- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

Browsing: Russia-Ukraine conflict

- Seven African leaders have visited Ukraine and Russia in an effort to put an end to the almost 16-month-old war.

- The Ukraine-Russia war is negatively affecting production and supply of food in Africa and across the globe.

- The African peace mission coincides with Ukraine’s counteroffensive to drive out Russian forces out of occupied lands.

Stung by worsening negative effects of the Russia-Ukraine war on their economies, seven African leaders have visited Kyiv and Moscow in an effort to put an end to the almost 16-month-old war.

African Peace Initiative Mission

In an initiative dubbed African Peace Initiative Mission, the seven were the presidents of Comoros, Senegal, South Africa, and Zambia, as well as Egypt’s prime minister and top envoys from the Republic of Congo and Uganda.

The ongoing war between Ukraine and Russia is increasingly negatively affecting Africa’s economic development. Continued loss of lives, higher economic costs to trade and …

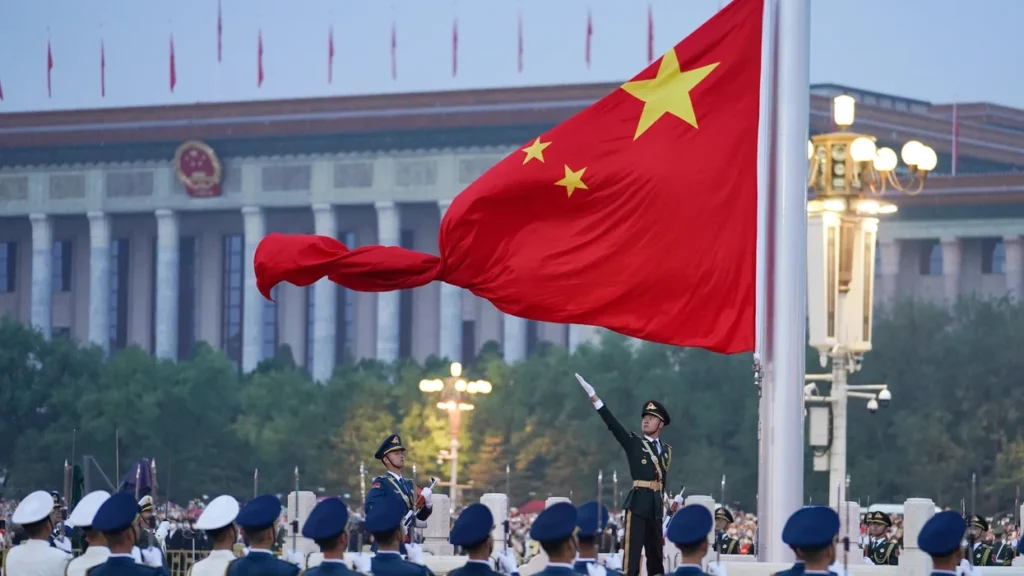

Xi Jinping has elevated the China-Africa friendship to its most significant level since Mao Zedong’s reign. With Xi getting a third five-year term and perhaps staying in power even longer, those relations will strengthen further. Thus, Africa will remain pivotal in China’s plans for global economic control.…

African countries will be largely impacted by the decision by the global cartel of oil producing countries to cut oil production given that only 14 out of 54 countries in Sub-Sahara Africa produce oil, which accounts for the lion’s share of their annual export earnings.

Many African countries have to import refined oil and rely on oil products in power generation. A hike in oil prices will boost economies of oil producing countries, by gaining foreign exchange earnings to carry out development projects such as Nigeria, Angola, Gabon, Libya, Cameroon, and Congo among others.

Consequently, this will create more job opportunities and greatly aid in poverty alleviation. In addition, the revenues could be redirected to other sectors that make significant contributions to the respective economies. By example, in countries like Cameroon, Gabon and Congo, internet infrastructure and technology could largely benefit from re-investing.…

A currency crisis is defined as a quick and abrupt depreciation of a country’s currency. Currency depreciation goes in tandem with turbulent markets and a loss of confidence in the country’s economy. Historically, crises have arisen when market expectations induce significant movements in the value of currencies.

The global economy is now in turmoil. As the world economy enters another era of a currency crisis, the value of the US dollar keeps rising. Over half of all international trade is billed in dollars. A stronger dollar thus hurts consumers globally, particularly in Africa, who rely on dollars to pay for imports.

The US Federal Reserve’s hawkish approach to increasing interest rates more aggressively than central banks in other major countries has contributed to the dollar’s appreciation. The fact that investors generally see the dollar as a “safe haven” asset during times of economic turmoil has added to its resilience.…

The current large-scale transition of the global economy, principally triggered by the current conflict between Ukraine and Russia as well as the standoff between China and the United States, creates a multipolar world map with new centres of power.

Brazil, Russia, India, China, and South Africa, also known as the BRICS nations, have enhanced industrial and financial might and are pushing for a seat at the global new power axis table. These nations are essential participants in international markets for products, services, and money, having a considerable, sometimes decisive, effect on how the global economy operates.…