- Pullman Hotel Nairobi: French hospitality firm Accor to Open 1st Premium Brand in Kenya

- Investors tip Abu Dhabi as the next tech powerhouse globally

- Unlocking global investment: insights from the ministerial roundtable at AIM Congress 2024

- UN Tourism empowers women entrepreneurs at AIM 2024

- Kenya’s business conditions stabilised in April but heavy rains a concern for Q2

- Floods Sweep Away Billions in Economic Gains in Kenya and Tanzania

- Chapa Founder’s insight: Africa’s startup evolution mirrors China’s growth trajectory

- Sustainable solutions: AIM Congress 2024 focuses on agriculture, health and investment

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

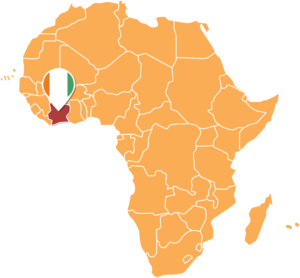

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- Data from Kenya Electricity Generating Company (KenGen) reveals that demand for electricity in Kenya grew at an average rate of 4.5% in 2021

- KenGen said attributed the growth to high business activity witnessed in the East African country, amid ongoing recovery from the impact of the coronavirus pandemic

- Of the amount, Mwathethe observed that more than 92% of the electricity consumption was from renewables

Kenya Electricity Generating Company (KenGen) has revealed that demand for electricity in Kenya has continued to grow at an average rate of 4.5% year on year in 2021.

The electricity producer said growth was driven by high business activity witnessed in the East African country, amid ongoing recovery from the impact of the coronavirus pandemic.

KenGen also revealed that the country had scaled up use of renewable sources during the year under review, further boosting its standing in the fight against climate change.

The firm’s board …

- Google is investing in Uganda’s SafeBoda from the Africa Investment Fund which was launched by Sundar Pichai, CEO of Google and Alphabet

- The Africa Investment Fund is part of a broader plan to invest $1 billion over 5 years to support digital transformation in Africa

- SafeBoda app was launched in 2017 to connect passengers to their community of safer and trusted drivers

Google has announced that it will invest in SafeBoda, a venture-backed company in Uganda.

This is the first investment from the Africa Investment Fund which was launched by Sundar Pichai, CEO of Google and Alphabet, at Google for Africa in October 2021.

In a statement seen by The Exchange Africa, Google said the funding will help drive SafeBoda’s growth in Uganda and Nigeria, scaling its transportation-led app to offer new payment and financial services solutions for its expanding set of customers: passengers, drivers and merchants.

Ricky Rapa Thomson, …

- The High Court ruled in favour of Enock Aura, a Kenyan citizen who moved to court arguing that the directive was illegal and a violation of the rights of Kenyans

- Aura’s sentiments were similar to those of lobby group Human Rights Watch which said the move undermines basic rights

- On November 21 Kenya’s cabinet secretary for health, Mutahi Kagwe, announced that beginning December 21, authorities will require anyone seeking government services to provide proof of full COVID-19 vaccination

Kenya’s High Court has temporarily suspended a directive requiring citizens to be vaccinated to access in-person services in government offices.

On December 15, a High Court judge suspended the directive by the Ministry of Health, days before it was meant to take effect.

On November 21 Kenya’s cabinet secretary for health, Mutahi Kagwe, announced that beginning December 21, authorities will require anyone seeking government services to provide proof of full Covid-19 vaccination. …

- A climate-smart crop insurance scheme introduced in Kenya combines satellite data and smartphone imagery to provide farmers with much-needed protection

- It relies on satellite images to determine if a particular area – sometimes covering up to 1,000 farmers

- Picture-based insurance requires farmer champions to periodically take photos on behalf of farmers’ crops at different growth stages

As climate change worsens, millions of smallholder farmers across sub-Saharan Africa grapple with unprecedented weather changes and influxes of pests and diseases that ravage their farms and devastate their livelihoods.

However, a climate-smart crop insurance scheme introduced in Kenya combines satellite data and smartphone imagery to provide farmers with much-needed protection.

To cushion farmers against climate change and boost productivity and resilience, governments and private sector players have been exploring various financing solutions.

Among them is index-based weather insurance, which relies on satellite images to determine if a particular area – sometimes covering up …

- Central Bank of Kenya has liquidated Imperial Bank of Kenya which was placed under receivership in October 2015

- The bank’s regulator said liquidation was the only feasible option, adding that it was acting in the interest of the general public

- Imperial Bank was placed under receivership, after CBK discovered massive fraud committed by its leadership through illegal deals, milking the bank at least KSh 34 billion

Kenya’s Central Bank has approved the complete shutting down of a bank that was placed under receivership five years ago.

On Thursday, December 6, Central Bank distributed a press release informing the general public that it was closing down Imperial Bank of Kenya Limited in Receivership (IBLIR) bank, seeing that it was the only feasible option.

The liquidation of Imperial Bank now sets the stage for the sale of its remaining assets.

After the bank went under, Central Bank placed it under the receivership …

- Uganda’s electricity sector has been named Africa’s best regulated for the fourth year running

- Other strong performers, including its East African neighbours, Kenya and Tanzania, and Namibia and Egypt

Uganda’s electricity sector has been named Africa’s best regulated across several key metrics, according to the African Development Bank’s 2021 Electricity Regulatory Index.

The country was named the best for a fourth year running, ahead of other strong performers, including its East African neighbours, Kenya and Tanzania, and Namibia and Egypt.

The 2021 Electricity Regulatory Index annual report covered 43 countries, up from 36 in the previous edition and assessed their impact on the performance of their electricity sectors.

It covered three countries in the North Africa region, four in West Africa, six in Central Africa, seven in East Africa and 13 in the Southern Africa region.

Commenting on the report, Kevin Kariuki, the African Development Bank’s Vice President …