The Covid-19 pandemic continues to rage. African countries have so far recorded fewer cases than most other continents. However, a new, more infectious variant of the virus has surfaced in South Africa. This new strain is a significant threat to continental health. Given that the bulk of African countries’ health systems leave a lot to be desired, this is a heavy blow.

That said, the effects of Covid-19 on African economies extend beyond the immediate impact on health. It goes to the effects of lockdown measures, interference with external trade as well as interruption of foreign inflows particularly, remittances from the diaspora, that have a considerable effect on most economies.

Diaspora remittances to Africa

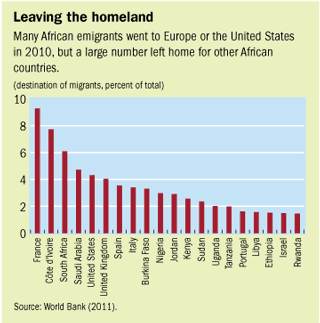

Driven by economic and other challenges, a sizeable number of Africans are living and working in different countries across the world. According to research by the Pew Research Center, over 25 million sub-Saharan Africans were living outside their home nations. As of 2018, there are reportedly over two million sub-Saharan Africans living in the USA. Some have gone the legal route to obtain papers allowing them to work legally. At the same time, others are undocumented and have found their way by hook and crook. Regardless of how they got there, these people send money home to take care of their loved ones. These large numbers of ‘diasporans’ have created a significantly large pool of foreign currency inflows into their economies contributing to Gross Domestic Product.

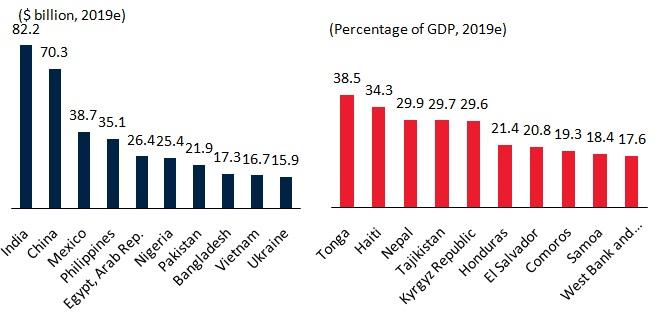

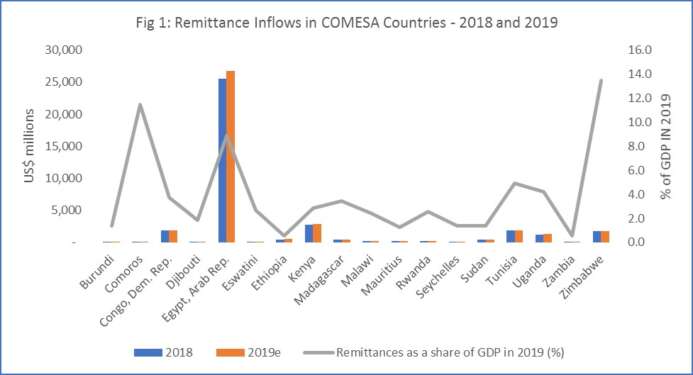

According to a World Bank report, as of 2018, remittances to sub-Saharan Africa grew to US$48 billion from a 2009 figure of US$29 billion.

Importance of remittances

Remittances offer opportunities for local recipients to take part in mainstream economic activity. It allows them to improve their savings by opening bank accounts and become financially included. Additionally, it reduces the level of unbanked and underbanked communities through opening up formal banking channels and as well as expansion into non-traditional financial services that allow them to receive funds.

This both increases the depth of financial services and scope of regulatory work and increases the uptake of technology.

In addition, it increases the standard of living by allowing households to spend more on essentials like health and education. More than half of diaspora remittances go to the rural areas where the majority of poor people live; as such, diaspora remittances have a role in assisting in poverty alleviation.

Also, it opens up free income for households to take part in small business activity, creating a further trickle-down effect into broader economic activity. In the process, remittances help to alleviate and reduce the levels of poverty.

Declining remittances

According to the World Bank, remittances to low and middle-income countries worldwide are expected to take a 14% dip this year as a result of the Covid-19 pandemic.

The World Bank brief projects that remittances to countries within the Sub-Saharan region of Africa were expected to fall to $44 billion, a decline of 9%, which is to be experienced by most countries that receive remittances.

The pandemic continues to rage the world over, resulting in economic deterioration in several countries. This translated to recessionary pressures, low employment opportunities for migrants, lower oil prices, and a decline in the value of currencies. These economic pressures will severely limit the available resources that migrants can send back to their home countries.

“Migrants are suffering greater health risks and unemployment during this crisis. The underlying fundamentals driving remittances are weak, and this is not the time to take our eyes off the downside risks to the remittance lifelines,” noted Dilip Ratha, lead author of the World Bank’s Migration and Development Brief and head of Global Knowledge Partnership on Migration and Development (KNOMAD).

Implications of Covid-19 induced remittance reduction

The decline in remittances has a significant negative effect on communities and economies. It could further plunge people back into profound depths of poverty, negating years of upward mobility. According to the United Nations Economic Commission for Africa (UNECA) estimate, growth could shrink by 1.4% in the best-case scenario. This could have the impact of sending millions of people over the edge of extreme poverty.

Further economic activity could slow down. The slowdown is premised on the fact that diaspora remittances were enabling improvements in disposable income spurring small business activity. A reduction in income that flows into the country will significantly lower the appetite for non-basic goods and also affect small business operations, especially in the informal sector. The business retardation will, in turn, have a negative effect on overall economic output.

For countries with higher inflows and more significant contributions to GDP from remittances, this reduction in inflows will significantly impact GDP.

Finding the balance

With the effect of the Covid-19 pandemic on the home country as well as the immigrant’s country, the fall in remittances will have a negative impact. Thus it is imperative that countries benefiting from these flows attempt to mitigate the situation. This is critical given that remittances act as somewhat of a cushion for the loss of brain and brawn.

One critical step is an attempt to reduce the cost of sending money. Given that senders are already cash-strapped cost reduction is a necessity. The sub-Saharan region has one of the highest structures for sending money to and from other countries averaging more than 8.5% of each transaction.

Regulation and innovation that pushes for the development of financial services aimed towards lowering costs are critical. For example, a regulation that somewhat relaxes barriers to entry will foster competition that leads to lower charges.

Further, any improvement in the use and uptake of digital technology will help to reduce the costs of sending money. Improved regulation and digital innovation coupled with an enabling environment that does not stifle new entrants under mounds of regulation, will provide some relief in that area.

As the African continental free trade area’s implementation takes off, governments must take the initiative in promoting cost reductions. Concessions such as increasing transaction limits or lowering ‘Know your Customer’ requirements for small amounts can contribute to reducing costs.

In conclusion

Diaspora remittances are an integral part of improving GDP and livelihoods. While Covid-19 has put a damper on remittances, it is vital to find ways of reducing costs and attempt to bolster remittances.

Also Read: Ghana approves herbal medication for Covid-19