- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Foreign Direct Investment

- Tanzania Investment Centre (TIC) targets to register 1,000 investment projects in 2024

- The government of Tanzania is also revising the immigration law to draw diaspora investors.

Tanzania Investment Centre (TIC)

From changing harsh taxing practices to revising the foreign direct investment environment – the Tanzania Investment Centre (TIC) is significantly making notable efforts to make the East African nation investor-friendly.

On Tuesday, July 16, TIC displayed its ambitious goal of attracting nearly $10 billion in capital investments in 2024.

The new target comes seven months later after the government of Tanzania introduced a new campaign to increase investment to around $14 billion attributed by locals.

Tanzania’s investment trajectory took an uplift witnessing 504 projects worth $5.2 billion in 2023 an increase from $3 billion previously.

According to TIC executive director, Gilead Teri, the ambition eyes building impressive growth in foreign and domestic investments for five consecutive years, factored by favourable …

- Economic experts have a bearish forecast on the US dollar, citing that it is likely to “consistently weaken” throughout 2024 as the US Federal Reserve winds up its aggressive stance.

- The prediction comes despite the ongoing big dollar sell off where asset managers are selling the currency at the fastest pace in a year.

- This is positive news for emerging and frontier markets, as they can start to see global funds and investors redirect capital back to these markets which have been starved of inflows for months.

Economic experts are making a bearish forecast against the US dollar, predicting that it is likely to “consistently weaken” throughout 2024 as the US Federal Reserve concludes its aggressive interest rate hiking agenda.

Nigel Green, CEO of the DeVere Group, states that this prediction persists despite the ongoing significant dollar sell-off, where asset managers are selling the currency at the fastest …

- Kenya seeks to attract $10 billion in Foreign Direct Investments (FDI) in the next four years despite dwindling inflows over the past years.

- The Kenya Investment Authority has partnered with UNDP and the World Bank to develop and implement an Investment Facilitation Framework and FDI Attraction Strategy.

- The framework is aimed at creating a transparent, predictable, efficient and trusted mechanism for effective investment facilitation.

Kenya aims to attract $10 billion in Foreign Direct Investments (FDI) in the next four years despite experiencing declining investment inflows in recent years. The East African country, in collaboration with the Kenya Investment Authority, has partnered with the United Nations Development Programme (UNDP) and the World Bank to formulate and implement an Investment Facilitation Framework and FDI Attraction Strategy.

Rebecca Miano, the Cabinet Secretary (CS) for the Ministry of Investments, Trade, and Industry (MITI) in Kenya, stated that the framework seeks to establish a transparent, …

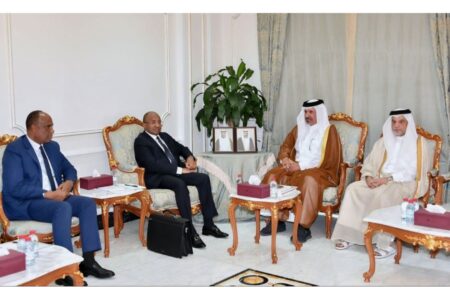

A recent meeting between the President of Zanzibar, Dr Hussein Ali Mwinyi and Qatar’s First Vice-Chairman, Mohamed bin Twar Al Kuwari highlighted these figures. The two high-ranking officials met in Qatar. The Zanzibar president called on investors from the rich United Arab Emirates to invest in the island.…

Should a common currency in the EAC come to fruition, the trade will be fueled by a reduction, albeit limited, in transaction costs, the elimination of exchange rate risk and region-wide price harmonisation – all of which will undoubtedly be underpinned by policy incentives.

- Monetary Union is the third stage towards EAC regional integration, capped through Political Federation.

- Considering individual economies are relatively small, currency harmonisation might play a significant role in improving intra-African trade.

- The IMF, through its chief Christine Lagarde, previously warned the EAC not to rush into a currency union, pointing to the issues faced in Europe.

Interest in regional integration, including monetary, in Africa has remained intense over the decades since independence. Consequently, various regional groupings have been formed. Those initiatives were stimulated by the generally small size of individual economies. This led to a desire to promote economies of scale in production and distribution. A …

Southern Africa, East and West Africa saw their flows of FDI rise in 2021. It was only in Central and North Africa that flows of foreign direct investment were flat or declined, respectively. Flows to North Africa fell by 5 per cent to $9.3 billion.

Egypt saw its FDI drop by 12% as large investments in exploration and production agreements in extractive industries were not repeated. Despite the decline, Egypt has the second highest flows of FDI in 2021 on the continent.

UNCTAD reports that it expects FDI flows to increase in North Africa owing to pledges of as much as US$ 22 billion to the region from Gulf states. In Egypt, according to the UNCTAD World Investment Report 2022 tripled green field projects of US$ 5.6 billion and real estate projects of US$ 1.5 billion.

In Morocco, FDI flows increased by 52% to US$ 2.2 billion. This was driven …

It is critical to strengthen a professional, independent supervision secretariat to make the AfCFTA agreement’s promise a reality. A strong secretariat can assist states in developing strong domestic institutions to administer, monitor, and enforce the AfCFTA. The moment for change has arrived. The conventional development models have failed Africa. The AfCFTA, on the other hand, signifies that Africa is open for business.…

AfCFTA will be a game changer for Africa, but its success depends on certain enablers being present. The first and most obvious impediment and an obstacle to the initiative will be mustering the political will of the signatories to implement the necessary reforms to enable its success. This may not always be politically feasible or possible.

The less obvious enablers and the financial institutions on the African continent. Their presence and activities have a direct and strong bearing on the success of AfCFTA. One of the foremost bankers on the African continent, Sim Tshabalala, the chief executive of the continent’s largest banking institution by assets, is fond of saying that banking is a derived business. This means that banks butter their bread from the activities of economic agents.

If AfCFTA is to succeed in its quest to merge the various comparative advantages of the countries that constitute Africa it will …

Interestingly, of the US$1.5 trillion in foreign direct investment recorded in 2021, 53% of that money was channelled towards developing economies. Africa made a very strong showing in terms of foreign direct investment in 2021.

According to the report, Africa attracted US$ 83 billion in foreign direct investment compared to the US$ 39 billion it achieved in 2020. Of the global investment flows that landed on African shores in 2021 US$ 41 billion went directly to South Africa.

Despite the positive developments that occurred in 2021 in foreign direct investment, the UNCTAD report concludes by stating that the growth and momentum in FDI flows in 2021 will not be sustainable given the adverse economic developments that have occurred in 2022.

UNCTAD expects these developments will either put downward pressure on the flow of FDI or flatten the curve.…

The movement of exchange rates on the parallel market has been caused by the government itself. Firstly, the government introduced a currency that economic agents have no confidence in because it did not have the macroeconomic fundamentals to give it credence. There was no parallel market for foreign currency during the years that the country made use of a basket of currencies.

The parallel market only emerged when the government introduced a surrogate currency called the bond note which was said to be at par with the United States dollar. No sooner than the surrogate currency had been introduced that the parallel market emerged, and United States dollars started trading at a premium.

Secondly, the government reportedly purchases foreign exchange on the parallel market. Through the central bank, the government issues new currency and then purchases foreign currency on the parallel market and drives up the exchange rate. It has …