- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Remittances

- Index shows that 90% of Kenya’s consumers who receive money transfers want integrated mobile ‘super apps’ so they can manage remittances with other financial needs.

- Kenya’s receivers want choice in digital and in-person remittance platforms as they look to the future.

- Kenya is a leader when it comes to financial innovation especially in the world of mobile money.

Kenya’s consumers are calling for greater innovation in international money transfer services so they can easily manage their personal finance needs.

According to Western Union’s inaugural Global Money Transfer Index, about 90 per cent of Kenya’s receivers want providers to offer remittance services in an integrated mobile ‘super app’, so they can efficiently manage collecting remittances with other commitments, such as paying for utilities.

The Global Money Transfer Index asks consumers how, when and why they use international money transfer capabilities today, as well as their expectations for tomorrow.

The results …

- Remittance flows to developing regions were shaped by several factors in 2022 including reopening of host economies as the COVID-19 pandemic receded.

- Remittances as a share of GDP are significant in the Gambia (28%), Lesotho (21%), and Comoros (20%).

- Industry data shows most of the funds go towards supporting families in purchase of food and household goods

Remittances to Sub-Saharan Africa grew by 5.2 percent to $53 billion in 2022 defying the effects of the global crisis.

World Bank’s report on Migration and Development however noted that the growth slowed from the 16.4 percent that was recorded in 2021.

“Remittances in 2023 are projected to soften to 3.9 percent growth as adverse conditions in the global environment and regional source countries persist,” noted the report.

Flows to Nigeria and Kenya have continued to dominate remittances to Sub-Saharan Africa although the region remains highly exposed to the effects of the global …

Until substantial reforms are implemented, and remittance flows channelled towards long-term economic prospects, the diaspora will continue to be a net negative for weak African economies. Africa cannot depend on exporting its brilliant people abroad to bring money home forever. Thus, governments must establish vibrant economies that appreciate the continent’s human capital and enable bright individuals to prosper.…

Nala is a cross-border payments company based in Tanzania. Selcom is a Pan African financial and payment services provider, offering a comprehensive range of payment, issuing and acquiring services.

Nala, whose services can be accessed via a customized, easy-to-use mobile application, has seeded its services in seven countries, including the US, UK, Kenya, Uganda, Rwanda, Ghana and Tanzania.

During the press conference, a live demonstration of a money transfer from the UK to a Tanzanian mobile wallet was conducted and became a success in less than a minute.

Benjamin Fernandez, Nala’s founder and Chief Executive Officer, stressed the importance of uprooting tech-savvy local talents to enhance the local fintech landscape as Tanzania lags in fintech take-up.…

Remittances to low and middle-income economies have enjoyed considerably strong growth over the last year, a sign of economic recovery as nations resume normalcy post-Covid-19.

Remittances to low and middle-income economies have enjoyed considerably strong growth over the last year, a sign of economic recovery as nations resume normalcy post-Covid-19.

According to the latest World Bank’s migration and development, analysis show a 7.3 per cent growth to clock $589 billion this year. Overall speaking, despite the devastating effects of the Covid-19 lock downs and resulting economic slowdown, remittances is one area that remained strong as the Diaspora did its best to continue sending money home.

The World Bank says last year, while other areas struggle, remittances showed resilience slipping down slightly by only 1.7 per cent and as mentioned, this despite the global recession due to Covid-19.

Generally speaking, remittance inflows to Sub-Saharan Africa grew by 6.2 per cent to clock $45 billion this year. The World Bank is optimistic that next year, remittance inflows will grow by 5.5 per cent riding on the back …

The Covid-19 pandemic continues to rage. African countries have so far recorded fewer cases than most other continents. However, a new, more infectious variant of the virus has surfaced in South Africa. This new strain is a significant threat to continental health. Given that the bulk of African countries’ health systems leave a lot to be desired, this is a heavy blow.

That said, the effects of Covid-19 on African economies extend beyond the immediate impact on health. It goes to the effects of lockdown measures, interference with external trade as well as interruption of foreign inflows particularly, remittances from the diaspora, that have a considerable effect on most economies.

Diaspora remittances to Africa

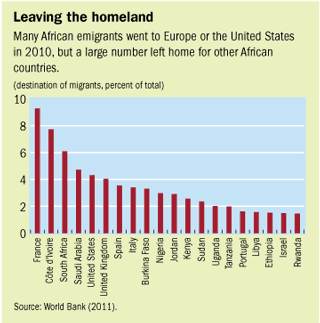

Driven by economic and other challenges, a sizeable number of Africans are living and working in different countries across the world. According to research by the Pew Research Center, over 25 million sub-Saharan Africans were living …

The largest movement of African migrants was within Africa where these emigrants also make a very clear contribution to the economy of the country they move into.…