- Russia is the world’s third-largest oil producer behind the United States and Saudi Arabia, and the world’s largest exporter to world markets

- The price of Brent crude has spiked US$110/bl, which points towards an over 80 per cent jump in 12 months and the highest level in eight years

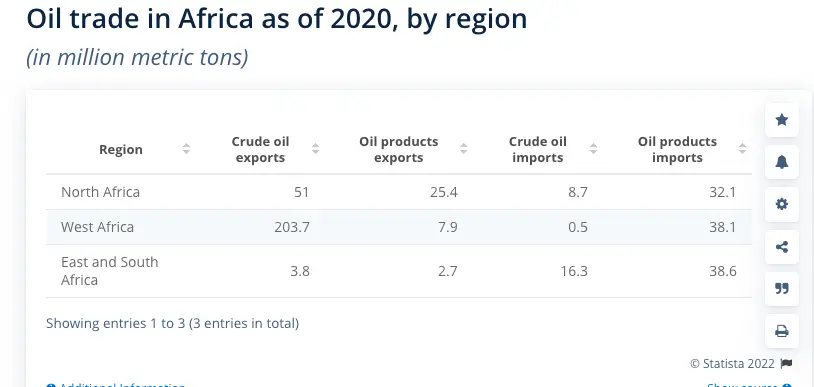

- Despite having oil reserves, African oil imports are significant in most countries even oil-producing nations

The Russia-Ukraine war is on its tenth day and it is terrible for everyone.

African governments, think tanks and energy organizations posit that sanctions against Russia pose a danger to African economies importing oil—which is by far the region’s biggest imported product.

Russia is the world’s third-largest oil producer behind the United States and Saudi Arabia, and it’s the world’s largest exporter of oil to global markets and the second-largest crude oil exporter behind Saudi Arabia.

Read: Ukrainian businesses thriving in Africa despite racist treatment towards Africans in Europe

At least 8 to 10 per cent of the global oil supply is catered by Russia. Europe relies on Russia for nearly 40 per cent of its natural gas—this proves the deterrent nature of conflicts.

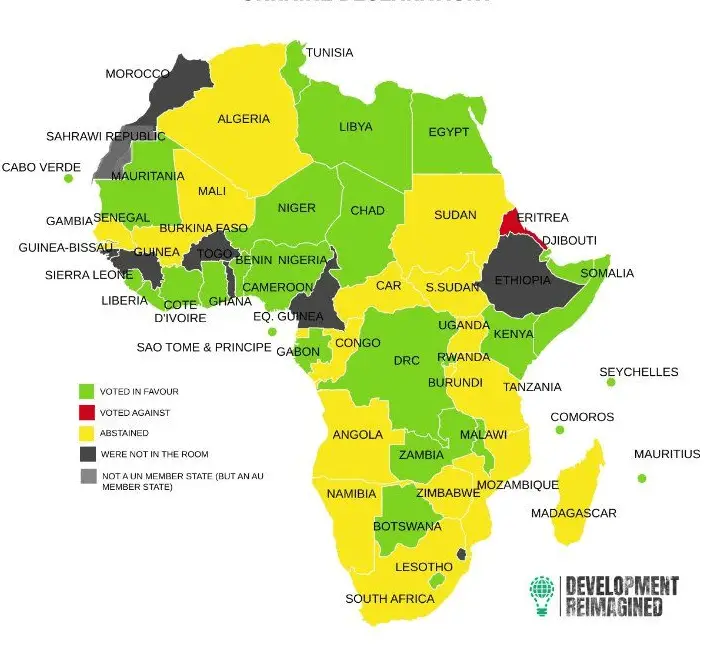

“The present situation regarding Ukraine, that pits the Russian Federation against the North Atlantic Treaty Organisation (NATO) and its allies threaten our already battered economies. It further postpones our reach for the Africa we want,” warned, South African Mineral Resources and Energy, Gwede Mantashe.

Global oil market and trade are experiencing chaotic trends, as reports show—markets are expected to remain volatile because significant oil and gas companies, including BP and Shell, have announced plans to step out Russian operations and joint ventures.

According to information from African Business, since the Russia-Ukraine war began, the price of brent crude has spiked US$110/bl, which points towards an over 80 per cent jump in 12 months and the highest level in eight years (VOA).

Russia-Ukraine war has developed a series of setbacks to the welfare of people, not only the war victims in Ukraine but other countries relying upon the supply of Ukraine and Russia’s wheat for food security as the price might shoot up, World Food Programme said.

Russia-Africa trade trend

As a gigantic energy superpower, Russia’s foreign direct investment (FDI) accounts for less than 1 per cent of Africa’s total FDI.

However, African Business argued that, with Russia being a small trading partner to Africa compared to the United States and China, the impact on trade would be marginal—yet few Africa developing economies such as Uganda will be more exposed.

Further, United Nations Conference on Trade and Development (UNCTAD) data show that Russia accounts for 2 to 3 per cent of Africa’s trade with the world—most of it is exports.

“Russia also accounts for 2 per cent of the world’s exports to Africa, and only 0.5 per cent imports from the continent” African Business.

Africa oil landscape

Africa has its fair share of somewhat most extensive oil reserves available. Libya (48.4 bn barrels), Nigeria (36.9 bn barrels), Algeria (12.2 bn barrels), Angola (7.8 bn barrels) and Sudan (5 bn barrels), according to information from Statista.

Read: Can African oil producers take advantage of the Ukraine crisis?

Following the latter, Africa’s oil output reached almost 8.4 million barrels per day in 2019—the same year, Nigeria led crude oil exports in the region with more than two million barrels of oil sold on the international market every day.

However, the relative satisfaction and self-reliance of powering Africa from available producing oil wells is still sought after and pretty far as Africa still imports oil abroad.

In 2020, Nigeria, one of Africa’s oil producers, championed oil importation, striking more than 466 thousand barrels per day, followed by Morocco with 240 thousand barrels per day (Statista).

In the same year, Africa import of petroleum products accumulated a volume of over 1.7 billion barrels per day, according to data from Statista. Across the region, oil importation has become a significant drain on fast-growing economies.

“Petroleum import accounted for 17 to 20 per cent of imports in Nigeria, Kenya, Egypt and Ghana in 2019. This ratio tends to increase as the oil price rises. We expect current account deficits to come under pressure and widen in oil-importing countries,” according to African Business.

In terms of numbers, African countries are trying to circumnavigate the oil chaos by utilizing their energy regulatory authorities, Tanzania, to be exact.

One of Africa’s fastest-growing economies, Tanzania, feels the Russian oil chaos. The East African nation saw retail fuel prices rising despite the government removing Tsh100 (0.043) fuel levy to shield motorists from the spike.

“Energy and Water Utilities Regulatory Authority (Ewura) said that from March 2, motorists in Dar es Salaam will buy a litre of petrol at Tsh2,540 ($1.10) from Tsh2,480 ($1.07), while a litre of diesel will cost Tsh2,403 ($1.04) a litre from Tsh2,338 ($1.01) and a litre of kerosene will cost Tsh2,208 ($0.95) a litre up from Tsh2,291 ($0.99)” according to information from The East African.

Tanzania is one of Africa’s potential powerhouses with an estimated 57 trillion cubic feet of proven natural gas reserves. Yet it is s one of 42 African countries’ net oil-importers.

When prices fluctuate, just as they have currently, spending on petroleum products puts economic growth in jeopardy.

That’s why the current Russian oil chaos continues to nail African governments and think tanks to realize the continent’s energy potential and cut down dependency on petroleum products.

Improvement of Africa’s oil production infrastructure is essential for the region’s target of becoming a powerhouse. Lack of government funding, pipeline vandalism and corruption in big producers such as Nigeria signal a cry for help in the sector.

Developing clean energy schemes— natural gas, thermal, biofuels, and solar energy provide Africa with enough room to sustain its spending and cut oil dependence.

Tanzania has begun exploiting its natural gas potential, Egypt is exploring a liquefied natural gas plant, and Tunisia is developing a gas field.

Africa’s economy is growing, so is its population. Responding to energy challenges such as oil imports price surges is of paramount importance—whether through short term remedies such as quotas to limit the use of oil products to the development of liquefied natural gas plants.

Flipping the other side of the coin, Africa can turn the Russia-Ukraine war oil price chaos into an opportunity for competitive oil producers such as Niger, Algeria, Libya and Angola to cash in with more crude oil exports.

Read: Tanzania: A hybrid solution to low oil supply problem