- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Eric Osiakwan

The first quarter of 2021 ended on a great note as two African fintech businesses gained unicorn status, a rare fit amidst a ragging global pandemic that is finally being aggressively tackled by the speedy supply of much-needed vaccines. Such is the African story – a trail of surprises in the midst of uncertainty. On 18th March 2021, Airtel Africa announced it had received a $200M investment from TPG’s Rise Fund at a valuation of $2.65B making it the latest African unicorn[1]. Exactly a week before, March 10th, 2021, Flutterwave from Nigeria also announced a $170M investment from Avenir Growth Capital, Tiger Global Management and others at a billion-dollar valuation[2]. In the tech world hitting a billion-dollar valuation is a big deal – you earn the name Unicorn, a mythical animal that represents the statistical rarity of successful ventures coined in 2013 by …

Three significant news items went on the global wire on 25th February 2021 as follows;

- Liquid Telecom, a member of the Econet Group that has laid more than 70,000km of fiber optic cable across Africa[1], raised $840M financing package (US$620M bond and a US$220M equivalent term loan in Rand). This was Liquid Telecom’s second bond issue and it was 5.5 times oversubscribed with JP Morgan Chase & Co, Standard Chartered Plc and Standard Bank Group Ltd as joint global bookrunners[2].

- Convergence Partners, a leading Pan African Private Equity fund[3] entered into an agreement with Nasdaq listed Inseego (INSG) to acquire 100% of their subsidiary Ctrack’s operations in Africa and the Middle East[4].

- Ecobank Nigeria, the largest country operations of Ecobank Transnational Incorporated (ETI), issued a London listed $300M bond that was 3 times oversubscribed[5] and drew significant international

In the last century, the fashionable and accepted route to success for young Africans was to complete their education and join the corporate world. A few university students aspired to become entrepreneurs; most educational institutions did not offer entrepreneurial programs. With few exceptions, African families used to guide their children to join a leading multi-national or work for a state institution, hoping they would climb the corporate ladder to become CEOs or at least senior management. That was prestigious until the paradigm shifted to tech entrepreneurship with the emergence of the computer, mobile and Internet industry in the latter part of the 20th century. Whilst a lot of African families have built successful entrepreneurial ventures in the past, this essay emphasis the growing move of corporates to tech entrepreneurship.

The likes of Dr. Nii Narku Quaynor who started Network Computer Systems (NCS) in 1988 and played a key role …

The last decade (2010-2020) was an important experiment in African tech ventures moving out of the “labs” and becoming real businesses that saw investors backing them with so much capital that from 2014 to 2019, the total number of VC deals doubled every year until the advent of COVID-19, which disrupted global economic activities in 2020.[1] However, 2020 saw some notable exits including World Remit’s acquisition of Sendwave for $500M[2], Network International buying DPO for $288M[3] and Stripe taking over Paystack for $200M[4] to enter the African market as Egypt’s Fawry gain unicorn status.[5] The IPO of Fawry the third Africa tech venture reach market capitalization of over $1 billion to after Jumia[6] and Interswitch[7] was overs subscribed 30 times. 2020 ended with another notable exit, with two initial shareholders in Ghanaian fintech startup, Zeepay, exiting from an initial investment of about …

On the 5th of November 2020, the 8th Angel Fair Africa will be virtual instead of in Dakar, Senegal due to the global pandemic[1]. $23M of deals have happened over the last seven events which brought selected entrepreneurs to pitch to a room of angel investors whose primary intent was to DO DEALS[2]. In April last year, Connected Med who was in our 2016 cohort was bought by the pharmaceutical giant Merck – the first exit by any company that has participated in our event.[3] The events have also resulted in numerous joint ventures, trade, sales, mentorship, relationships and other deals that we not have even recorded.

In September 2013 when we launched the event in South Africa my friend Russell Southwood, editor of Balancing Act Africa wrote the most amazing headline – “Angels Over Johannesburg – South Africa hosts the first …

Forty-three leading global investors from Africa, Europe, the US, and the Middle East have signed up to participate virtually in the 8th Angel Fair Africa on 5th November 2020.

The investors are from Angel Africa List (AAL), Africa Venture Capital and Private Equity Association (AVCA), America Capital Association (ACA), Women-In-Capital (WIC), Viktoria Business Angel Network, Brightmore Capital, amongst others. Anime Partners and MSM Property Fund are supporting the investor participation.

The ten selected ventures to pitch to these investors have gone through our one-month Africa Virtual Accelerator (AVA) @ https://www.africavirtualaccelerator.com/in.php. They are, ShopMeAway led by Racine Carr; Kalpay led by Ibrahima Kane; AgroInnova led by Amos Narh; Adi&Bolga led by Abimbola Oladeji; Kladika led by Muthoni Mwangi; Gift Pesa led by Pamela Muriuki; Ejoobi led by Simangele Mphahlele; Kweza led by Ropafadzo Musvaire, Afrijob Network led by Harriet Kariuki and Curacel led by Henry Mascot. Their participation …

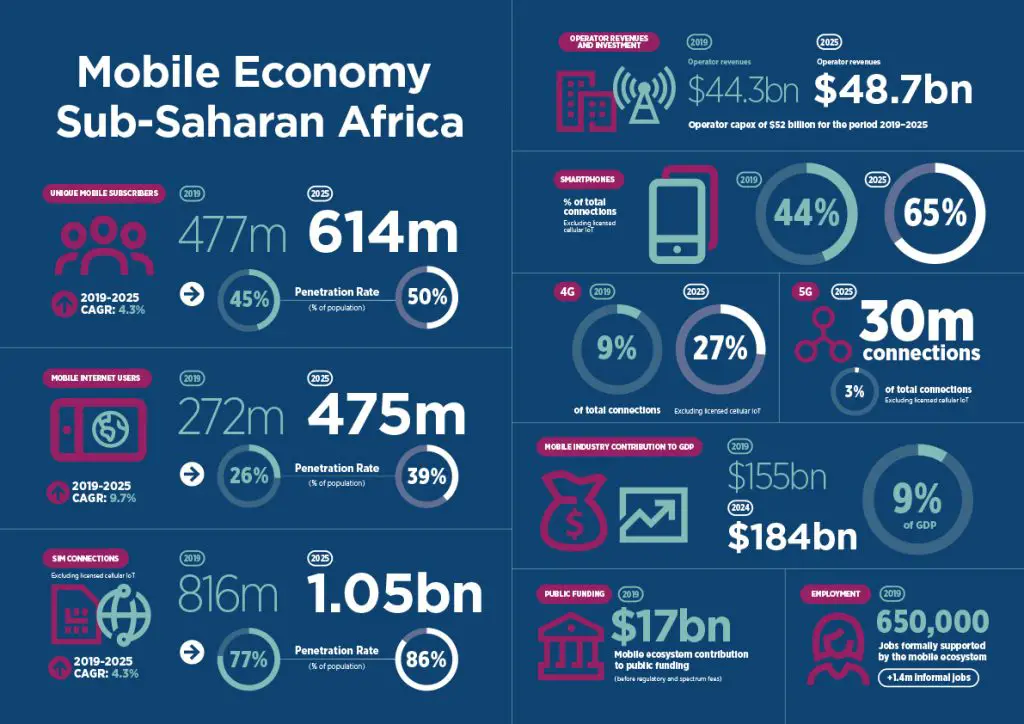

On the 1st of October 2020, the Global System Mobile Association (GSMA) released their “Mobile Economy Sub-Saharan Africa” report which forecasted the mobile economy in Africa into 2025.[1] A positive outlook to start the month of October and the last quarter of 2020.

The highlight of this forecast is that by 2025, even with 1.05 billion sim connections and 614 million unique mobile subscribers and smartphone adoption reaching 65% of the total population, only 39% of Africans would be experiencing their mobile web on those smartphones. This seems to suggest that even though there would be exponential smartphone growth over the period the cost of connectivity may be a showstopper. That’s not necessarily the case because there’s more happening than meets the eye.

The Mobile Network Operators (MNOs) are going to spend collectively about $52 billion on infrastructure between now and 2025 and this would grow their revenues …

The 8th Angel Fair Africa (AFA) will be held on 5th November 2020 in which the selected Africa tech ventures will pitch before a room of female and male investors.

The event gives entrepreneurs a chance to pitch their ideas to a host of investors from various sectors of the economy. This year’s AFA will be held virtually and it is only rightly so since the event is themed “The bold new normal in the new normal” doing deals in a virtual environment.

Having already amassed and distributed capital in the excess of USD 23 million in just 7 years since its inception in 2013, Angel Fair Africa has quickly gained popularity. The shortlisted finalists have been selected from various leading partners such as Google, Impact Hub Dakar, CTIC Dakar, MEST Africa, StartupBootcamp Africa, Viable, Adei Institute and iHub.

https://theexchange.africa/industry-and-trade/telcos/mastercard-vodacom-ink-a-cashless-system-deal/

With emphasis on gender balance in its representation of …

On the 10th of July 2020, Helios Holdings Limited announced a merger with Fairfax Africa Holdings Corporation to form Helios Fairfax Partners Corporation – a pan Africa focused alternative investment manager.[1] On the same day, Eversend, an African fintech startup also announced over a $1M raise through crowdfunding.[2] Prior to that Helios announced a $100M investment from the Commonwealth Development Corporation (CDC) into their fund IV.[3] On the 1st of July 2020, our portfolio company, www.hotelonline.co announced the acquisition of two travel tech companies.[4] On 30th June 2020, www.msfafrica.com announced the acquisition of fellow fintech Beyonic based in Tanzania.[5] On 23rd June, 2020 www.acumen.org announced their exit from KopaGas of Tanzania as part of the $25M acquisition by Circle Gas.[6] Then on 22nd January 2020, www.mypaga.com announced the acquisition of Apposit an Ethiopian software company as the entry strategy …

President Obama’s chief of staff, Rahm Emanuel once said “you never want a serious crisis to go to waste. It provides the opportunity to do things that were not possible to do before”.[1] When the COVID-19 crisis hit the global north the fear was that it would be most devastating in Africa with Bill Gates predicting that ten million lives would be wiped out by the virus.[2] But he was wrong because African leaders did what was not possible before – they locked down their countries and instituted adherence to the protocols of social distancing and washing of hands. These preventive measures and the sudden change of behavior slowed down the virus’s serious impact in Africa. According to Harvard Health preventing the spread of the virus is rooted in behavioral change.[3] Starting up new behavior in the new normal was what the US and Europe could not …