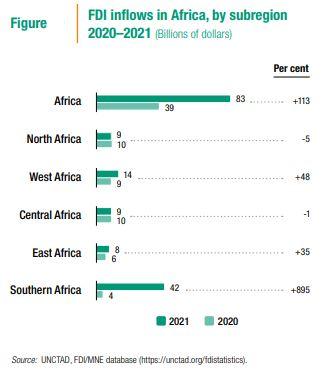

Africa scored a record US$ 83 billion of foreign direct investment flows in 2021, according to the annual World Investment Report published by the United Nations Conference for Trade and Development (UNCTAD).

In 2020 the same publication reported that the continent attracted US$ 39 billion in FDI, which it says was 5.2% of global foreign direct investment. Most countries in 2020 recorded marginal flows of foreign direct investments owing to the COVID pandemic.

- Africa had a very impressive showing of foreign direct investment in 2021, according to UNCTAD.

- UNCTAD’s World Investment Report 2022 shows that southern Africa had a superlative increase in FDI flows of well over 800%.

- FDI in Africa was driven by merger and acquisition activity led predominantly by South Africa.

The publication adds that the foreign direct investment figure for the continent was inflated by what it called “…a single intrafirm transaction… in the second half of 2021”. This is a reference to a share swap agreement between South African multinational Naspers and its Dutch-listed investment unit Prosus.

This transaction was for US$ 46.1 billion. International law firm White & Case reports that, “South Africa continued to be the most active country for dealmaking, in terms of both value and volume.

A total of 41 deals in South Africa worth US$46.56 billion were announced during the first half of the year (2021)—already higher than any annual value total on Mergermarket record (since 2006).”

The case of South Africa, which was the leader in terms of foreign direct investment on the continent, highlights the importance of corporate activity and mergers and acquisitions. In February 2022, boutique investment bank RMB published an article on its website to the effect that foreign investor interest in undervalued SA businesses could drive local corporates to accelerate investment and M&A. The investment bank said South African companies are trading at attractive valuations compared to developed markets. This, the bank believes, is the reason why several large South African companies have been acquired by foreign investors. South African companies are compelling investment cases; however, in several instances, many have share prices that have stagnated or traded at significant discounts to their intrinsic value.

China sneezes, will Africa catch a cold?

RMB noted that most of the merger and acquisition transactions that took place in 2021 had premiums ranging on average, between 45% to 50%. This, the bank says, shows how attractive the valuations had become. In 2021 430 transactions occurred that can be classified as mergers and acquisitions. Of these transactions, 70 were valued at around ZAR 750 billion or US$ 47 billion.

Added to this, the number of foreign participants in M&A transactions increased by 10% in 2021 compared to 2020. The most notable of these transactions are Heineken’s offer to purchase Distell, which made it an alcoholic beverages and spirits leader in Africa. The Ardagh Group, which is an international metal and glass packaging company, offered to purchase South African glass manufacturer Consol Holdings. On the JSE logistics company, Imperial was purchased by Dubai-based DP World. These are some of the notable transactions that moved the dial in terms of foreign direct investment and significantly improved the metric for the continent. There were also transactions pending from 2020, which were subsequently finalized in 2021. The most prominent of these transactions was the delisting of Afrox Limited by Linde PLC and PepsiCo’s acquisition of Pioneer Foods.

- Other drivers of FDI flows in Africa were increases in project finance deals for renewable energy projects and general investments in oil and gas.

- Project finance flows swelled FDI flows, and they came from multilateral institutions and capital market players.

- Nearly all regions of the continent experienced increases in FDI except for North and Central Africa

RMB expects that this trend of foreign direct investment in South African companies will continue in 2022. This is because South African companies are still undervalued relative to their global peers. These companies, investors should note, have great upside potential in terms of the quality of their business and future earnings. Valuations of South African companies will look even more attractive as investor confidence increases.

According to RMB, South African companies are sitting on strong balance sheets, which they will need to deploy into the economy in terms of pursuing growth opportunities. South Africa had a stellar year in terms of the flow of foreign direct investment driven by mergers and acquisitions. The inclusion of the US$ 46 billion transaction which took place in South Africa distorts the FDI statistic for the rest of the continent. When the flows to South Africa are excluded from the overall flows to the rest of the continent, UNCTAD notes that FDI on the continent looks the same as the rest of the world.

Investment in Africa is risky but rewarding

Southern Africa, East and West Africa saw their flows of FDI rise in 2021. It was only in Central, and North Africa that flows of foreign direct investment were flat or declined, respectively. Flows to North Africa fell by 5 per cent to $9.3 billion.

Egypt saw its FDI drop by 12% as large investments in exploration and production agreements in extractive industries were not repeated. Despite the decline, Egypt has the second highest flow of FDI in 2021 on the continent.

UNCTAD reports that it expects FDI flows to increase in North Africa owing to pledges of as much as US$ 22 billion to the region from Gulf states. In Egypt, according to the UNCTAD World Investment Report, 2022 tripled green field projects of US$ 5.6 billion and real estate projects of US$ 1.5 billion.

In Morocco, FDI flows increased by 52% to US$ 2.2 billion. This was driven by a large international project finance deal announced in that country to finance the construction of a power line.

Oil and gas drove the increase in FDI flows to West Africa. Nigeria doubled its FDI to US$ 4.8 billion. The country also benefitted from an increase to US$ 7 billion in project finance deals to fund notable real estate projects like the Escravos Seaport project. Ghana saw its FDI flows increase by 39% from its mining industry. Global gold miner Newmont Corporation is building a US$ 850 million mining facility in the country.

- China played a significant role in increasing the flow of FDI to African shores by sponsoring projects on the continent.

- Other principal sponsors of FDI projects on the continent are the United Kingdom and France

East Africa grew its FDI flows by 35%. Ethiopia was the leader in 2021. The country enjoyed increases of up to US$ 4.3 billion from Chinese investments. This UNCTAD attributes to the country’s strategic position in China’s Belt and Road Initiative. Uganda experienced increases in FDI by 31% and Tanzania 35%. Central Africa as a region experienced flat FDI flows at US$ 9.4 billion. The Democratic Republic of the Congo had buoyant FDI flows on account of its mineral resources, namely oil and gas and mining. Its FDI flows increased by 14%

Despite this very impressive and pleasing showing, UNCTAD notes that the total greenfield announcements remained depressed, at $39 billion, showing only a modest recovery from the low of $32 billion in 2020 (down from $77 billion in 2019).

Conversely, power and renewables were behind the continent’s increase in project finance deals. These transactions increased in number by 26% to 116. Multilateral finance institutions and capital market investors were the providers of project finance on the continent in 2021. The largest project was the announcement in Mauritania of a power-to-x hydrogen project for $40 billion by CWP Renewables (Australia).

The UNCTAD reports concluded by stating that European investors remain by far the largest holders of foreign assets in Africa, led by the United Kingdom ($65 billion) and France ($60 billion).