- Africa’s quest to unlock trillion-dollar food economy potential

- Partners back AIM Congress 2024 vision for global economic stewardship

- AIM Congress 2024: pre-event forums set the stage for strategic insights on global showcase

- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Falling transport and food costs drive down Kenya’s inflation to 5 per cent in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

Month: August 2020

On March 15th this year the government announced a raft of measures to curb the pandemic brought about by COVID-19. Among the measures were that government employees and businesses were to be shut, a minimum number of people maintained and the rest to start working from home except for those providing essential services.

It is now five months down the line and the initial excitement that a new formula had been found of remote working from home has become a damper and many CEOs have realised it is not workable. During this time into a pandemic that rapidly reshaped how companies operate and which is nowhere in sight in ending, an increasing number of executives now say that remote work, while necessary for safety much of this year, is not their preferred long-term solution once the coronavirus crisis passes.

Some companies had even vowed …

While many company executives focus on product development and budget cuts, forgetting that the company success will largely depend on customer satisfaction. As we wrestle with Covid-19 pandemic and global recession, how companies interact with their customers is more vital than ever before making customer experience as the key ingredient that will determine the success of any company.

Most research carried out in 2020 such as Adobe Digital Trends, ranks customer experience at the top a head of digital marketing, video marketing and even social media. A survey by Deloitte in 2017 on Global Contact Center, found that 88 percent of companies now prioritize customer experience in their contact centres. Companies offering better customer experience earned between 4 and 8 percent more than their competitors as seen in SmartInsights and Temkin Group 2019. Brands that create a company culture focused on customers help their employees work together to …

None of us particularly like money-lenders and few of us would want the stress and unpleasantness of being the type of money-lender that proliferates in cities like Kampala – leeching returns of 10% a month against assets pledged by desperate borrowers. The reason that these bloodsuckers can exist is that access to credit on reasonable terms, or at all, from banks is still so difficult to get for most businesses.

Also Read: Mobile money loans affecting banks’ lending – report

The fact is that there are some great businesses that cannot grow and often struggle to survive because cash-flow is such a huge problem. In Europe many businesses use “factoring” to improve their business cash-flow and reduce the time they spend trying to collect money. But the truth is that the banks that provide this service are so selective about the businesses they deal with and the invoices they process …

VUCA (Volatility, Uncertainty, Complexity and Ambiguity) in Sub-Saharan Africa presents challenges to doing business that are distinct and unique to each market in the region. Such issues as political and economic risk which affect business decisions and hamper business growth in some climes, language barriers and cultural distinctions which affect communication and understanding in trade and currency value disparities all create opportunities for solutions through strategic government relations.

Also Read:Coveting larger markets: Ethiopia’s bid to join WTO

Forbes®, in defining the meaning of the acronym, explains that ‘Volatility’ refers to rate of change at a market or global scale. The more volatile the market is, the higher its chances of change. ‘Uncertainty’ deals with the level of confidence with which the future can be predicted. Where the market situation is uncertain, there is greater difficulty to predict and anticipate a market shift. ‘Complexity’, which refers …

The Nigerian economy may see a dip into recession, announced by the World Bank, in 2020, the worst the African country has seen in 40 years. This was largely due to the effects of the fall in the global price of oil, a commodity the nation‘s economy is heavily reliant on, and the outbreak of the COVID-19 pandemic, that nearly crippled not just Nigeria’s, but the global economy.

But these challenges were not the only catalysts for Nigeria’s imminent recession, issues around insecurity, infrastructural deficit, trade barriers, and power supply challenges all form a crude mix that has managed to drive the country down this very path.

Since the election of the Buhari’s administration in 2015, a lot more focus has been placed on driving local content and boosting local production, particularly in the agriculture sector. This was also in line to make the Nigerian economy …

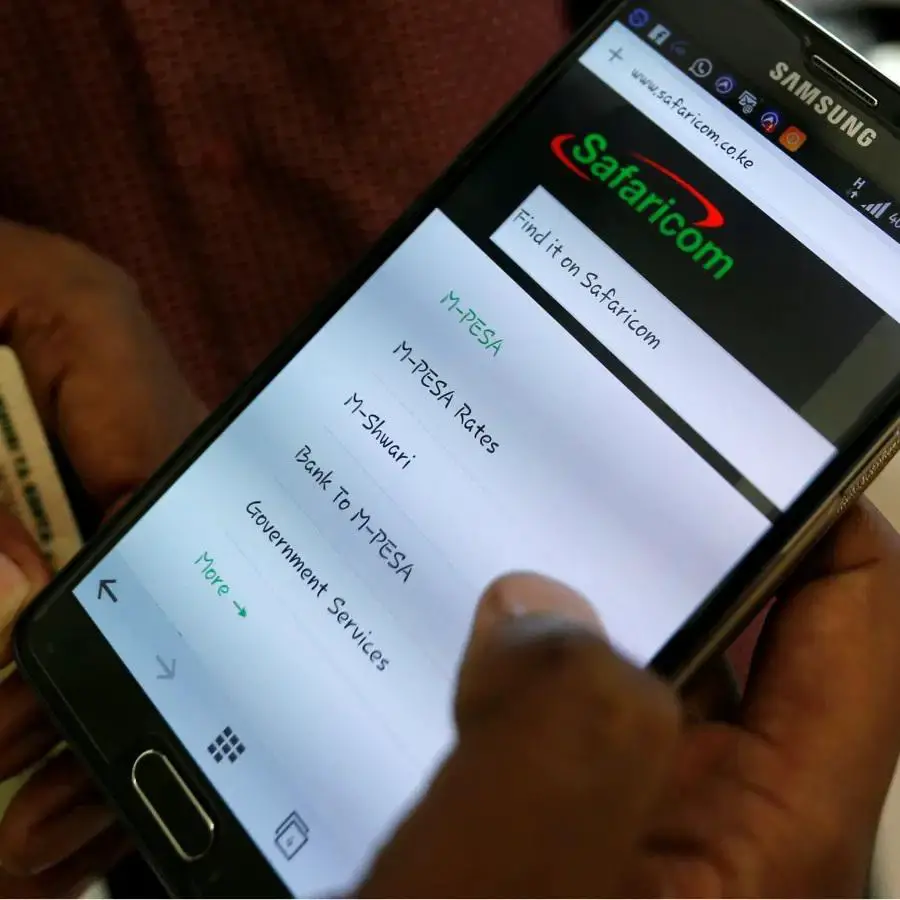

The second half period of 2020 has been marked with persistent bearish sentiment exacerbated by the financial performance amidst uncertainty in economic and business recovery in the pandemic era. On a year to date (YTD) basis, the NSE-20 and NASI have posted negative returns 34.2% and 22.2%, respectively. However, there have been outstanding performers that bucked the general market trend. Absa NewGold ETF (a security whose value is pegged on the value of global price of gold) is up 39.5%; Kenya Airways (+86.8%) on a buy-out fueled price rally; and Olympia Capital (+21.9%). The key index counters are all negative with the key banks (Equity, KCB and COOP) sharply lower, on average by 41% YTD while Safaricom and EABL have retreated 12.1% and 22.4% YTD, respectively.

Also Read: Understanding Stock Market Liquidity in African Exchanges

The bearish market coupled with uncertainty around resolution of the Covid-19 pandemic, has shifted investors’ …

Africa’s labour pool is uniquely made up of various sections, the most dominant one being the informal sector—encompassing the most human capital, catering for most young-population livelihoods and it is highly un-attended—in terms of proper management and regulations by governments across the region and there is substantial evidence to back this claim.

According to a 2018 publication by the World Bank Understanding the informal economy in African cities: Recent evidence from Greater Kampala, the informal sector accounts for huge employment in African cities, marking 86 per cent of total employment in sub-Saharan Africa according to the International Labor Organization estimates (ILO).

“With a pervasive informal sector, city governments have been struggling with how best to respond. On the one hand, a large informal sector often adds to city congestion, through informal vending and transport services, and does not contribute to city revenue,” …

Nature hurts economies, and if such economies are not well equipped to handle the aftermath of flooding, famine, water scarcity, or food insecurity—the more shocking realities are bound to come.

Climate change is real and it hurts African economies, and the region is being slapped with a heavy price to pay, amid its struggle to mark sustainable development.

According to a 2018 report by The Conversation, in the same year—almost 10,000 homes were wiped off the ground by floods, displacing nearly 2 million people in Africa up to September 2018.

In East Africa, Tanzania losses nearly $2 billion in damage from floods according to a report published by Nature Climate Change in 2017.

As the least emitter of greenhouse gases, Africa stands to lose a lot in this battle, with climate action funding coming in short and countries such as the United States of America and China tiptoe on taking …

In February 2020, just weeks after Kenya and the US had commenced talks to set up a trade deal, another announcement was being made. The US Department of Agriculture announced that Kenya will start receiving wheat from Idaho, Oregon, and Washington State after the states addressed plant health concerns.

The announcement ensured that a trade barrier that existed prohibiting US wheat exports was lifted. It allowed US wheat growers in the Pacific Northwest access to Kenya’s wheat market for the first time in over a decade after the US-Kenya Trade and Investment Working Group adopted a phytosanitary protocol.

Kenya’s domestic wheat production only meets around 10 percent of its annual demand. According to KNBS, Kenyans consume an estimated one million tonnes of wheat annually hence the country faces a deficit of more than 750,000 tonnes.

The country sources much of its wheat import volume from nearby suppliers—Tanzania, South Africa, Russia, …

National savings have not reached the levels sought to sustain the required investment for economic transformation…