- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

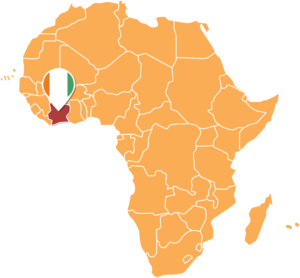

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- Britam Holdings says it is changing tact to focus on low-income earners, even as it marks paying KSh 3 billion ($26.3 million) in health and life insurance claims to under-insured customers since 2015

- Emerging Consumer Business Director Saurabh Sharma said many Kenyans could not afford insurance covers currently offered in the Kenyan market

- Sharma noted that low-income earners continued to be the ones affected mainly by risk events, including hospital admissions, loss of a loved one, or business interruptions such as fires and theft

Kenyan insurer Britam Holdings says it is changing tact to focus on low-income earners, even as it marks paying KSh 3 billion ($26.3 million) in health and life insurance claims to under-insured customers since 2015.

The company’s Emerging Consumer Business Director Saurabh Sharma said many Kenyans, especially smallholder farmers and small businesses, could not afford insurance covers currently offered in the Kenyan market.

Sharma noted that …

- Kenyan-headquartered company MarketForce has closed $40 million Series A round, the largest Series A round of its kind in East and Central Africa

- Through the funding, the company will expand its business and avail more digital financial and banking services through its extensive merchant network

- MarketForce is a leading B2B Commerce and Fintech marketplace that empowers informal merchants in Africa to order, pay and receive inventory digitally and conveniently

MarketForce, a company headquartered in Kenya, is the latest startup to receive millions in funding.

On Tuesday, February 22, MarketForce revealed it closed a $40 million Series A round, the largest Series A round of its kind in East and Central Africa.

The company said it will use the funding plans to scale merchant inventory financing and expand in existing markets.

The company said it will avail more digital financial and banking services through its extensive merchant network. MarketForce has a …

- At least 2.3 million Kenyans in 23 arid and semi-arid counties affected by drought will benefit from government relief

- He added that the government had undertaken several measures since the 8th of September 2021, when he declared the ongoing drought a national disaster

- He said the government had released KSh 2 billion to assist the affected households through relief food distribution, water trucking and a livestock offtake programme

At least 2.3 million Kenyans in 23 arid and semi-arid counties affected by drought will benefit from government relief. On Monday, President Uhuru Kenyatta flagged a consignment of emergency relief supplies to reach all affected people.

Kenyatta said the government is focused on implementing interventions to build resilience in all vulnerable households.

He added that the government was diversifying livelihoods from drought-sensitive activities to drought-resilient ones and improving early warning and impact forecasting systems.

He added that the government had undertaken several …

- Stanbic Bank majority shareholder Standard Africa Holdings Limited (SAHL) has received regulatory approval from the Capital Markets Authority to further extend the exemption from making a complete takeover

- Under the exemption, SAHL aims to acquire a maximum of 10.6 million ordinary shares in Stanbic to bring its total shareholding to up to 75.0 per cent of Stanbic Holdings’ ordinary shares

- SAHL first announced the intention to purchase shares from willing shareholders in March 2018 to acquire 59.0 million ordinary shares at a price of KSh 95.0 per share

Standard Africa Holdings Limited (SAHL) has received regulatory approval from Kenya’s Capital Markets Authority (CMA) to acquire a bigger stake in Stanbic holdings.

Standard Africa Holdings Limited (SAHL), which is the majority shareholder in Stanbic Holdings, said it received regulatory approval from the CMA to further extend the exemption from making a complete takeover.

Under the exemption, Johannesburg Stock Exchange (JSE) listed …

The company has managed to make a strong comeback from when it faced an existential threat when prices of commodities slowed down in 2014. Prior to that period, mining company shares were hot because of China’s urbanization. It drove prices of commodities through the roof taking the shares of resource companies with them.

When China’s economic growth slowed down the miners also felt the pinch. The pinch was felt especially at Gold Fields which had to restructure its business and retrench at least 1,300 workers mainly from Ghana to ensure the long term sustainability of the company. The restructuring produced desirable results characterized by net cash inflow of US$ 235 million. In that same year, its Australian operations produced 1 million ounces of gold.

The company’s operations are massive and span 3 continents.…

- Bloomberg Philanthropies has partnered with CARE to assist women who own small agriculture-based businesses to build capital and access credit to invest in and grow their businesses

- Through the initiative, the partners will expand existing Village Savings and Loans Associations (VSLAs) for agricultural funds in Tanzania, Rwanda, and the Democratic Republic of the Congo

- VSLAs are member-driven community funds that encourage financial inclusion and independence by pooling resources and providing low-interest rate loans

Bloomberg Philanthropies has partnered with CARE to expand existing Village Savings and Loans Associations (VSLAs) for agricultural funds in Tanzania, Rwanda, and the Democratic Republic of the Congo.

The deal will enable women who own small agriculture-based businesses to build capital and access credit to invest in and grow their businesses, ensuring long-term economic sustainability for themselves and their families.

VSLAs are member-driven community funds that encourage financial inclusion and independence by pooling resources and providing low-interest …