- How transition finance can catalyse Africa’s green industrial revolution

- Stanbic PMI Report: Mixed performance as Kenya’s agriculture, construction offset manufacturing decline

- Uganda’s land management gets a tech makeover to boost transparency

- Nigeria’s output dips fastest in 19 months on a sharp rise in costs

- Apple faces growing backlash over Congo exploitation

- Why East Africa is staring at higher wheat prices in 2025

- Nairobi Gate SEZ pumps $7 million into Kenya’s agro-processing industry

- What impact will the US election have on Africa?

Browsing: KCB GRoup

- Kenya Commercial Bank (KCB) Group has committed to building on the successes of Joshua Oigara who has left the group after nine and a half years

- The group’s Chairperson Andrew Kairu Oigara for his service to the Group since joining in 2011 and said he had led the Group through its fastest growth in a decade

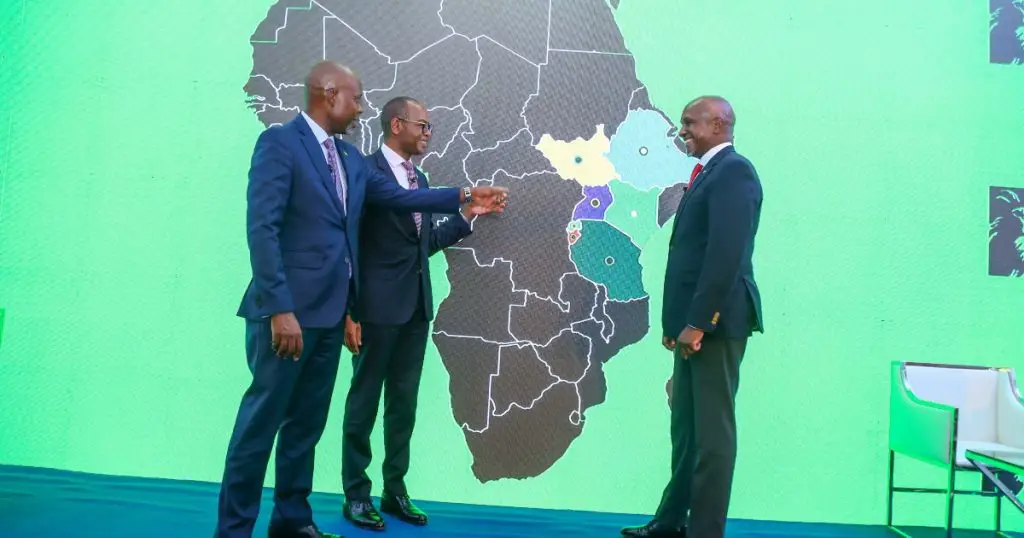

- The revealed that the group’s growth ambition is to become the undisputed regional lender

Kenya Commercial Bank (KCB) Group has said it is committed to becoming the undisputed regional lender amid the exit of its long-serving CEO Joshua Oigara.

The group’s chairperson Andrew Kairu commended Oigara for his service to the Group since joining in 2011 and said he had led the Group through its fastest growth in a decade.

“He has left a solid legacy for the Group across Africa and beyond that is dotted by the transformation of millions of lives, enhanced …

- Livestock farmers in Kenya’s arid and semi-arid lands (ASALs) will receive training and financing from KCB Foundation

- The partnership will train and equip farmers from ASALs with climate-smart agricultural practices to mitigate the dire impacts of climate change

- The two-year partnership will mobilise KSh 100 million in financing for the farmers through strategic partners to grow the funding to KSh 500 million

- Kenya is currently facing a drought that has left more than 2.5 million people on the brink of starvation and poverty. Pastoralists and farmers now have less and less time to recover

Livestock farmers in Kenya’s arid and semi-arid lands (ASALs) will receive training and financing from KCB Foundation following a partnership with the United States Agency for International Development’s Kenya Investment Mechanism.

The partnership will train and equip farmers from ASALs with climate-smart agricultural practices to mitigate the dire impacts of climate change. The two-year partnership will …

- KCB Group Plc has recorded a historic 74 per cent rise in profit after tax for the full year ending December 2021, to hit KSh 34.2 billion compared to KSh 19.6 billion a year earlier

- The bank attributed the performance to increased income, cost management and lower credit provisions which saw the Group post higher returns to shareholders

- Provisions for the period reduced by 52% to close at KSh 13.0 billion from KSh 27.2 billion a similar period in 2020

KCB Group Plc has recorded a historic 74 per cent rise in profit after tax for the full year ending December 2021, riding on an economic recovery across its key markets.

During the period under review, net profit grew to KSh 34.2 billion compared to KSh 19.6 billion a year earlier, on

the back of increased income, cost management and lower credit provisions which saw the Group post higher returns …

While others are still trying to wrap their heads around blockchains and the safety of cryptos, Africa is embracing this digital currency with both hands. So much that in Kenya, you can even buy your groceries and I mean vegetables with cryptocurrencies.

That’s right, and this is not only in urban centres like the bustling capital of Nairobi, no, no, no, but it is also in the villages, upcountry. Peasants on the Coastal towns are trading in cryptos, buying and selling. Here we are not talking of mining cryptos only but rather using the digital currency for normal day to day trade, like Is said to buy supplies.

The way it works is, the cryptocurrency, a famous one in Kenya is coined Sarafu, which has now become an accepted medium of transfer such that one can use Sarafu to trade for goods and services.

Sarafu and others like it are …

Commercial banks in Kenya have been on the limelight with accusations of abetting money laundering and being involved in national corruption scandals. Such was the case several banks which in 2018, CBK accused them of participating in payments for the National Youth Services (NYS) scandal.,

In this case, the director of public prosecution announced that he was considering prosecuting 20 senior officials in five banks, which they believe aided the laundering of at least Ksh1 billion ($10 million) looted from the National Youth Service (NYS) between January 2016 and April 2018.

These commercial banks have however developed mechanisms to conform to anti-money laundering laws developed in Kenya.

The law requires all financial institutions including banks, insurance companies, and SACCOs to file with the Financial Reporting Centre daily reports on transactions above Sh1 million and those deemed suspect. This is under the Proceeds of Crime and Anti-Money Laundering Act (POCAMLA).

Bank

KCB Group Plc profit after tax surged six per cent to Ksh19.2 billion ($186.1million) for the nine months ending September 2019, on the back of significant growth in the loan book and non-funded income.…

Borrowers in Kenya should now expect interest rates as high as 30 per cent following the repeal of the interest rate cap law.

Parliament failed to raise the required quorum to defend the rate cap law which came into place in September 2016.

There has been a push by bankers, mainly through their lobby group-Kenya Bankers Association (KBA) to have controls on rate cap revised.

READ:Kenyan Banks begin feeling the interest rates cap effects

The law which has been in place for the last four years has controlled lending rates by commercial banks at four percentage points above the Central Bank of Kenya (CBK) Rate.

CBK has retained its benchmark lending rate at 9.0 per cent for the sixth straight time since bringing it down in July 30 2018.

This means banks could not charge loan at rates above 13 per cent, a move that was aimed at sparing …

KCB Bank Kenya has signed a pact with Japan based giant lender Sumitomo Mitsui Banking Corporation (SMBC) to drive cross-border trade and deepen financial inclusion.

The agreement between the two largest banks in their respective regions, signed in Yokohama last week, will see the two lenders expand their financial offerings provided to clients in both East Africa and Japan, effectively enabling more cross border trade flows.

Under the deal, KCB will provide banking services—including banking accounts and cash management, trade finance, export credit agency finance and treasury related products— to customers introduced by SMBC to KCB.

“We believe that new business opportunities will arise from the rapid economic development in Kenya and therefore seek to areas of mutual partnership to support such development, utilizing the product capabilities and global and local network of both banks,” said Paul Russo, the KCB Group Director Regional Businesses during the signing ceremony on …

KCB Group is seeking to deepen its new women proposition, committing billions of shillings towards funding women owned and women run enterprises.

According to the bank, the drive is meant to strengthen its diversity and inclusivity focus as part of its sustainability agenda by simplifying financial inclusion for women.

The programme dubbed ‘Women Value Proposition’ has seen the bank disburse loans worth Ksh7.1 billion (US$68.9 million) to 1,400 women to date, KCB said in its current Sustainability Report.

It is aimed at increasing credit facilities to women alongside, providing them with technical and non- financial support.

READ ALSO:KCB commits Ksh10 million for Afro-Asia Fintech Summit

The initiative is in line with KCB Sustainability 10-point action plan on diversity and inclusion. This pillar aims to incorporate gender diversity as part of its strategic initiative to ensure that we encourage more women to take up key roles in business ventures.

“KCB …

Nairobi Security Exchange’s top share index-NSE 20 shed some 43.09 points or 1.67 per cent to stand at 2543.59 on Friday, even as volumes rose from the previous trading.

The index that tracks blue chip companies at the bourse has been on a downward streak in recent weeks, affecting other indices, amid a continued decline in large cap stocks.

READ ALSO:NSE dips as 2018 ends on a bear market territory

During the last day of the week trading, All Share Index (NASI) shed 0.28 points to stand at 148.05. The NSE 25 Share index ended 9.25 points lower to settle at 3572.56, market data shows.

Market turnover for Friday however stood at Ksh332 million (US$3.2 million) from the previous session’s Ksh179 million (US$1.7 million) as the number of shares traded rose to 12.5 million against 9.9 million posted the previous day.

Week on week turnover however retreated to Ksh1.16 …