- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: zimbabwe

- Africa has huge potential to power global supply chains for automobiles, handsets, food, renewable energy, and healthcare.

- The value of the African supply chain finance market rose by 40% between 2021 and 2022, reaching $41 billion.

- Africa has at least a fifth of the world’s reserves in a dozen metals critical for the energy transition.

- African countries need to capitalize on their comparative advantages and bolster technology adoption, improve logistics and leverage trade agreements.

Riding on its key comparative advantage of driving green transition globally, Africa can become a new hub for international supply chain, including for technology intensive industries. However, to realize this ambition, the ball lies principally in the court of policymakers in Africa and businesses to position the continent at an advantage.

These revelations are contained in the new United Nations Conference on Trade and Development (UNCTAD) Economic Development in Africa Report 2023 released on 16th…

In May 2023, Zimbabwe released a gold-backed digital currency for peer-to-peer and business transactions. It acted as a store of value as the Zimbabwean dollar continued its steep depreciation. International gold prices controlled by the London Bullion Market Association will dictate the local pricing of Zimbabwe’s digital currency tokens.…

- Key staff in Eswatini and Zimbabwe have gained critical skills on how to harness Africa Continental Free Trade Area (AfCFTA).

- The training will be rolled out in Kenya, Seychelles, Rwanda, and DRC starting June, this year. It is critical for helping businesses identify and compare emerging opportunities in Africa.

- The programme equips staff with integrated and reliable trade intelligence on international market performance and opportunities as well as market access conditions.

Staff from over 80 companies and public agencies in Eswatini and Zimbabwe have gained critical skills on how to harness opportunities under Africa Continental Free Trade Area (AfCFTA). The training was undertaken by the African Trade Observatory, one of the five operational instruments of AfCFTA charged with driving intra regional trade of small businesses.

The online dashboard is critical for helping businesses identify and compare emerging opportunities across the continent. It provides integrated and reliable trade intelligence on international …

- The Reserve Bank of Zimbabwe last month began to loosen the tight monetary policy it had in place over the last 2 years to act against inflation.

- The hawkish stance of the central bank began to change when the RBZ announced that it would reduce interest rates by 50% to 150%.

- Zimbabwe’s central bank’s hawkish stance has resulted in a weakening economy and rising unemployment.

The Reserve Bank of Zimbabwe held the global record for highest interest rates, reaching a staggering 200%. The central bank has lowered this to 150% on the grounds that the inflationary conditions that required the significant increase have subsided. As is typical with hawkish monetary policy approaches, Zimbabwe’s central bank’s hawkish stance has resulted in a weakening economy and rising unemployment.

On 3 February 2023, the Zimbabwean monetary authorities issued the country’s first Monetary Policy Statement via the central bank. Twice a year, the Reserve …

- The VFEX or Victoria Falls Stock Exchange is Zimbabwe’s exclusively United States dollar only stock market which was launched 3 years ago.

- The Zimbabwe Stock Exchange or ZSE’s main board has been shrinking because of companies migrating to the VFEX.

- Companies in Zimbabwe constantly experience a shortage of foreign exchange to support their increasingly import reliant businesses.

The number of companies that are delisting from the main board of the Zimbabwe Stock Exchange, often known as the ZSE, and moving their operations to the ZSE’s hard currency equivalent, the Victoria Falls Stock Exchange (VFEX), has been growing. When the central bank eliminated the favorable foreign exchange retention levels that had been the primary draw of the VFEX, it is anticipated that the outflow from the ZSE will slow down in 2023. This comes after the central bank eliminated the foreign exchange retention thresholds.

- Zimbabwe’s banking and financial industry reflects the overall health of the economy.

- The country has broadly experienced capital flight and negligible foreign direct investment during the last 2 decades.

- Policy inconsistency has undermined Zimbabwe’s banking and financial industry together with its capital account.

Thungela Resources set to diversify beyond coal in South Africa

Zimbabwe has been dubbed the sick man of southern Africa for the past 25 years. The country has seen capital flight and an outflow of foreign investment. There are numerous causes for this result. The primary cause has been policy blunders and so-called “flip-flopping” by government gatekeepers.

Like to the rest of the world, Zimbabwe’s banking system reflects the activity of the actual economy. Banks and other financial services institutions serve as financial mediators for real economy players. This indicates that banks serve as a vital link between surplus and deficit units.

In economic terms, this means …

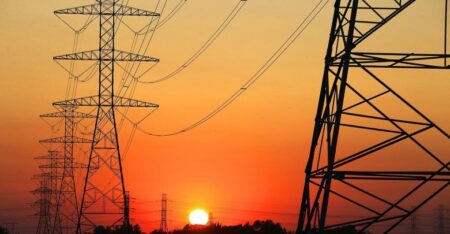

- Zimbabwe is experiencing crippling power outages characterized by black-outs that can extend to as much as 19 hours a day.

- The electricity shortage is now common place with South Africa recently announcing Stage 6 power cuts.

- The debt capital markets, specifically the issuance of green bonds is a possible solution to rolling black-outs.

Zimbabwe is in the middle of a power crisis that can be attributed to the low water levels at the country’s Kariba Dam which has in times past been used to supplement the country’s power needs. Power outages are a part of every day living in the country.

However, the latest power crisis seems to be more intense threatening to scupper economic growth. Businesses and citizens have had to adjust to erratic power supply schedules. It is now commonplace for people to wake up at midnight to iron their clothes and use their electric appliances as this …

Zimbabwe’s potential to become the bread basket of Africa again may be possible. The country still possesses fertile soils and a favourable climate, and with the right support, the agricultural sector can be revitalized to once again become a major contributor to the country’s economy, providing food security for the nation and for Southern Africa. What is needed are investments in technology and infrastructure, support for smallholder farmers, encouraging private sector investment, and addressing climate change.

Zimbabwe has a long history of agriculture dating back to the 11th century when the Shona and Ndebele people began cultivating crops such as millet, sorghum, and corn. In the 20th century, the country became known as a major agricultural producer, particularly in the areas of tobacco, wheat, and maize (corn). The country’s fertile soils and favourable climate made it an ideal location for farming, and the government actively promoted and supported the agricultural …

When buying any product what do you really look at on the labels? How often do you check where the products were made? Who knows, maybe some of the products are made on Mars.

One thing for sure is you will come across a tag which reads: ‘Made in Zimbabwe,’ ‘Proudly manufactured in Zimbabwe’ or simply ‘Grown in Zimbabwe.’

Exports continue to grow this year thanks to the increasing popularity of Zimbabwean products in regional markets.

According to statistics recently released by ZIMSTAT, Zimbabwe’s exports grew by 12.8 per cent, from US$3.75 billion to US$4.22 billion, between January and August this year.

This growth has been anchored by export growth in emerging and non-traditional markets in countries such as United Arab Emirates (UAE), China, Belgium, and Italy.

The figures show that Zimbabwe’s products to United Arab have grown to US$1.38 billion in 2022. Exports to China also grew to around …

The commission also approved the Dairibord Zimbabwe/Tavistock Estates deal and the acquisition of 100 per cent shareholding in DSI Underground by Sandvik Holdings.

“The transaction was classified as a horizontal merger since the parties are competitors at the same level and in the same relevant market. Examination of the proposed acquisition by Sandvik of 100 per cent of the shares in DSI sought to establish whether the merger will be contrary to public interest through substantially lessening competition or creating a monopoly situation that will be contrary to public interest in the Zimbabwean market,” read the report on the acquisition.

According to CTC, Sandvik-the acquiring firm, is a public limited company incorporated in Sweden and is into high-tech and global engineering. In Zimbabwe, Sandvik operates through its subsidiary, Sandvik Mining and Construction Zimbabwe (Pty) Ltd (“Sandvik Zimbabwe”), and supplies drill rigs, underground trucks and loaders, aftermarket-parts, service and rock tools, …