- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Kenya

Masisi’s visit to Kenya has an agenda to have the East African nation reconsider its stance on “the utilisation of natural resources”.…

Stanbic Bank Kenya and Industrial Commercial Bank of China (ICBC) have partnered with Chinese Trade Agent Zhejiang International Trading Supply Chain Co. Ltd (Guomao) to launch the Africa China Agent Proposition (ACAP) initiative. (https://navalpost.com/)

The initiative which has been launched in different parts of Africa aims to assist African importers source and validate quality goods, safely and efficiently, from the most competitive suppliers in China.

The ACAP offering is expected to revolutionize African importers’ view of China’s supplier universe. It will also ease the cash flow of African importers by providing access to financing while empowering importers with sight and control of the entire importing and logistics process.

It was initially launched in Nigeria and Ghana in May 2019 with roll out to South Africa and Kenya following.

Currently African importers order from only a handful of trusted Chinese suppliers. This limits the negotiating power of African importers …

A first-of-its-kind study has found that worldwide illegal streaming of the English Premier League (EPL) delivers £1M in uncaptured sponsorship media value per match.

The study –– produced by sponsorship valuation firm GumGum Sports in partnership with digital piracy authority MUSO at the behest of an unnamed elite EPL club –– focused on eight matches spanning the 2018-19 season. On average, each match saw an audience of 7.1 million fans across as many as 149 countries.

The pirated audience was largest in China, where illegal streams served more than 1 million fans per match. After China, illegal streaming was most prolific in Vietnam, Kenya, India, and Nigeria.

The U.S. and the U.K. had the 10th and 11th largest piracy audiences streaming the match. The global study also broke down its £1M-per-match finding by an on-pitch sponsor, noting that, of the seven deal placements analyzed, the majority of value came from …

Local cement manufacturer Savannah Cement has confirmed plans to expand its market reach beyond Kenya to the neighboring regional countries.

The market reach expansion program at Savannah Cement will also involve a local market enhancement program to satisfy a growing demand for high-quality cement products as the government’s efforts to roll out affordable housing under the Big 4 agenda continues to gain steam

According to Savannah Cement Managing Director Ronald Ndegwa, as part of the market expansion plans, the firm, is currently undertaking a Kshs. 5 billion capacity grinding plant expansion program at its Kitengela manufacturing complex.

Speaking, at an event to mark Savannah Cement’s 7th anniversary, the expansion project, Ndegwa said, involves the construction of a 1,200,000 tons per year milling plant to double the firm’s current installed capacity.

The project which is currently underway, he said, is running on schedule with plans to commission the second grinding plant …

Kenya’s Strathmore University, in collaboration with SYSPRO, a global provider of industry-built Enterprise Resource Planning (ERP) software for manufacturers and distributors have released research findings of a production and manufacturing industry in Kenya .

The study explored productivity and competitiveness of the manufacturing sector in Kenya, from close to 100 companies drawn from 12 sectors on the role of new technologies in improving the sector and the state of adoption and use of these new technologies.

The study, titled “An Investigation into the Implementation of Technological Aids and ERP Solutions in the Manufacturing Industry in Kenya”, had Prof. Ismail Ateya, Dean of Research and Innovation, as the principal investigator and Prof. Reuben Marwanga as the co-investigator.

The findings were presented at a launch event attended by Betty Maina, the Principal Secretary, State Department of Investment and Industry in the Ministry of Industry, Trade and Cooperatives, and Dr. Vincent Ogutu, Vice …

Tanzania is consistently hindering East Africa’s integration by its aggravated actions in dealing with its neighbours…

Investors are keen on new developments at the Nairobi Securities Exchange (NSE) as the market opens its counters for derivatives trading.

The NSE Derivatives Market (NEXT) futures start trading today with the official launch of the market slated for Thursday, July 11, 2019.

“NEXT provides new opportunities to investors, enabling them to better diversify their portfolios, manage risk, and deploy capital more efficiently,” NSE Chief Executive Geoffrey Odundo said.

Futures contracts provide investors with risk management tools in the wake of unexpected volatility in asset prices.

READ:NSE gets green light for Derivatives Market

NEXT will also enable Kenya to consolidate its position as a leading financial services hub offering a wide variety of investments products.

The NEXT will commence with index futures and single stock futures on selected indices and stocks respectively, the bourse’s management said.

The Exchange will initially offer index futures contracts on the NSE25 Share Index …

The premier global event for coffee, tea and chocolate enthusiasts, the Coffee, Tea and Chocolate Festival (CTC Festival) is set to be held in Kenya this year.

Dubbed The Journey of Taste, the festival to be held in March 2019 in Nairobi, celebrates in one location the burgeoning of speciality coffees, ergonomic tea selection and chocolate lifecycle.

It is expected to bring more than 40,000 people together in one venue to explore private training, innovation labs, interactive workshops and live stage shows among many other activities.

World Barista Champions, producers

Kenya is the first African country to host this world-class festival.

“We are excited to be showcasing to local, regional and global players and visitors, the variety that is offered by Kenya, in terms of coffee and tea,” says Obed Mutua, General Manager of Four and One Worldwide Kenya.

He added, “Participants will get the chance to meet world Barista …

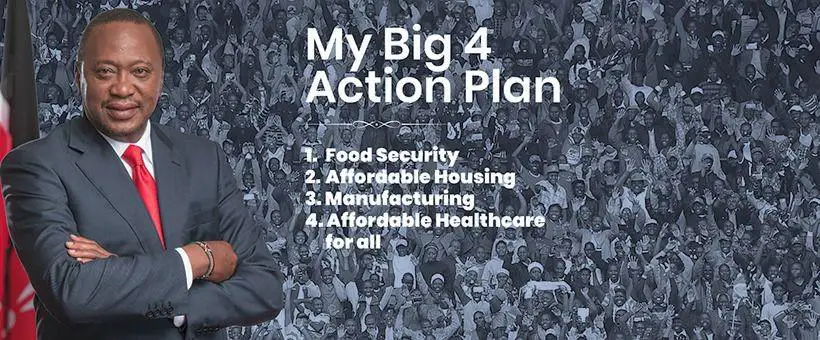

World Bank Vice President for Africa Hafez Ghanem has assured of the Bretton Woods institution’s support for Kenya’s Big 4 development blueprint which drives the government’s development agenda.

Ghanem has singled out the provision of affordable healthcare as an area that his organization is keen on collaborating with the government to ensure its success.

READ ALSO:Boost for Kenya’s Big 4 as World Bank extends US$250 million

“The World Bank is committed to supporting Kenya in advancing the Big 4 Agenda both in technical and financial cooperation,” Mr Ghanem said.

The World Bank VP was speaking when he paid a courtesy call on President Uhuru Kenyatta at State House, Nairobi.

President Kenyatta praised the collaboration between his administration and the World Bank, saying the partnership has seen implementation of projects that have impacted positively on the lives of Kenyans.

READ:World Bank gives Kenya US$750M loan, but why?

President Kenyatta …

Kenya’s insurance sector has been rocked with controversies among them failure to meet contract obligations, exposing policy holders to risks rather than being cushioned as expected of indemnity.

In the latest twist of events, it has emerged that over ten insurance companies in Kenya are not paying claims, despite collecting billions in monthly premiums from their clients.

This has left hundreds of thousands exposed to risk while affected persons suffer despite having insurance covers.

There are 37 general insurance companies and 25 long term insurance companies, placing the total number of underwriters at 62.

The country’s insurance market has also been infiltrated by banks, which are offering insurance services under the ‘Bancassurance’ umbrella.

READ:What’s next for the insurance industry in Kenya?

Billions in premiums

According to official data by the industry regulator-Insurance Regulatory Authority (IRA), insurance industry gross premium written stood at Ksh216.37 billion (US$2.12billion) as at end of …