- Africa’s agritech potential crucial for economic growth

- EAC set for fastest economic growth as Sub-Saharan Africa recovers in 2024

- DRC Joins Organisation of Southern Cooperation to Boost Bilateral Ties With Member States

- The takedown of Chinese-backed cybercrime ring in Zambia

- New threat in 2024: Red Sea shipping disruptions by Houthi rebels ripple through global trade

- High Demand for Short-Term Rentals in Nairobi as Hospitality Sector Evolves Post Covid-19

- Blue Economy Investments to Earn Kenya $921m Annually In Revenue Boost

- Africa’s Economic Performance 2024: Lasting Optimism?

Browsing: East Africa

The Kenya Association of Manufacturers (KAM) has partnered with e-commerce players in Kenya to boost access of manufacturing SMEs to local and international markets through e-commerce.

This is in the wake of low uptake of e-commerce in Kenya despite its immense benefits.

The partnership, therefore, seeks to promote the uptake of e-commerce by SMEs to enable them to gain access to global markets and new international customers and reinventing their business models to align with changing technologies.

Speaking at the inaugural event, KAM Board Member and SME Hub Chair, Ms Ciiru Waithaka noted that the increased attention on SME growth, both at a national and global scale, points to a reckoning that the future of business hinges on their success.

“The unique and dynamic nature of SMEs in the manufacturing sector calls for an adaptive approach in developing policies and interventions that most importantly centres their needs and proposed solutions …

Kenya is bidding to host the 24th edition of the United Nations World Tourism Organization (UNWTO) General Assembly in 2021; when the congregation of the UNWTO members meets for its bi-annual, 23rd session this week in St Petersburg, Russia.

Through the Ministry of Tourism and Wildlife, Kenya will be looking at leveraging its vast past experience in hosting top global events to make a case for the event to be hosted here in 2021.

The move is in line with the ministry’s long-term strategy to diversify the tourism product to attract more tourists into the country and consequently enhance the revenue stream.

READ:Kenya’s tourism on the rise as numbers hit all-time high

On average, over 1,000 delegates from over 130 member countries of the UNWTO, attend the five-day bi-annual meeting, translating into millions of dollars in foreign revenue for host countries over the duration of the stay.

READ ALSO:

…KCB Group is seeking to deepen its new women proposition, committing billions of shillings towards funding women owned and women run enterprises.

According to the bank, the drive is meant to strengthen its diversity and inclusivity focus as part of its sustainability agenda by simplifying financial inclusion for women.

The programme dubbed ‘Women Value Proposition’ has seen the bank disburse loans worth Ksh7.1 billion (US$68.9 million) to 1,400 women to date, KCB said in its current Sustainability Report.

It is aimed at increasing credit facilities to women alongside, providing them with technical and non- financial support.

READ ALSO:KCB commits Ksh10 million for Afro-Asia Fintech Summit

The initiative is in line with KCB Sustainability 10-point action plan on diversity and inclusion. This pillar aims to incorporate gender diversity as part of its strategic initiative to ensure that we encourage more women to take up key roles in business ventures.

“KCB …

Kenya’s banking industry has witnessed a myriad of changes in the last four years as lenders adjust to remain profitable since the capping of interest rates.

Mergers and acquisitions have become a norm in the country as the rate cap law, which came into place in September 2016, continues to weigh on banks’ earnings and loan growth.

READ:Why banks in Kenya will lend at a maximum 13%

The latest is the KCB Group PLC (KCB) take-over of National Bank of Kenya (NBK), which now sets the stage for the integration of the second tier lender into KCB.

In an announcement approved by the Capital Markets Authority (CMA) and published on Friday September 6, 2019, KCB confirmed that it had received consent to acquire NBK from shareholders holding 297,130,033 issued ordinary shares out of 338,781,200 issued ordinary shares, representing 87.7 per cent by the offer closure date on August 30, …

Regional financial services group—I&M Holdings (plc) has announced a 17 per cent after tax profit growth for its 2019 half year financial results bouyed by a strong non-interest income.

The lender’s net profit for the year to June 30 closed at Ksh4.5 billion compared to Ksh3.9 billion recorded in a corresponding period last year.

READ ALSO:I&M quarter three profit jumps 20.4% on higher income

Durng the period, the Group’s loan book expanded six per cent to close at Ksh172.1 billion up from Ksh162.8 billion for the similar period last year.

On the other hand, customer deposits recorded a 12 per cent growth from Ksh210.9 billion in June 2018 to close at Ksh237.2 billion as at June 2019.

On account of increased allowances for loan losses, the net Non-Performing Assets (NPAs) recorded a decline of 28 per cent to Kshs 9.2billion.

Total assets recorded an impressive growth to …

Kenya Airways has reported its half-year performance for the half-year to June 30 amid losses at the national carrier.

KQ, as it is known by its international code, posted a Ksh8.563 billion loss for the period, a slip from Ksh4.035 billion in a similar period.

READ:Kenya airways in trouble as loss deepen to US$74 million

This came as total operating costs jumped 15.5 per cent to Ksh61.5 billion from Ksh53.2 billion, a move that eroded gains made in total income which increased to Ksh58.6 billion during the period.

This was up from Ksh52.2 billion income realised in a corresponding period last year.

“Some of these losses can be attributed to the return in to KQ service of two Boeing 787’s that were on sub-lease to Oman Air, investment in new routes and adoption of the new International Financial Reporting Standard (IFRS 16),” KQ chairman Michael Joseph told investors …

Hong Kong is targeting investment and trade deals in Kenya in renewed effort to deepen its relations with the East Africa’s economic power house.

The Hong Kong Trade Development Council (HKTDC) this week led a delegation to Nairobi and Mombasa, eying investments in the Kenyan market.

It is keen to tap on investments under the government Public Private Partnership (PPP) initiatives, in a close collaboration with the Kenya National Chamber of Commerce and Industry (KNCCI).

The delegation which included ten leading companies held talks with the Kenyan business community and government in Nairobi and Mombasa, with KNCCI playing host during the six days visit that commenced on Monday.

Hong Kong companies are eying investments in Export Processing Zones (EPZ), export market, Special Economic Zones, logistics, real estate and trade.

READ ALSO:What Kenyatta secured at China Belt and Road Summit

Speaking during a Nairobi forum, KNCCI President Richard Ngatia encouraged …

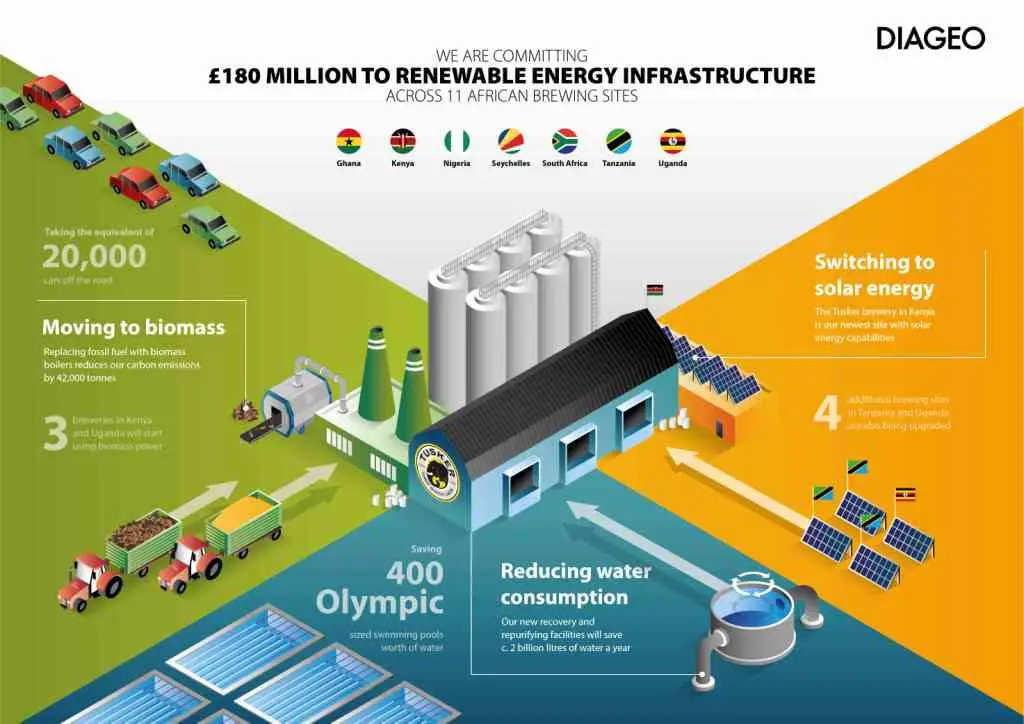

Diageo has committed to invest £180 million (US$217million) in renewable energy resources across its African sites, the British multinational alcoholic beverages company has announced.

According to the world’s second largest distiller, the move is to ensure its breweries are the most carbon and water efficient.

This commitment represents Diageo’s largest environmental investment in a decade confirming its commitment to reducing its carbon footprint and addressing climate change.

READ ALSO:How KBL’s water savings are quenching communities’ thirst

The investment will touch 11 of Diageo’s African brewing sites where it will deliver new solar energy, biomass power and water recovery initiatives.

It is also targeting to bring new infrastructure designed to improve the long-term sustainability of Diageo’s African supply chain in seven countries.

“We believe this is one of the biggest single investments in addressing climate change issues across multiple sub Saharan markets. It demonstrates the strength of our commitment to …

Tanzania suffers from an extreme shortage of electricity access standing at 32.8 per cent of its 57 million people.…

In her quest to pursue more renewable energy, Kenya has injected an additional 79 megawatts of geothermal power to the national grid.

This follows the completion of Unit 1 of Olkaria V Geothermal Power Plant by the Kenya Electricity Generating Company (KenGen) PLC.

The Unit was first synchronized to the grid on the June 28 and thereafter subjected to commissioning tests. It was then taken through a series of load tests until it attained its full design output of 82.7MW.

Commenting on the milestone, KenGen Managing Director & CEO, Mrs. Rebecca Miano, said the additional capacity would play a significant role in supporting Kenya’s power needs while enhancing the amount of green energy in the national grid.

“We are delighted to announce the completion of the first unit of Olkaria V Geothermal Power Plant and subsequently injecting 79 MW to the national grid. This brings to 612MW the total amount …