- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

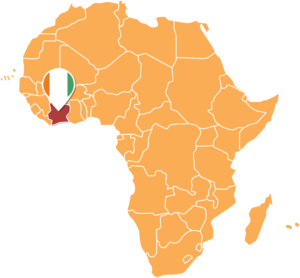

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

Given these enabling circumstances, KKR offered to buy out RJR and reorganize the business and optimize value from its operations. This initial attempt was not warmly received, and RJR sought other investment companies to purchase it. What then ensued was what members of the investment community call putting the company in play.

This describes a scenario where one company is actively pursued by several suitors who desire to purchase it. In the end KKR triumphed albeit having paid a massive premium for the company. Unfortunately, the company did not realize the gains that it had envisaged it would.

The Nabisco operation of the company was spun off into a separate entity and the tobacco interests were also kept separate. All the gains the company anticipated it would make were swallowed up by tobacco lawsuits so that by 1994 the KKR had all but written off its investment in RJR Nabisco.…

M-Pesa is on course to become a US$1Bn business.

Safaricom Plc (NSE: SCOM) released its interim results on 10th November announcing a 12.1% year-on-year (y/y) rise in 1H22 net earnings. Combing through its numbers against our estimates, its net earnings per share print (KES0.92) outperformed our expectation of KES0.85. The outperformance was primarily driven by lower than forecasted cost environment. Direct costs came in at KES44.5Bn (+20.3% y/y), beating our forecast of KES49.2Bn, while operating costs came in at KES23.4Bn (+10.3% y/y) outperforming our forecast of KES29.6Bn.

M-Pesa revenues printed at KES52.3Bn (+45.8% y/y), against our forecast of KES55.9Bn. Behind the strong y/y growth, total transaction value grew 51.5% y/y to KES13.7Tn with volumes up 42.0% y/y to 7.3Bn. Two other factors were at play in the revenue performance: The lapse of zero-rated transactions (as expected) and a 31.3% y/y rise in 30-day active M-Pesa average revenue per user …

Because outside of the governments, politicians, civil servants, lobbyists and pressure groups that thronged the Conference there is a cohort of entrepreneurs that are passionate about reversing climate change, that have fantastic commercially viable and innovative ideas, but who require funding and strategic support to make these ideas a reality.

And so I want to suggest that as well as taking personal responsibility for our carbon footprint and doing all that we can to minimise our negative impact on Planet Earth, we should also be investing in line with environmental, social and governance principles at all times – and ensuring that 20% of our investments in 2021/22 should be directly targeted at investments that will have a positive environmental impact. …

The scope of green finance is broad and encompasses initiatives taken by both public and private entities such as financial institutions, governments and international organizations in developing and supporting sustainable impacts through key financial instruments which lay the foundations of sustainable business models and investments.

Projects that fall under the green finance umbrella include the reduction of industrial pollution and lowering the carbon footprint, climate change mitigation, biodiversity conservation, promotion of renewable sources of energy plus energy efficiency, circular economy initiatives, sustainable use of natural resources and many more.

For Africa to tackle the climate menace, it needs concerted efforts from all the above parties for desired outcomes to be reaped. …

In 1991, Ethiopia was among the poorest in the world having endured a devastating famine and civil war in the 1980s and by 2020 it was one of the fastest-growing economies in the world averaging 9.9 per cent of broad-based growth per year.

The GERD will help secure the future water supply not only in the Nile Basin but in the entire region, thereby curbing the occurrence of severe drought and famine.

The flow of the River Nile has been nothing but winding, peacefully meandering its way downstream, oblivious of the decade-old tension that besieges its much-needed waters.

Egypt, Sudan and Ethiopia are neighbours that have been embroiled in a row over the construction of the Grand Ethiopian Renaissance Dam (GERD) by Ethiopia on the Blue Nile causing a diplomatic standoff among the countries.

Being the longest river in Africa, the Nile bears paramount significance across several African nations that …

While others are still skeptical around the world, crypto currency is not only taking root in Africa but is now starting to bear fruit. The Central Bank of Nigeria has announced it launching its own national digital currency, the eNaira.

While others are still skeptical around the world, crypto currency is not only taking root in Africa but is now starting to bear fruit. The Central Bank of Nigeria has announced it launching its own national digital currency, the eNaira.

This announcement makes Nigeria the first African country to have a central bank-backed digital currency.

Central Bank Governor Godwin Emefiele says the currency will serve to accelerate financial inclusion in the country of over 213 million people. A lot of African countries are taking only baby steps towards allowing the use of cryptocurrencies and may are warning their public to be wary.

However, Nigeria is proving why it is Africa’s biggest economy with its Central Bank envisioning the crypto option will accelerate financial inclusion and even allow for cheaper and faster remittances.

“This digital money, the cryptocurrency, will allow us to have easier targeted social interventions, as well as help …