- How transition finance can catalyse Africa’s green industrial revolution

- Stanbic PMI Report: Mixed performance as Kenya’s agriculture, construction offset manufacturing decline

- Uganda’s land management gets a tech makeover to boost transparency

- Nigeria’s output dips fastest in 19 months on a sharp rise in costs

- Apple faces growing backlash over Congo exploitation

- Why East Africa is staring at higher wheat prices in 2025

- Nairobi Gate SEZ pumps $7 million into Kenya’s agro-processing industry

- What impact will the US election have on Africa?

Browsing: World Bank

- Kenya’s new loan will be disbursed through an instrument called Development Policy Operations (DPO).

- The loan will support key policy and institutional reforms that will help Kenya institute financial solutions in the short-term.

- Kenya is expected to institute reforms creating fiscal space, improving agricultural competitiveness, and improving governance.

The World Bank Group has approved a $1 billion loan to Kenya to support its budget as East Africa’s largest economy ploughs through one of its toughest economic conditions. The new financing will be disbursed through an instrument called a Development Policy Operations (DPO). The credit will support key policy and institutional reforms in the country. The planned reforms will help the nation institute financial solutions in the short-term.

Kenya is expected to institute reforms in her fiscal space, improve agricultural competitiveness and streamline governance. The East African powerhouse qualified for financing under the DPO in 2019 and has since received four …

- Experts warn South Africa’s growth is too low to create enough jobs to absorb new workers entering the labor market.

- The country’s fiscal position is projected to deteriorate due to weakening mineral revenue. Utility Eskom’s debt bailout, wage bill, and rising debt pile more pressure.

- As a result, public debt is not expected to stabilise. And headline inflation will return to the midpoint of the target range by end 2024.

South Africa’s real GDP growth is projected at 0.1 percent in 2023, reflecting a significant increase in the intensity of power outages, and weaker commodity prices and external environment.

According to the International Monetary Fund (IMF), annual growth is expected at about 1.5 per cent over the medium term. The country is under vice-like grip of long-standing structural impediments.

South Africa’s power outage woes

For instance, South Africa is struggling with product and labor market rigidities. It …

- A rising number of informal women traders in border towns are resorting to corruption to survive.

- Corruption, harassment, and sexual bribes is threatening the success of enterprise between African economies.

- The World Bank estimates small-scale cross-border trade provides income to 43 percent people in Africa.

Small-scale trade remains vital in securing livelihoods in East Africa, but rampant cross-border corruption is posing a serious threat to a vital cog in this enterprise—thousands of informal women traders.

This is unlike during pre-colonial period when African communities used to travel long distances, crossing today’s “borders” to barter their goods with traders from a different ethnic group.

Why informal women traders resort to corruption

Today, enterprising communities—mostly informal women traders—at border towns resort to corruption to survive, the World Bank explains. Quite often, official border posts are marred with service delays and congestion, the perfect fodder for cross-border corruption.

With suppressed cross-border trade …

- Kenya's forex reserves dipped to $6.2 billion on May 19, an eight-year low, before a slight improvement to $6.4 billion on May 26.

- At $6.4 billion, Kenya's reserves are just 3.60 months of import cover, which is below the Central Bank of Kenya’s desired target.

- What's more, the reserves are below the East Africa Community preferred threshold of 4.5 months of import cover, hence exposing the country to high volatilities in the global market.

A dip in export earnings, coupled with reducing diaspora inflows at a time of huge debt repayments have left Kenya grappling with low forex reserves, raising concerns on the health of East Africa's economic powerhouse.

The low forex reserves are further compounding the dollar shortage problem that has been gripping importers for months. Importers, mainly in the manufacturing and the energy sectors, have been struggling to secure the greenback to replenish their suppliers.

Kenya's forex reserves

- Angola has become Africa Trade Insurance Agency’s (ATI) 21st member state by paying $25 million in capital subscription fees.

- ATI’s gross exposure in Angola currently stands at $467 million.

- The membership was funded the Angolan National Treasury and proceeds from the landmark BITA water project.

Oil-rich Angola has become the 21st African member state joining pan-African insurer, Africa Trade Insurance Agency (ATI) after paying $25 million in subscription fees. The deal will also see Angola become first Lusophone member country in the underwriter.

ATI was established in 2001 by seven Comesa countries and with technical and financial backing of the World Bank. The agency’s core mandate is to provide insurance against political and commercial risks. This is considered necessary in order to attract foreign direct investments across member states.

Luanda’s membership was funded by the Angolan National Treasury resources and proceeds from the landmark BITA water project. BITA …

- Kenya’s Nairobi Securities Exchange posted drop in capitalization in April due to investor flight.

- Other poorly performing bourses were Uganda, Mauritius, Namibia, Morocco, Tanzania, Rwanda and Tunisia.

- Zambia, South Africa, Ghana and Egypt remained positive railing Zimbabwe and Malawi.

Zimbabwe has maintained the lead in the African equity markets returns by recording the highest gains at 112.33 percent year-to-date, the latest data shows. In the period under review, Malawi recorded the highest month-on-month value of 10.96 percent.

At the same time Kenya posted the highest drops both on year-to-date and month-on-month, Nairobi Securities Exchange (NSE) monthly barometer indicates, which stood at negative 15.56 percent and minus 3.52 percent, respectively.

Other poor performers across Africa were Uganda, Mauritius, Namibia, Morocco, Tanzania, Rwanda and Tunisia. In West Africa, Nigeria performed poorly on the month-on-month index but remained positive year-to-date. Zambia, South Africa, Ghana and Egypt remained positive railing Zimbabwe and Malawi.

Kenya’s …

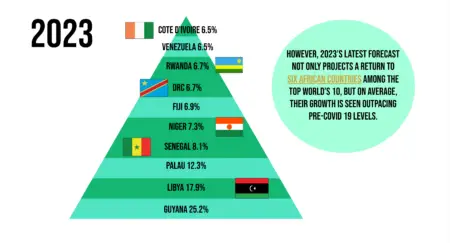

- Africa’s average GDP will stabilize at around 4 percent in the course of the next two years, notes AfDB.

- The continent needs alternative sources of imports and new export markets to counter disruptions caused by the war in Ukraine.

- Economists are urging African economies to look at expediting intra-African trade to stave off global shocks.

A significant number of African nations continue to show economic resilience in the face of tougher global challenges. The latest update by the African Development Bank (AfDB) on economic review says the continent has a stable outlook in the 2023-2024 financial year.

Africa’s Macroeconomic Performance and Outlook report provides an up-to-date assessment of the continent’s macroeconomic performance and a forecast of expected performance on the backdrop of global economic challenges.

Africa average GDP to stabilise at 4 percent

The lender estimates that Africa’s average GDP will stabilise at around 4 percent in the course of …

- Dr Kamau Thugge, who is President Ruto’s advisor on fiscal affairs, is set to take over from Dr Patrick Njoroge.

- Previously, Dr Thugge served as the Permanent Secretary at Kenya’s National Treasury between 2013 and 2019.

- Prior to his nomination as Principal Secretary, he worked as a senior economic adviser in the Ministry of Finance since 2010.

President William Ruto has nominated former IMF economist Dr Kamau Thugge for appointment to head the Central Bank of Kenya. Dr Ruto picked Dr Thugge out of a list of six candidates who were interviewed on May 9th for the job that helps define Kenya’s fiscal policy.

Dr Thugge is not a stranger at Kenya’s financial industry. For close to 10 years, between 2013 and 2019, he served as the Principal Secretary, National Treasury under former President Uhuru Kenyatta. He was, however, hounded out of office over allegations of corruption. The scandal, which …

- DRC’s economy is rising with real GDP growth at 8.9 percent in 2022 and projected to 6.8 percent in 2023.

- Macroeconomic imbalances have, however, emerged piling inflationary pressures.

- The roiling conflict in the East and upcoming elections complicate macroeconomic management.

The International Monetary Fund (IMF) has outlined a number of tough measures for war-tone DRC as it seeks $200 million financing. The funds are part of the country’s Special Drawing Rights (SDR), the supplementary forex reserves maintained by the IMF. They are units of account for the IMF, and not a currency per se. What’s more, they represent a claim to currency held by IMF member countries and DR Congo can access about $200 million.

An IMF team led by Mercedes Vera Martin met with the authorities in Kinshasa between April 19–May 3. This was on the fourth review of the three-year arrangement under DRC’s Extended Credit Facility (ECF).

Macroeconomic

…- Lender AfDB is looking to harness global equity funds to finance climate change mitigation in Africa.

- AfDB statistics show that only 14 percent of $29.5 billion that was invested in climate finance for Africa in 2020 was from the private sector.

- AfDB is set to hold climate change financing meeting in Sharm El Sheikh, Egypt, this May.

An increasing number of people across Africa are grappling with unpredictable but definite cycles of failed rains, flash floods or severe drought as climate change-induced weather patterns become the norm in the continent that is one of the least polluters globally.

“Africa, the continent that pollutes the planet the least, is today one of the world’s most vulnerable to climate risks,” admits the African Development Bank.

In many countries in Africa today, it is nearly impossible for farmers to practice rain-fed agriculture, which is the primary option for 99 percent of agricultural production