- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Month: May 2019

It targets agricultural,building,construction and waste management sectors in the country

Leading construction and building equipment supplier, Ganatra Plant & Equipment Ltd and NIC bank have partnered to finance purchases of new JCB Back-hoe Loaders in Kenya.

This is in the wake of a credit crunch in the market occasioned by the interest rate cap law, which has lowered the purchasing power of majority of investors.

READ:Why Kenya’s Central Bank has retained minimum lending rate at 9%

The partnership is seeking to reduce the financial load from the customers by offering them flexible financing terms including a cost reduction of 20 per cent.

In the financing partnership signed in Nairobi this week, NIC will offer an 80 per cent financing, thus offering small medium enterprises and corporate organisations the opportunity to acquire the Back- hoe Loader through asset financing.

The move will therefore free up cash that can be directed …

33% of manufacturers in the country plan to reduce the number of full time employees

Only 48 per cent of manufacturers in Kenya have expressed optimism that the sector would grow this year, a latest survey has revealed, as investments in the country continue to face headwinds.

According to the Q1 ‘Manufacturing Barometer’ by the Kenya Association of Manufacturers (KAM), the biggest worry by industry players over the next six months (61 per cent) is the high cost of raw materials, which is making their products uncompetitive both locally, regional and in the international markets.

About 57 per cent are worried about pressure from increased wages, 54 per cent are concerned over decreasing profitability while 48 per cent fear that taxation policies in the country will affect their businesses.

Oil and energy prices which have remained high worries 43 per cent of the surveyed manufacturers in the country, the study …

Equity Bank says branches are making it easy for SMEs to access products that are right for them

Equity Bank continues to enhance its Small and Medium-sized Enterprises (SME) offering through its supreme banking branches, as the bank embraces new technology and ways of working to meet the retail customer needs.

Thanks to the growing adoption of digital banking which has seen banks shift from brick and mortar expansion (branches), the space at banking halls has enabled SMEs to largely access supreme banking which has been targeting high net worth individuals.

Currently, 96 per cent of transactions at Equity are being done on digital platforms, the Nairobi Securities Exchange (NSE) listed lender has reported.

READ:Banks in Kenya battling for digital lending space

“This has allowed the bank to transform the branches into advice-giving arms. This branch based venture offers preferential services customized banking solutions with exclusive privileges and unrivalled …

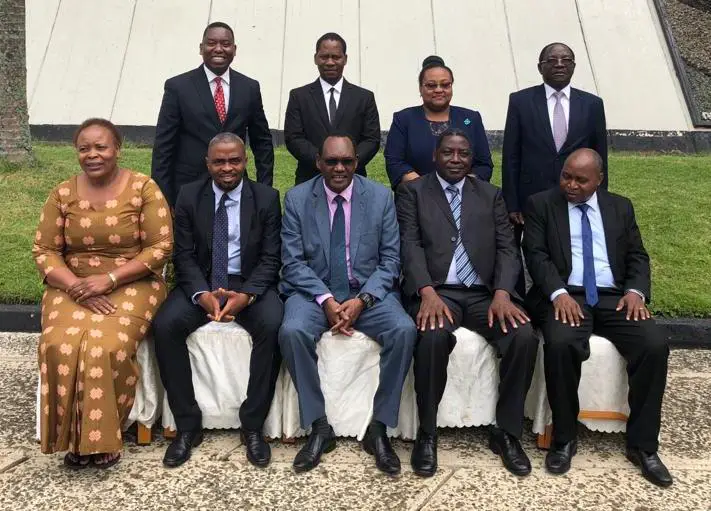

The two have agreed to implement a Single Customs Territory (SCT) to enhance clearance of goods and promote trade

After close to two years of a trade tension between Kenya and Tanzania on free market access of locally produced goods, the two neighbours have agreed to call a truce.

Back-to-back trade talks have seen the two agree to open their borders for trade while they move to jointly implement a Single Customs Territory (SCT), as agreed, to enhance the process of clearance of goods.

The SCT is a step towards a full customs union, achievable by the removal of restrictive regulations and reducing internal border controls on goods moving between partner states. The ultimate goal is the free circulation of goods.

The tiff

The two East Africa Community (EAC) member states have recently been entangled in a trade raw on local content which led to a tit-for-tat ban on some …

How Kenya is banning gambling advertising

The Kenyan government has banned outdoor advertisement of gambling as it moves to introduce a raft of new measures to tame growing addiction and expansion of the lucrative multi-billion industry, which has found a strong foothold in Africa.

Advertisement of gambling on all social media platforms has also been banned in Kenya, dealing a blow to gambling firms which have been spending billion—cumulative—on adverts to lure millions into their businesses.

In a notice to betting, lotteries and public gaming license holders dated April 30, the Betting Control and Licensing Board (BCLB) has also banned adverts between 6am and 10pm, which means all adverts on television and radio will run during watershed hours(after 10pm), a move it says is intended to protect consumers from effects of gambling.

“We wish to remind you that gaming is a demerit good and all demerit goods have the potential …

Commissioning of an Agricultural Trade Information System (ATMIS) in the country will spur rapid growth of the economy as farmers, agro-dealers, regulators and consumers interact easily online.

TradeMark East Africa`s (TMEA) Country Director, John Ulanga said ATMIS is a powerful digital platform that brings together all agriculture stakeholders including experts in the field and markets for commodities.

`Digitization of the agriculture sector will contribute towards rapid economic growth in the East African region because it will provide access of our commodities to the regional market,` Ulanga said while opening training of stakeholders on the how to use ATMIS in Dar es Salaam last week.

He said among other things, the platform will be used by Ministry of Agriculture and Cooperatives to issue permits for various goods and services but also allow farmers and agro dealers pay fees and commission online.

Ulanga further noted that TMEA has invested in the development…

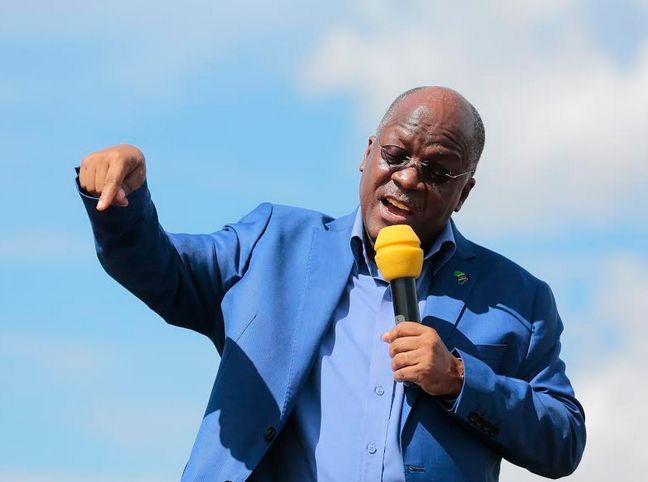

President John Magufuli on 1st May said there would be no pay rise for civil servants this year – the fourth time he addressed Workers` Day without salary increment – defending the position as meant to avoid inflation.

Addressing at the International Labour Day which was observed at the national level in Mbeya city in the Mbeya Region, the Head of State said his first priority is to build the economy, expressing optimism that development projects being implemented now shall warrant increments in future.

`I know you expected to hear me announce a pay rise. If I do that today, tomorrow transport and everything else will go up. Please be patient, ` the president appealed.

Prior to his address, the social media was awash with predictions that after celebrating three previous Workers` Day without announcing the sweet news, the president would not end his speech without the declaration of …

Cash transfers equal to the cost of common development programs have the same impact

Just last year, the World Bank asked Kenya to expand its cash transfer programs to the poor noting that these programmes were having a great impact than the traditional aid. The Bank urged the Kenya;s Treasury to ramp up allocations for direct cash transfer programmes beyond the 519,878 Kenyans covered as at 2015 under the social safety net plan.

In the World Bank report titled “Fiscal Incidence Analysis for Kenya” which analyses the impact of the direct cash programmes in Kenya, the multilateral lender says the elderly cash transfer programme covered only around three percent of all households in Kenya in 2015/16.

This call is now being backed by research as more people evaluate the effects of cash transfer programmes in Africa replacing the old model of donor dictating the project and how a beneficiary can …

Dimension Data Solutions Ltd & SAP has announced a strategic partnership in the East Africa that will give customers the ability to leverage intelligent enterprise solutions localised for the African market that can be integrated with SAP solutions

Africa is welcoming a new dawn in adoption of technologies that are making the continent remain relevant among other global peers. These technologies are guided by evolving needs of consumers which dictate that a the need to integrate technology in all aspects of their life. Such technologies include Artificial Intelligence (AI) and Internet of Things (IoT).

Dimension Data, a USD 8 billion global technology systems integrator and managed services provider is seeking such integration through global partnerships steered at making the African tech user safe and efficient. This is also guided by the desire to tap into the strengths of different players in the industry to offer holistic IT solutions.

Such …

The funds will support the Kenya Mortgage Refinance Corporation

The World Bank has approved a USD250 million International Bank for Reconstruction and Development (IBRD) loan to support housing projects in Kenya.

The funds are expected to enhance access to affordable housing finance for Kenyans who are unable to access long-term housing finance.

The Kenya Affordable Housing Finance Project (KAHFP) will support the establishment and operationalization of the Kenya Mortgage Refinance Corporation (KMRC), a largely private sector-owned and non-deposit taking financial institution under the supervision of the Central Bank of Kenya.

KMRC’s goal is to drive affordability of mortgages by providing more long-term funding to financial institutions, an incentive to enable them to offer long tenure loans to homebuyers.

The project will also assist the Ministry of Lands and Physical Planning to improve property registration and address structural constraints in the land management system in Kenya.

“We believe that Kenya’s vibrant …