- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Tullow Oil

- Tullow’s 2023 operating revenue surpasses expectations with strengthened Group financial position through a cut in debt.

- British firm has secured long-term capital through a $400 million debt from Glencore Energy.

- Explorer is projecting a $800 million free cash flow from 2023–2025 and a sustainable revenue flow outlook thereafter.

British exploration firm, Tullow Oil, has singled out Kenya oil project as one of its key areas in production growth for 2024, as it expects to deliver $800 million in operating revenue from 2023 to 2025.

This is captured in its financial results for 2023, where Tullow reiterated the delivery of its plan, which is achieving targeted results and a much-improved business. During the year, Tullow continued to evolve and built a strong and unique foundation to create material value, the company reported.

Several significant milestones were achieved in 2023, including the start-up of Jubilee South East which has given Ghana’s upstream …

- The country’s petroleum products distributor, Kenya Pipeline Company (KPC), is set to take over the refinery.

- It will utilize it for storage of super petrol, diesel, kerosene and the latest now being development of a bulk LPG (cooking gas) reserve.

- The Kenya Petroleum Refineries Limited was originally set up by Shell and British Petroleum Company BP to serve the East African region in the supply of a wide variety of oil products.

Kenya plans to fully turn its defunct oil refinery into a storage center for imported products, as the dream of refining its own crude oil fades ahead of commercial production projected to commence before 2027.

Both the government and British exploration firm, Tullow Oil, which is seeking joint ventures for the Turkana oil project, are hopeful Kenya will go into commercial oil production in the short-term.

However, it is now clear that the country has no plans …

- Kenya is putting together incentives that could help mobilize Foreign Direct Investments in upstream oil activities.

- The latest developments add to efforts by the government to support Tullow Oil in scouting for investors for Project Oil Kenya.

- India and China are some of the countries where the government is keen on in tapping from.

In May 2023, an announcement by British oil explorer Tullow Oil that it wants out of Kenya’s oil dream send shockwaves in the industry as its move threatened to derail the country’s journey of becoming a net oil exporter.

At that moment, Tullow Oil partner, a Canadian firm Africa Oil Corp had left the project on concerns over difficulties in finding an investor, who can support Kenya’s commercial oil export business.

The other partner TotalEnergies is fast shifting investment focus to oil producing fields in other markets. For Kenya to evacuate its crude, it has to …

- The Dubai edition aims to strengthen collaboration among African energy decision makers and stakeholders with the UAE and businesses and investors in the Middle East

- The African Energy Dubai event’s Venture Capital will boost Africa’s energy sector growth by facilitating optimal investment and industry cooperation between UAE and African stakeholders

- Middle Eastern investment opportunities in African oil and petrol projects are critical in assisting the continent in meeting its increasing energy demands

The Dubai leg of the Invest in African Energy event will highlight capital and partnership opportunities across Africa’s expanding energy sector, will be hosted by the African Energy Chamber (AEC) on March 30 2023.

Following the success of the London (U.K.), Oslo (Norway), and Frankfurt (Germany) editions of the Invest in African Energy receptions in 2023, the Dubai edition aims to strengthen collaboration among African energy decision makers and stakeholders with the UAE and businesses and investors in …

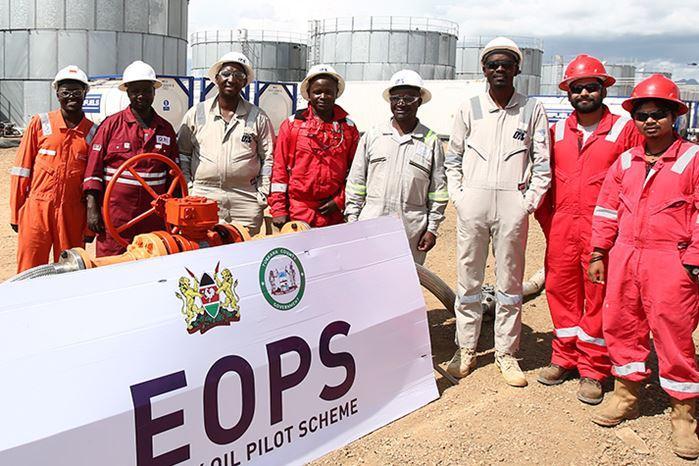

- Tullow Oil has reiterated its commitment to scale up the development of Project Oil Kenya in 2023

- The global independent oil and gas exploration and production firm said it plans to invest KSh 1.24 billion (US$10 million) in Project Oil Kenya

- Tullow and its Joint Venture partners (Africa Oil and Total Energies) are also working closely with the local government agencies seeking to finalise the firm’s field development plan (FDP)

Tullow Oil Plc has reiterated its commitment to scale up the development of Project Oil Kenya in 2023. The global independent oil and gas exploration and production firm said it plans to invest KSh 1.24 billion (US$10 million) in Project Oil Kenya appraisal engagements focusing on fine-tuning the Field Development Plan (FDP) and related local operations.

A trading statement and operational update issued by the London Stock Exchange (LSE) listed firm confirms that efforts to secure a strategic partner for …

The $3.5 billion and 1,443 km crude oil pipeline project, stretching from Lake Albert in Uganda to Tanzania’s port in Tanga, will be fast-tracked to commence the implementation of the project, which was put on hold last year.

Tullow is a recognised independent oil & gas, exploration and production company based in Africa and South America The company has interests in over 70 exploration and production licences across 15 countries.

According to information from The Citizen, a Total delegation led by President, Exploration and Production Arnaud Breuillac held talks with Energy minister Dr Medard Kalemani on Friday. The talks aimed at updating the Tanzania government on the new development.

“We are now enabled to fast track finalisation of legal and commercial agreements to pave the way for the Final Investment Decision (FID) before commencing implementation of the Project,” he said.

However, as both partners—Tanzania and Uganda face-off COVID-19 challenges, Mr …

For Tullow Oil, the year 2020 has not started particularly well with collapsing hopes, poor oil output and boardroom maneuvers almost pushing the British oil firm into oblivion. In the peak of the storm, the company lost half its value on the stock market after bad fairing in Ghana and Guyana and a delay in the sale of the Ugandan stake. This led to global readjustment with the Kenyan operations announcing job cuts.

This is a situation well explained by Dorothy Thompson, Executive Chair, Tullow Oil plc. “This has been an intense period for Tullow as we have worked hard on a thorough review of the business which has led to clear conclusions and decisive actions. We are focused on delivering reliable production, lowering our cost base and managing our portfolio to reduce our debt and strengthen our balance sheet. Even with recent events in oil markets, Tullow’s assets remain …

In a jammed conference room in a Nairobi hotel in early 2019, a panel of rights activists poked holes at the Kenyan oil exploration and mining activities in Turkana. Blow by blow, the team illustrated how Kenya stands to lose if radical measures are not put into place to ensure the resource benefits the country.

The Kenya Oil and Gas working group called for an audit of the contracts of oil mining to ensure they follow international standards. Charles Wanguhu, a social activist coordinator of the Kenya Civil Society Platform on Oil and Gas, said in international practice, if a company prospects and fails to find oil, it meets its costs.

However, if it finds oil, the country pays for the expenses. Therefore, Wanguhunotes that in the case of Kenya, the need for audit will ensure that the costs which Kenyans will pay for do not include those wells that …

The International Monetary Fund (IMF) has taken a key interest in Uganda’s economy, whereas the East African economy is likely to grow by 6 per cent in the financial year 2019/2020 (July-June), which is slump from the previous projection of 6.3 per cent.

According to Reuters, the IMF noted the delays to be attributed by the delays in the public investment necessary for kicking off oil production.

On May 9, 2019, IMF statement noted that Uganda’s economy continued on its robust recovery with projected growth of 6.3 per cent in the fiscal 2018/2019, unequivocally highlighting the timely implementation of public infrastructure and oil-related projects would support growth in the medium term.

The Washington DC-based fund said in a statement published on Wednesday that, “Downside risks have increased linked to uncertainty related to oil production,”.

Also, the statement noted that “the electoral period and the complex external context” also weighed on …

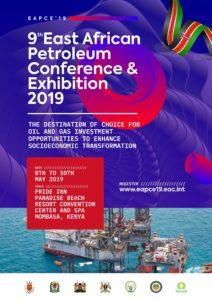

East African countries are set to attend the ninth East African Petroleum Conference and exhibition to discuss investment opportunities to enhance socio-economic transformation.

This year`s conference is themed:` East African Region – the destination of choice for Oil and Gas Investment Opportunities to enhance Socioeconomic Transformation.`

Chairperson of the organizing committee, Marin Heya said over the weekend that over 1,000 local, regional and international delegates will be attending the three-day conference that will be in Mombasa from May 8.

`The conference will help attract investors on oil and gas into the region given the potential in the region, ` Heya said.

He revealed that the Chinese geo-spatial and survey firm BGP and CNOOC are among the companies that are expected to attend the three-day conference.

The official also stated that the East African Community (EAC) member states, including Kenya, Uganda, Tanzania and Rwanda will exhibit at the conference alongside international …