- Tanzanian inches closer to clean cooking dream with roll out of $1.7 billion plan

- Why the planning of new cities must embrace a visionary approach to succeed

- First Saudi WoodShow in Riyadh attracts over 8,000 visitors

- Kenya Apparel Exports Targetting $1 Billion by 2025

- Inaction On SDGs to Cost Global Economy an Extra $38 Trillion

- Pullman Hotel Nairobi: French hospitality firm Accor to Open 1st Premium Brand in Kenya

- Investors tip Abu Dhabi as the next tech powerhouse globally

- Unlocking global investment potential: ministerial roundtable insights at AIM Congress 2024

Month: April 2020

Investment banking fees in Sub-Saharan Africa reached an estimated US$128.2 million during the first quarter of 2020, a decline of 15 per cent from last year’s strong start.

Advisory fees earned from completed mergers and acquisitions (M&A) transactions generated US$33.5 million, down 38 per cent year-on-year, while syndicated lending fees declined 47 per cent to US$35.7 million.

The authors of the report, Refinitiv, note that Equity capital markets underwriting fees more than tripled to reach US$36.7 million, a first quarter total only exceeded twice since the company’s records began in 2000.

China’s Belt and Road Initiative, AfCFTA to anchor Africa’s economy

Bond underwriting fees increased 20 per cent to US$22.3 million, again the third-highest first quarter fee total since our records began.

Almost one-quarter of fees in the region during the first quarter of 2020 were earned from government and agency deals. Almost two-thirds of all fees were generated in …

South Africa, Africa’s second-largest economy could be in deep trouble, as the nation’s currency—rand eased against the dollar early on Wednesday, whereby the currency kept on sustaining losses a day after the central bank surprisingly cut lending rates, according to information from Reuters.

The nation’s finance minister Tito Mboweni also gave a warning on the possible trail towards a deep recession this year. In a different occasion, the finance minister highlighted that a recession could hit due to the global coronavirus (COVID-19) pandemic, that has put the world economy at risk.

However, South Africa’s diversified economy was already in recession before the COVID-19 pandemic took a large toll on its economy.

READ:Recession could hit Sub-Saharan Africa, World Bank says

At 0625 GMT, the rand traded at 18.4770 per dollar, 0.9 per cent weaker than its previous close, according to data presented by Reuters.

However, according to the South African …

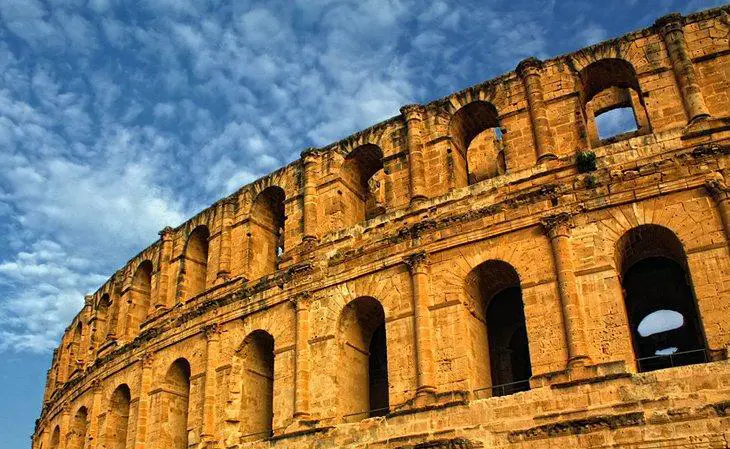

Tunisia, one of Africa’s top exotic tourists’ destinations fate is hanging in the balance, due to the novel coronavirus (COVID-19) pandemic threatening the sector, as more than $1.4 billion and 400,000 jobs are at stake.

According to information from Reuters, an official document showed Tunisia seeking a loan guarantee from bilateral partners to issue sovereign bonds this year.

Further, Reuters highlighted that, in a letter sent to the International Monetary Fund (IMF), Tunisia’s central bank governor and finance minister said the country’s economy would shrink by up to 4.3 per cent, the steepest drop since the nation’s independence in 1956.

The IMF, which approved on Friday a $745 million loan to Tunisia to counter the consequences of the coronavirus, said a new funding programme with Tunisia could start in the second half of this year.

Hence, the size of the new programme remains unknown.

Earlier this year, the Tunisian Minister …

At a time when physical contact is discouraged due to spread of coronavirus, Tanzania’s little town of Kilimanjaro, has set up Automated Teller Machines (ATM) for the sale of milk. There is little human contact involved apart from the exchange of money making the machines a vital game changer in curbing spread of the virus.

The move has set a global precedence in the use of digital telecommunication for commercial purposes. What stands out is the fact that the technology has not been set up in the bustling urban town of Dar es Salaam but rather on the outskirts in the small town.

“This is what technology is for…it not only for the urban centers, it should be used to make life easier in rural areas as well, and the set up of automated milk dispensers in rural Kilimanjaro is a good example,” says milk producer Ivan Mangesi.

Ivan is …

Tanzania has eventually allowed teenage mothers to return to school after the World Bank approved a USD500 million loan as support for the improvement of Tanzania’s education system.

Tanzania had until now denied pregnant girls to return to school after delivery and to push it to change its mind, for over the last two years, the World Bank withheld the requested loan in a bid to push Tanzania to ease the law.

Tanzania’s President John Magufuli is known to hold a hard stance against pregnant teenagers returning to school after delivery. As a result, activists in the country and abroad signed petitions against the World Bank funding the country’s education programs.

Now two years down the road, the World Bank’s board has reversed its stance and approved the loan. While the International Development Association is in support of the loan approval, other international donors like the US cautioned strongly against …

Tanzania has released reprinted versions of several denominations of the country’s banknotes. The new banknotes are meant to be more secure against duplication and forgery.

The new security features include the removal of the classic thin stripe in the old banknote, called the motion thread and replacing it with a rolling star.

The former security feature (the motion thread) used a motion image that had special colour effects when the note is moved side to side.

The new feature now, the rolling star, also has a movement and color change trait, but makes wavy motions when the note is tilted.

The central bank, the Bank of Tanzania (BoT) announced early April that the change affects denominations of TZS 2000, 5000 and 10000.

The last time the BoT changed the country’s banknotes was in 2010. The central bank’s Governor Professor Florens Luoga explained in a press statement that the re-printed banknotes …

By Eric Osiakwan

When I postulated the digital economy in Africa in 2013 as a precursor to becoming a fulltime angel investor and subsequently writing about its KINGS in 2016, it never crossed my mind that in 2020 COVID-19 would be the SPEEDING agent. Who could have predicted COVID-19 except Bill Gates who alluded to a viral outbreak in his 2015 TED talk whiles George Bush and Barack Obama were more accurate in prospecting 2020 as the year? However, none of them envisaged the extent of this epidemic which has pretty much collapsed the capital markets and slowed down the economies of many countries with many of us at home – literally trying to survive the pandemic.

Policy action

African leaders took the major decision to declare a lockdown and, in some cases, daily curfews for fear of the virus spreading and overwhelming the (in some cases non-existent) healthcare …

On Monday, the Executive Board of the International Monetary Fund (IMF) approved the immediate debt service relief of 25 of IMF’s member countries under the IMF’s revamped Catastrophe Containment and Relief Trust (CCRT) as part of the fund’s response to help deal with the impacts of the contagious Coronavirus (COVID-19) pandemic.

According to a statement provided by the lender, the funds go after the world’s poorest and most vulnerable members to cover their IMF debt obligations for an initial phase over the next six months.

Further—IMF highlighted that the debt relief will help these 25 nations to channel more of their scarce financial resources towards vital emergency medical and other relief efforts.

IMF’s Managing Director Ms Kristalina Georgieva, said “The CCRT can currently provide about US$500 million in grant-based debt service relief, including the recent US$185 million pledge by the U.K. and US$100 million provided by Japan as immediately available …

International Monetary Fund (IMF) Executive Board approved the disbursement of $1 billion to Ghana to address the COVID-19 Pandemic.

Ghana has already been affected by the pandemic with the country’s growth slows down, exchange rates under pressure and tightening of financial conditions.

The fund to be drawn under the Rapid Credit Facility will help meet the pressing fiscal and balance of payments needs that the country is facing and speed support from other development partners.

The International Monetary Fund (IMF) is closely monitoring ghana’s situation and is ready to provide policy advice and further support if needed.

Also Read: World Bank, IMF grant Somalia debt relief

“The COVID-19 pandemic is impacting Ghana severely. The budget deficit is projected to widen this year given expected lower government revenues and higher spending needs related to the pandemic. The Fund’s emergency financial assistance under the Rapid Credit Facility will help address the country’s …

Kenyan based Digital banking platform Kwara has announced the launch of its Kwara Pronto digital banking platform which is planned to help SACCOs at risk of disruption from the Coronavirus pandemic (COVID-19) to quickly go digital, remain in operation and continue serving members.

The platform will be offered free for 3 months and will be available for the first 50 SACCOs who qualify.

Due to government-enforced restrictions on movement and social distancing measures during COVID-19, SACCOs are unable to operate at full capacity. As a result, members face challenges applying for loans, transacting and accessing their funds.

Kwara is offering access to an essential version of its core digital banking platform, which will enable SACCOs who qualify to quickly onboard and bring their operations online, at no cost, for the next 3 months. This is an effort to enable SACCOs and their members to keep transacting while observing social distancing.…