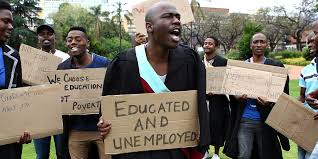

- Youth Unemployment in Kenya: The Role of Vocational Training

- New $900,000 initiative aims to boost sustainable trade in Tanzania

- Organization of the Petroleum Exporting Countries’ (OPEC) pride in its African roots

- AIM Global Foundation pushes for stronger Gulf-Africa trade partnerships

- Investment opportunities in South Sudan’s emerging gold industry

- Family planning drive in Kenya gets 450,000 self-injectable contraceptive doses from UK

- AfDB commits $2 billion to revolutionise clean cooking in Africa, save forests

- The harsh realities of family laws for African women revealed

Uganda

- Tanzania has offered the Uganda National Oil Company (Unoc) to use the Dar es Salaam port for oil importation.

- This presents a strategic alternative amid the ongoing importation stalemate between Uganda and Kenya.

- The legal dispute between Uganda and Kenya over oil importation policies is pending before the East African Court of Justice (EACJ), with indications that Uganda may withdraw the case.

Tanzania has stepped forward with an enticing proposition that Kampala finds hard to ignore, especially regarding the ongoing deadlock in Nairobi-Kampala oil imports.

Tanzania has extended an offer to the Uganda National Oil Company (Unoc) to utilise the Dar es Salaam port for its fuel importation needs. This development comes as Uganda explores alternatives in response to Kenya’s steadfast position on Kampala’s oil importation demands.

Uganda’s grievance at the East African Court of Justice (EACJ) remains pending amid these unfolding events, casting a shadow of uncertainty over …

- The Uganda National Oil Company (UNOC) is directly importing petroleum products from Vitol Bahrain, aiming to reduce reliance on Kenyan firms and mitigate high fuel prices.

- UNOC’s direct importation and sale of fuel to OMCs in Tanzania and Uganda is a significant step towards fostering stronger regional ties, promoting economic growth, and ensuring energy security.

Uganda National Oil Company (UNOC) has started the sale of petroleum products to oil marketing companies in both Uganda and Tanzania.

This is part of a broader strategy to test the waters before UNOC embarks on a direct importation agreement with the global oil titan, Vitol Bahrain. This maneuver signals a new era in East Africa’s energy dynamics, especially following a cooling of relations between Uganda and Kenya over fuel supply mechanisms.

Breaking New Ground: Uganda National Oil Company Direct Importation Deal

For years, Uganda’s fuel supply chain was heavily dependent on Kenyan OMCs. However, …

- For millions of households in Uganda, remittances play a vital role in safeguarding food security, healthcare, savings and investment opportunities.

- IFAD data shows 75% of money sent to Uganda is used to fight poverty and improve access to nutrition, health, housing and education.

- The remaining 25 percent is used to support small businesses and facilitate access to financial products.

The UN’s International Fund for Agricultural Development (IFAD) has partnered with Stanbic Bank Uganda (SBU) in a plan to reduce the cost incurred by Ugandans sending money back home by half through a digital payment platform dubbed FlexiPay.

The partnership will also provide remittance recipients, especially in rural areas, with digital and financial training to promote the savings culture and foster digital finance uptake among these communities.

Cost of remittances in Uganda

At the moment, the average cost of sending money back home for Uganda’s migrant workers is 11.3 per cent, …

Uganda Revenue Authority(URA) disagreed with importers over a recent proposal to amend payments of customs duty.

URA wants custom duty to be paid at the port of entry while importers prefer payments to be made under the current system which is once the goods are in the country.

A notice signed by the Uganda Revenue Authority commissioner customs, Dickson C Kateshumbwa, stated that all payments for home consumption declarations to Customs will be valid for only 72 hours from the date of assessment as opposed to 21 days reflected on payment registration notices which it said will be effective immediately.

Bond warehousing has been banned for milled and broken rice, sugar, wines and spirits except at duty-free shops. Also, building materials, tubes and motor vehicle tyres motorcycle tyres, used motor vehicles that are 14 years old from the date of manufacture, garments, dentifrices and footwear were also included.

Also Read:

…Increased competition between Simba cement and Kampala cement is driving prices down in Uganda.

A 50-kilogramme bag now retails at an average price of $7.5 from $10.8 with some brands charging even lower.

Before the entry of Simba cement and Kampala cement, Hima Cement and Tororo Cement have been the dominant market players in Uganda.

The drop in prices has been long coming following last year’s drastic measures by Uganda’s Ministry of Trade, Industry and Co-operatives to fast track licensing of new cement manufacturers. The removal of 10 per cent import duty on clinker has also lowered production costs.

Some cement manufacturers rely on clinker as a raw material in their production while Tororo and Hima rely on pozzolana as their raw material which is mined in Kasese and Tororo.

The government of Uganda had threatened to allow imported cement to come into the country on a special …

Uganda spends less money in the agriculture sector than any other East African country a World Bank report on public expenditure review shows.

The report shows that Uganda spends only 3.6 per cent of its budget on agriculture, which is the lowest in the region. Rwanda spends 5.3 per cent more on agriculture than any other country in the East African region. Kenya follows closely spending spends 5.2 per cent of its budget on agriculture while Tanzania spends 3.9 per cent, which is slightly above what Uganda spends.

Agriculture in Uganda remains the largest employer with 68 per cent of the population engaged in this sector. Still, much of this sector is still largely subsistence due to lack of funding to support the commercialisation drive.

Presenting findings of the report, Dr Ladisy Komba Chengula, the World Bank lead agricultural economist said that Uganda’s share of final public expenditure in the …

The Bank of Uganda reduced its interest rates for the first time since February 2018 in a bid to support economic growth.

The monetary policy committee agreed to reduce the central bank rate by 1% to 9%. The rediscount rate and the bank rate were also adjusted by a similar amount to 13% and 14%, respectively.

This rate cut is expected to be of relief to businesses facing cash difficulties in funding operations or expansion. Businesses that are struggling with low sales and reduced household spending, can also get a boost from the rate that is cut through consumer lending.

“This policy move is expected to boost already high liquidity levels in the banking sector and this will eventually accelerate credit growth and real economic activity,” said Adam Mugume, Executive Director for Research at Bank of Uganda (BoU).

Also Read: Bank of Uganda warns of rising cost of debt repayment

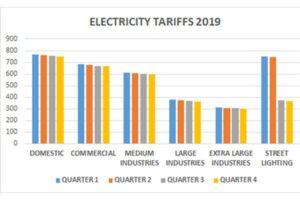

…Electricity Regulatory Authority (ERA) has reduced power tariffs by an average of Ush2.4 from October to December quarter.

The tariff reduction will apply to all consumption categories including domestic and extra-large consumers.

The first 15 units for Ush250 with units from sixteen upwards now costing Ush752.5 per unit from Ush755.1 in September.

During this period, commercial consumers will enjoy Ush3.4 tariff reduction from Ush669.5 to Ush666.1 while medium industrial users will pay Ush595.6 per unit from Ush599.2, which has been reduced by Ush3.6. Large industries will pay Ush364 from Ush365.7, saving the industrialists Ush1.7.

Extra-large industries, on the other hand, will be paying Ush302.6 per unit from Ush304.7 in the previous quarter saving them Ush2.1 in the three months leading to December.

The Electricity Regulatory Authority has maintained its strategy to continue reducing tariffs on street lighting, which was reduced by almost a half last month to Ush371.4 per unit.…

The Bank of Uganda has warned government against the accumulation of foreign debt, saying the central bank is under a lot of pressure to obtain foreign exchange to repay loans.

Speaking during the IMF and AfDB-organised conference in Kampala during the weekend, Bank of Uganda Governor Emmanuel Tumusiime Mutebile, said that the rising cost of servicing the debts is putting pressure on the Central Bank to accumulate foreign exchange reserved for future imports.

“The biggest challenge for Bank of Uganda (BoU) is how to accumulate foreign exchange reserves to service external debt. The forex reserves have to be purchased from the domestic market, without causing sharp exchange rate depreciation pressures that would eventually pass through to domestic inflation, thereby warranting tightening of monetary policy and later on impacting on economic growth,” said Mr Mutebile

Mr Mutebile revealed that for instance, in the 2019/20 financial year, the central bank has to …