- The Africa Fintech Accelerator program will remain open until August 25th, and the first cohort will debut in September.

- Plug and Play, the world’s leading innovative platform will partner with Visa to ensure the program’s success.

- Visa committed to invest $1 billion in Africa by 2027.

Africa’s fintech Industry is the continent’s most rapidly growing economic activity. Its growth to fame has attracted plenty of investors and international organizations, each trying to promote the adoption of digital money globally. In recent news, Visa is accepting applications to its Africa Fintech Accelerator Program, urging blockchain-based and fintech startups to sign up. (Alprazolam)

Africa’s fintech accelerator program

To further the continent’s digital transformation, Visa took an active role in supporting Africa’s fintech industry. This global payment technology company has officially opened applications for the Africa Fintech Accelerator Program. The main aim of this endeavour is to revive the adoption rate of digital money after the market experienced trying times after the FTX crash.

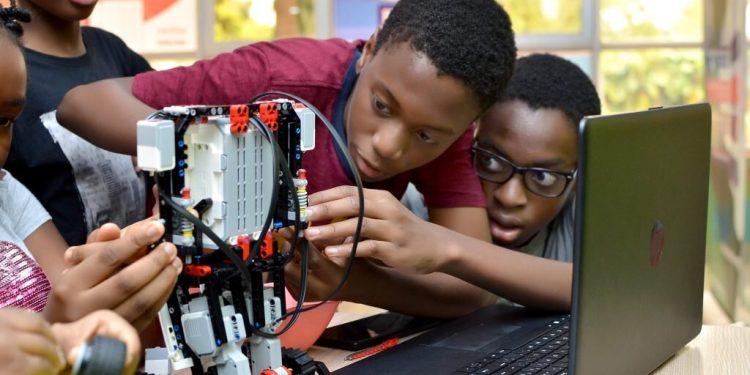

The program offers blockchain-based startups and any fintech company a unique opportunity to access training, technology, a substantial network and potential investment opportunity. The Africa Fintech Program will run twice a year to ensure maximum availability without compromising on the quality offers. Visa has revealed that each cohort will last 12 weeks, accommodating up to 20 selected blockchain-based startups.

As an accelerator program, startups still in their Series A phase will benefit the most, and Visa has vividly encouraged them to participate.

The Africa Fintech Accelerator program will remain open until August 25th, and the first cohort will debut in September. The program will pave the way for a new phase of innovation driving digital money throughout the region.

Africa’s fintech industry is among the recent upcoming markets alongside Agritech, E-Commerce and the Web3 Market. It also coincides with Visa’s commitment to invest $1 billion in Africa by 2027. By providing the necessary expertise, resources and industrial connection, Visa intends to significantly contribute to Africa’s rapid digital transformations.

In addition, Plug and Play, the world’s leading innovative platform, will partner with Visa to ensure the program’s success. They have also pledged to provide participants with valuable content, professional mentors, and one-on-one coaching sessions. In addition, provide several network connections that will significantly benefit Africa’s fintech industry.

Eligibility of startups

The emergence of blockchain technology and web3 has led to the development of numerous industries. Developers, innovators and entrepreneurs discovered that its immutable and decentralized nature can easily redefine how we approach several issues. (https://www.tmjandsleep.com.au/)

As a result, this led to the rapid growth of Blockchain-based startups with diverse capabilities. To narrow this growing trend, Visa has stipulated six categories that will filter the eligibility of certain startups. This ensures that the Africa fintech Program will focus solely on improving digital money in the region.

Read: Africa: Google picks fifteen startups for its accelerator programme.

Unlocking money movement

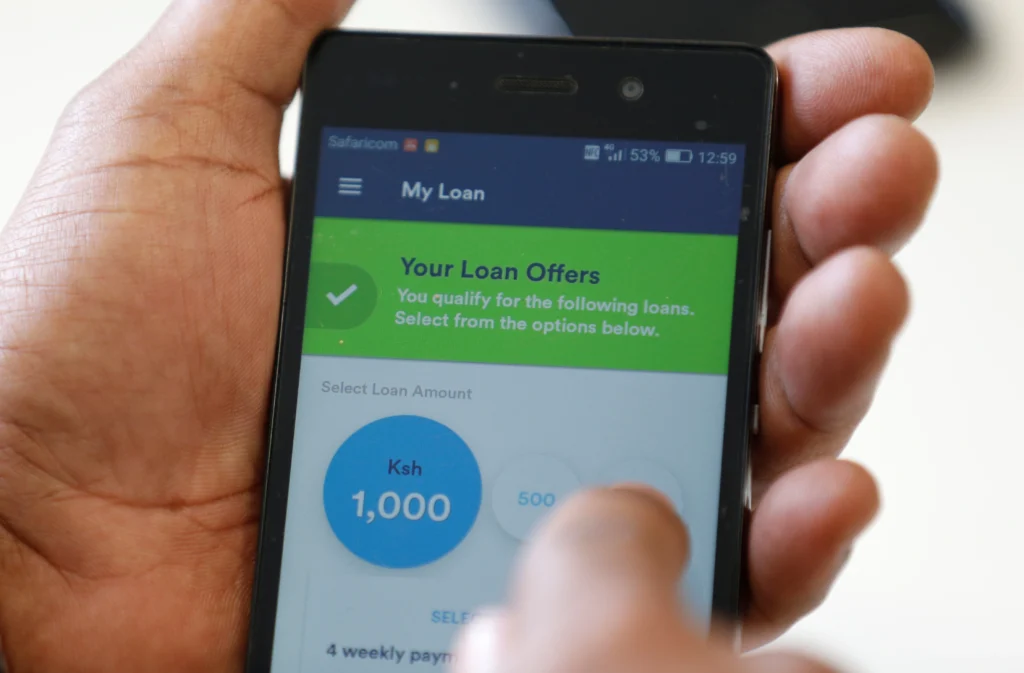

The first criterion is the ability of the startup to unlock money movement. One of the main goals of Africa’s fintech industry is to promote financial accessibility throughout the entire continent. Focusing on digitalizing various payment types creates new commerce opportunities for several companies.

For instance, during the pandemic period, E-commerce significantly propelled, and today most organizations have a digital entity. Providing cross-border remittances, timely fund disbursements, open banking, and adequate mobile money flow interoperability are a few of Africa’s fintech industry’s goals.

Embedded finance

The second criterion is the startup’s ability to provide embedded finance. This is a startup’s ability to utilize advanced intelligence to enhance payment and finance experience in B2B and B2C commercial models. One of the vital components in Africa’s digital transformation is the rapid growth of AI-based systems.

Blockchain-based startups must utilize this new technology to remain on par with their peers. The Africa Fintech Accelerator program has also indicated that startups should utilize technology to improve their instalments, flexible financing, consumer loyalty and fintech-as-a-Service.

Empowering merchants and SMEs

A startup’s ability to empower its merchants and SMEs is also a crucial criterion for Visa. One of the primary beneficiaries of Africa’s fintech industry is small and medium businesses and upcoming commercial models. These businesses can access the global market, expanding their market opportunity through digital money.

Creating a more efficient digital payment system to foster financial inclusion should be the main driving point of startups eager to sign up. In addition, they should focus on net-generation omnichannel payments, digital onboarding, work capital optimization and merchant value-add solutions.

Payment infrastructure enablers

Any blockchain-based startups signing up for the Africa fintech accelerator should be payment infrastructure enablers. This means they should provide a base layer of payment infrastructure and use enabling services providing authentication and fraud solutions.

With Africa’s fintech industry rapidly growing, it presents a bigger challenge for most organizations. Cybercrime involving fintech startups has significantly risen over the past decade. Thus, to curb such demerits, startups must have several vital features. They include; digital onboarding and identity management systems, credit core and risk management solutions and data solutions that provide insight into the overall system performance.

The future of finance

As a global payment system, Visa is among the top advocates for financial inclusion. Thus, to keep in line with its goals, they have depicted that each startup applying should have in mind a plan for the future of finance. This includes embracing new technology improving not only efficiency but speed.

Currently, one of the primary industries undergoing revolutionary change is the finance industry. To keep up with this pace, startups must embrace network technology like AI-powered payments, using blockchain and enterprise DLT and programmable digital money.

Sustainable and inclusive finance

To ensure the proper growth of Africa’s fintech industry, startups must showcase a payment system that provides sustainability. Any innovation must provide long-lasting solutions that ensure business continuity and change within the ecosystem.

The Africa Fintech Accelerator Program has stipulated that participants should employ technology that will contribute to an eco-friendly economy. This criterion is a startup’s pace to drive inclusiveness, reduce inequality and create a positive impact through providing financial services to underserved communities. This ensures that Visa plays a significant role in promoting the continent’s digital; transformations.

Leila Serhan, Visa’s Senior Vice President and Group Country Manager said, “Through the Visa Africa Fintech Accelerator, Visa is committed to driving financial innovation, fostering entrepreneurship, and supporting the growth of Fintech ecosystems across Africa. This accelerator represents a unique opportunity for Fintech startups to access invaluable resources, mentorship, and potential investment opportunities.” She has encouraged all fintech startups to participate.