- African Heads of State call for tripling of World Bank’s concessional financing

- SpaceX offers Starlink kit at half price for first-time Kenyan customers

- Mobile Banking Reshaping the Gender Gap in Financial Inclusion

- Unleashing ideas: AIM Congress sets the stage for over 450 dialogue sessions

- Abu Dhabi welcomes over 330 partners for AIM Congress 2024

- Kenyan Farmers Receive $2M Boost from Africa Fertiliser Financing Mechanism

- Brace for High Interest Rates for a Longer Period World Bank Warns Kenya

- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

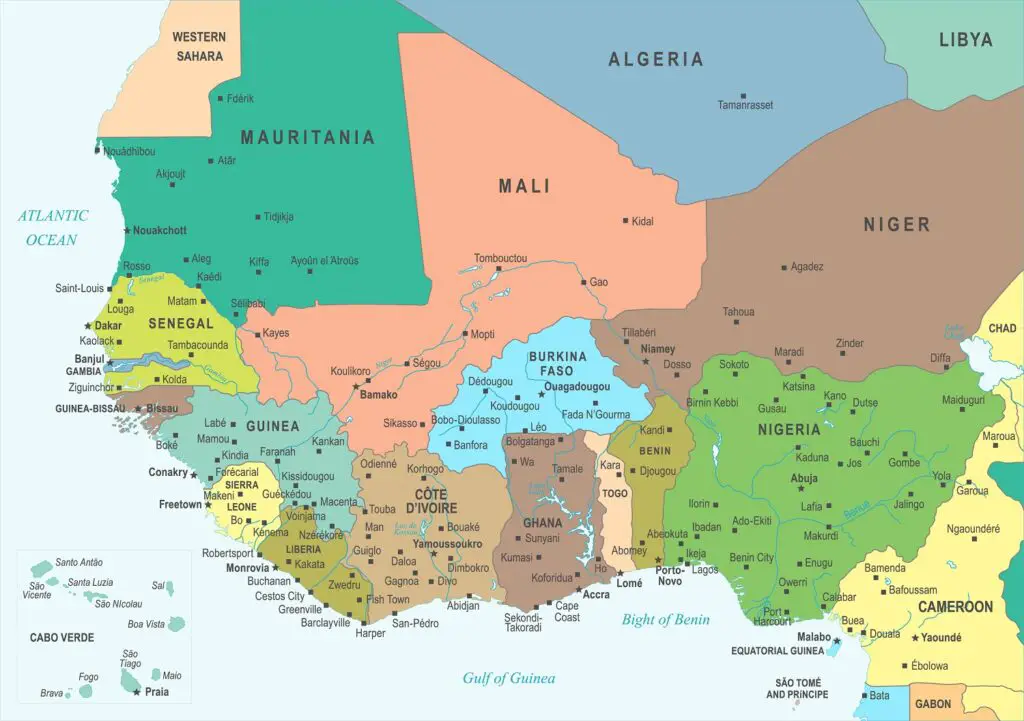

Browsing: Nigeria

Whether Nigeria and Ghana will abandon their digital currencies and jump on the Eco train is an unclear narrative, but it appears unlikely because of the significant investments put into them and the optimism by the governments to embrace digital transformations.

Nigeria had banned cryptocurrency transactions in February last year which increased the popularity of the eNaira as an alternative for cross-border trade and remittance inflows.

eNaira critics say that the solutions being offered by the digital currency are already existing in online banking and bank card transactions. …

The UN says that e-government holds an explosive potential to ensure public institutions deliver public services in an effective, accountable, efficient and transparent manner.

Africa is showing the greatest growth in developing e-government in service delivery. United Nations member states In Africa with a low e-government development index (EGDI) have since reduced from 26 in the year 2016 to seven last year.

However, there is no single country in Africa that has high EGDI values.…

“As per directive from Dubai Civil Aviation Authority (DCAA), all air transport services with inbound and transit passenger movements to the emirate of Dubai from any point in the Republic of Kenya are temporarily suspended for 48 hours effective from 20 December 2021 at 10.30hrs Local Time Dubai.”

Customers who are the most affected by this decision were told that they could not travel on Emirates flights while those from Dubai were unaffected.

“Customers will not be accepted for travel on Emirates flights at Nairobi during this time. Outbound passenger operations from Dubai to Nairobi remain unaffected.”…

- The Southern Africa region received the most significant share of Foreign Direct Investment in 2020

- Nigeria, South Africa and Angola attracted the highest amount of Foreign Direct Investment

- East Africa received the lowest amount on the back of policy challenges and rising political tensions in countries such as Ethiopia

Southern Africa regained its lead at the most significant Foreign Direct Investment (FDI) hub in 2020, on the back of diversified economies.

A report by The East African also reveals that Morocco and Egypt received a majority of investment in the Northern Africa region. At the same time, Nigeria, Ghana and Côte d’Ivoire dominated in the west.

According to the Africa Attractiveness Report 2021 by Ernst and Young, Angola took the largest share of Foreign Direct Investment in central Africa.

East Africa

The report reveals that East Africa received the lowest foreign direct investments (FDI) last year, on the back of …

- AEW 2022, in partnership with various international oil companies, national oil companies, and governments, is the AEC’s annual conference, exhibition, and networking event.

- AEW 2022 will build on the momentum of the 2021 conference, providing sessions whereby the discussion on Africa’s upstream, midstream, and downstream sectors will be provided.

- AEW 2022 is focused on positioning regulatory reforms at the center of Africa’s energy sector development.

After a successful end to this year’s Africa Energy Week 2021[AEW], the African Energy Chamber has announced the next year’s dates.

The 2022 Energy premier week will take place from the 31st of October to the 4th of November 2022 across multiple venues at the V&A Waterfront in Cape Town, The African Energy Chamber has announced.

The second edition is deemed to be a bigger Energy event in the Continent under the theme ‘Developing Africa’s Energy Future by Creating an Enabling Environment.’

This …

For the five years since 2002, Kenya registered its golden period in terms of economic growth. This was during President Mwai Kibaki’s first five-year term which ended in 2007. The Kenyan economy blossomed with the growth noticeable in both industry and tourism as well as in improved livelihoods.

At this time, the growth attracted the attention of the International Monetary Fund (IMF) and the World Bank because Kibaki’s government was not keen on funding from the Bretton Woods institutions. The government largely financed its budget from the revenues it collected which was unheard of in the previous regime. President Daniel Moi, Kibaki’s predecessor had deeply entrenched corruption in the country which wrecked the economy to almost collapse.

But today, the economy is worse than it was under Moi with the Jubilee government overseeing the worst job cuts, company closures and distressed livelihoods due to corruption. While the Covid-19 pandemic has …

- Through the passing of the Petroleum Industry Bill (PIB) on 1 July 2021, Nigeria has taken significant steps to boost oil and gas output.

- Projects such as the $2.8 billion, 614Km Ajaokuta-Kaduna-Kano (AKK) pipeline connecting the eastern, western, and northern regions of the country, have been driven by the country’s gas policies.

Nigeria has for years dominated the investment space in Oil and Gas in Africa. For decades it has emerged as the only country in Africa that is at the forefront of attracting the biggest players in the sector and steering forward project developments across the Value chain.

With the Covid 19 pandemic bringing to a halt many business opportunities and frozen investment in most parts of the world, Nigeria was largely impacted as finance trends started shifting during this time from fossil fuels to renewable resources, and this time African hydrocarbon players such as Nigeria found themselves competing …

Mergers and acquisitions worth US$52B were completed in South Africa during the first half of 2021, with the value of deals growing by 958% from 2020 with the tech sector in the lead according to Refinitiv Data that provides financial markets and infrastructure data . According to Digest Africa, the value of mergers and acquisitions in the African tech ecosystem in 2018 was US$504M with 24 out of the 39 deals taking place in South Africa making it the country with the most mergers, acquisitions and exits among the KINGS countries. …

- TLG’s investment supports their digital banking aspirations and helps position FairMoney to grow their share of wallet

- FairMoney operates a credit-led strategy: offering credit via an app and subsequently offering bank accounts

- The average loan size is 30 Euros and customers can grow their loan limits up to 1,000 Euros over time

TLG Capital has announced an investment it has made into a Paris based fintech company, FairMoney in Nigeria.

FairMoney, which operates a neo-banking platform in Nigeria provides underbanked users with bill payment solutions and collateral-free lending. The company has a microfinance bank license from the Central Bank of Nigeria, which permits it to officially operate as a financial services provider in the country.

The company’s Co-Founder and CEO, Laurin Nabuko Hainy, says TLG’s investment supports their digital banking aspirations and helps position FairMoney to grow their share of wallet while offering services to the financially excluded and …

Passenger vehicles were Kenya’s fourth-largest import overall in 2014, valued at US$420 million and making up 2.3% of total imports (by value) while commercial vehicles ranked seventh, valued at US$370 million.

“If the current trend of 10% to 12% growth per annum on vehicle imports is to be maintained, Kenya will have five million vehicles on the road by the year 2030,” Deloitte said.…