- History beckons as push for Kenya’s Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

- Empowering the Future: Humanity Protocol’s Dream Play Initiative

- TikTok Community Guidelines update aims to curb hate speech and misinformation

- Rwanda sees 39% surge in bank borrowers as Sacco and MFI loan uptake declines

- Kenya Ports Authority wins dispute case over cargo release

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

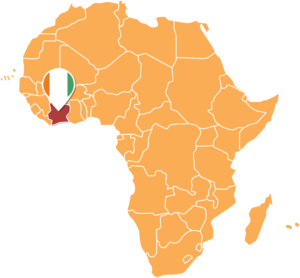

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- The Entrepreneur’s Odyssey is a mobile and tablet-friendly, a self-paced curriculum that includes online lessons across 21 modules with a total of 28 videos of approximately 20-30 minutes each

- Its launch comes at a time when the small business segment in the region has faced unprecedented changes in the wake of the COVID-19 pandemic, further fueled by the rapid acceleration of digital transformation and e-commerce

Mastercard Academy has launched ‘The Entrepreneur’s Odyssey’, a digital education platform that brings together a range of world-class academic and business resources to help small businesses learn and thrive.

The Entrepreneur’s Odyssey is a mobile and tablet-friendly, self-paced curriculum that includes online lessons across 21 modules with a total of 28 videos of approximately 20-30 minutes each.

According to Mastercard, the platform follows a five-pathway approach which is open to all aspiring and established entrepreneurs with no limits on the number of viewers and is …

These figures place Africa among the world’s fastest-growing tech countries in terms of VC growth year over year. In Silicon Valley, these figures represent a day and a week.

The potential that investors and founders are looking for is to bring substantial swathes of Africa’s unbanked population online.

According to numerous estimates, including The Global Findex Database, Africa has the highest percentage of unbanked people in the world, as well as a considerable number of underbanked SMEs and consumers.…

Doja cat is an American rapper, singer, record producer who was born in Los Angeles, California on 21st October, 1995.

She was raised in Los Angeles where she started releasing music on Sound Cloud when she was a teenager.

She left the school at the age of 16. She was in junior year and spent time in downloading beats from social media including YouTube and others to create her own music.

She was self taught in using Garage Band.

She has a fascinating image on Instagram as well as TikTok. She has become very popular now a day among the youth.

Quick update

- Full name: Amala Ratna Zandile Dlamini

- Source of wealth: songwriter, singer, rapper, record producer.

- Age: 25 years.

- Birth place: Los Angeles, California.

- Height: 6m

- Nationality:

- Date of birth: October 21, 1995.

- Occupation: singer, songwriter, rapper, record producer.

- Marital status:

Doja Cat Net Worth

Doja …

- Faulu sees growth in its bancassurance business following the automation of its insurance sales in 2020

- Sales from the bancassurance agency have so far hit Ksh 327 million this year, a 31 per cent growth compared to a similar period last year

- The financial institution added that it is targeting to reach one million customers within a year as it rolls out its technology strategy which has digitized its entire operations

Faulu Microfinance Bank has seen significant growth in its bancassurance business following the automation of its insurance sales last year.

The Bank says it shrugged off a tough operating environment due to the coronavirus pandemic, to record increased uptake of insurance products through its bancassurance unit.

Overall sales from the bancassurance agency have so far hit Ksh 327 million this year, a 31 per cent growth compared to a similar period last year, driven by strong demand across the …

I&M Group PLC has launched its rebranded operations in Uganda, following its acquisition of Orient Bank Ltd on 30th April 2021.

The Ugandan bank will now operate as I&M Bank (Uganda) Limited and adopt the Group’s vibrant corporate logo and colours.

The Nairobi-based financial Group announced that the rebrand comes after I&M Group’s successful acquisition of a 90% shareholding in Uganda’s Orient Bank Ltd earlier this year.

This received regulatory approval from the Central Bank of Kenya, Bank of Uganda, Capital Markets Authority of Kenya as well as the Common Market for Eastern and Southern Africa (COMESA), and is part of the Group’s broader strategy to grow its business by increasing its geographical footprint across the Eastern African region.

“The rebrand will not only unlock the bank’s potential, but also will enable it to reach out to more customers within Uganda, and in Eastern Africa as a whole. Further, …

- Safaricom has recorded a 12.01% increase in profit after tax to hit KSh37.06 billion

- The growth in profitability was mainly driven by a 16.91% uptick in service revenue

- This was on the back of a recovery in Mpesa revenues coupled with a slower 14.7% growth in total operating costs

Safaricom has recorded a 12.01% increase in profit after tax to hit KSh37.06 billion in the first half of 2021/2022, from KSh 33.06 recorded in a similar period last year.

The accompany has attributed the growth in profitability to a 16.91% uptick in service revenue on the back of a recovery in Mpesa revenues coupled with a slower 14.7% growth in total operating costs.

The firm’s CEO said the pandemic dealt a major blow to the economy in 2020 but they are encouraged with the gradual recovery recorded across major sectors of the economy including the agriculture, manufacturing and tourism sector.…