region has recorded a marked increase in the number of PE funds looking to invest in the region from 72 in 2016 to 97 in 2018, according to a new report released by KPMG and the East Africa Private Equity and Venture Capital Association (EAVCA).

In 2017 and 2018, 84 PE-backed deals were reported at an estimated value of US$1.4 billion.

According to EAVCA Executive Director Eva Warigia, the region recorded a 12 per cent increase in the amount of funds sourced from the domestic market largely driven by participation by pension funds.

“Local participation by pension funds is one way to mitigate against the risk attached to investing in Africa,” Warigia said during the release of the report.

“Participation of pension funds in private equity investments is improving access to capital for small businesses whilst enabling the funds to tap into new sectors for their portfolio …

Kenyan listed banks had an improved performance on aggregate in the first quarter of 2019 as they recorded improved profitability in a relatively tough operating environment, a survey by Cytonn Investment has revealed.

During the quarter, return on equity rose to 19.2 per cent from 18.4 per cent in Q1 2018, with equity group having the highest at 22.8 per cent, Cytonn’s Q1’2019 Banking Sector Review indicates.

The report, themed ‘Consolidation and Diversification to drive Growth’, analyzed the Q1’2019 results of the listed banks.

“We note that the increased emphasis on operating efficiency by banks seems to be bearing fruit, with the listed banking sector’s operating efficiency improving year-on-year, which was further supported by a recovery in interest revenue, largely supported by the asset re-allocation to government securities, and increased lending to specific segments”, said Caleb Mugendi, investment Associate at Cytonn Investments.

“The continued focus on alternative banking …

EFG Hermes, the leading financial services corporation in frontier emerging markets (FEM), has for the second year running been ranked the number one frontier market brokerage firm in the Extel Survey 2019.

The firm also remains the second highest ranked brokerage firm in the Middle East and North Africa(MENA).

Prior to this accolade, EFG Hermes was also named, for the second time in as many years, the leading Africa (Ex-South Africa) Equities House by the Financial Mail, attesting to the success of its expansion into African markets.

EFG Hermes launched its operations in Kenya in 2017 and has been using its Nairobi office as the hub for its East African research coverage and trading execution.

“As the most dynamic and leading economy in the region, we strongly believe that Kenya is the most appropriate hub for the region,” said Kato Mukuru, EFG Hermes’ Head of Frontier Research.

“Holding our ground …

Tala, the leading consumer lending app in emerging markets, has disbursed loans to over 2.5 million customers globally, in the wake of continued global expansion of financial technology.

READ:Kenyan fintech companies brace for sectors’ revolution

This was revealed on Monday during the celebrations to mark the company’s five year anniversary in Kenya.

When Tala, formerly Mkopo Rahisi, was launched in Kenya in 2014 becoming the first in the world to offer unsecured mobile loans direct to consumers.

Since then, Tala has expanded credit access across Kenya by using alternative data to instantly underwrite and disburse credit to people who have been excluded from traditional finance due to lack of credit history or formal records.

READ:Tala raises $30 million to expand into new markets

Speaking during the launch of ‘Tala at 5’ celebrations, the head of Tala’s Kenya business, Ivan Mbowa, noted that Tala has changed the way people …

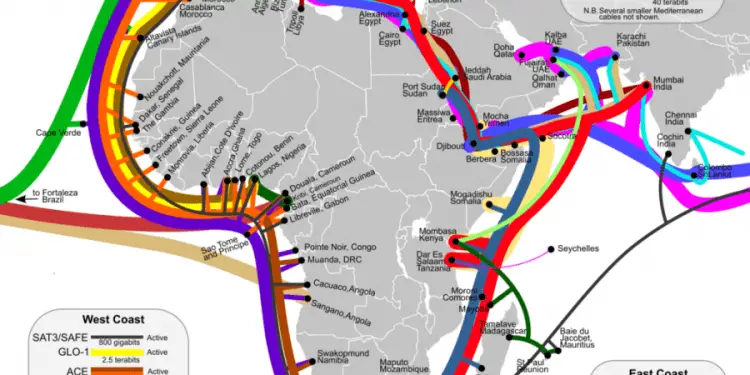

Pan-African telecoms enabler SEACOM has further extend its corporate market offering into the East African region, under its Seacom Business brand, by providing its industry-leading Internet connectivity and cloud services directly to corporate customers in Uganda.

SEACOM has been a leading data connectivity provider in Uganda enabling access though the service provider segment.

READ ALSO:SEACOM and Microsoft to boost connectivity in Kenya

It is now bolstering its presence in Kampala by expanding its enterprise reach and will now be able to provide corporate organisations in Uganda with reliable data connectivity and cloud services.

SEACOM will provide a corporate-grade consistent service quality by leveraging its existing high-speed fiber-based network infrastructure that extends from Kampala onto its diverse subsea international backbone.

Speaking during the launch, SEACOM’s Managing Director for the Eastern North and East Africa region, Tonny Tugee, said the new development is part of the telecoms provider’s plan to strengthen …

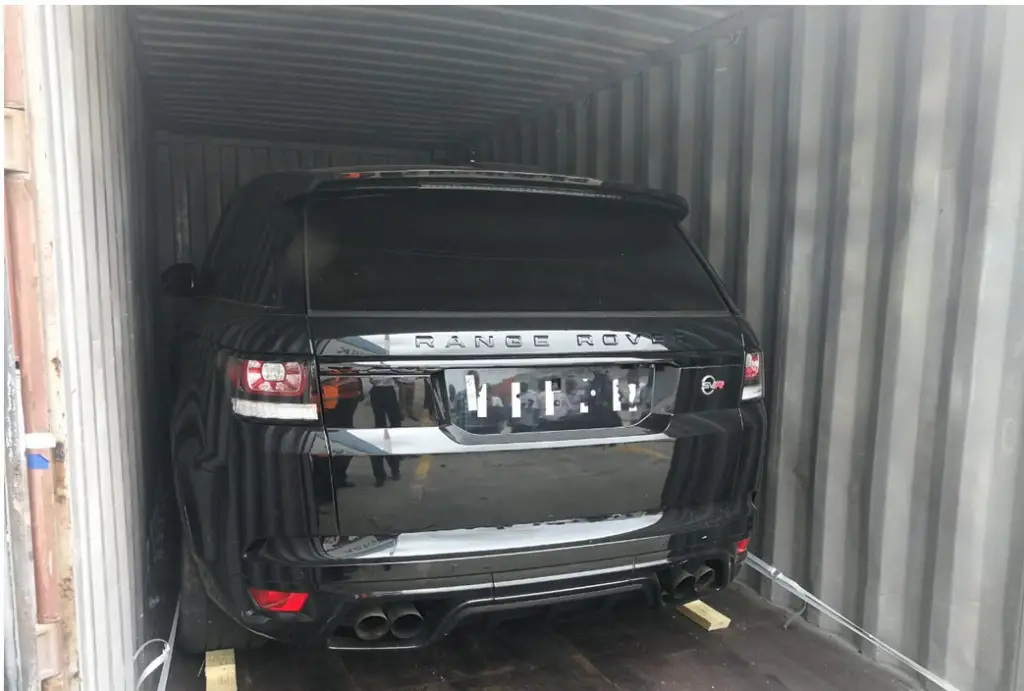

Kenyan authorities have unearthed an international car smuggling racket targeting the East Africa region, one in many that have been busted in recent times.

On May 9, 2019, Customs officers in Mombasa received intelligence to the effect that two 20-foot containers on board a ship sailing to the Port of Mombasa was suspected to be stolen motor vehicles from the United Kingdom.

The containers arrived at the Port of Mombasa on May 11, 2019 aboard MV. MSC Positano from Oman and had not been declared.

Authorities subjected the two containers to x-ray cargo scanning where the images revealed the presence of top of the range motor vehicles.

According to import documents, the Range Rover Sport cars, which were subject of an international motor vehicle crime and smuggling investigation, were on transit to Uganda.

“a multi-agency team led by Customs officials undertook a verification exercise on May 28, 2019 confirming the …